To calculate accrued sick time for an employee, take their total worked hours, multiply them by your sick leave accrual rate, and that’s their available sick time. Like this:

- A new employee has been working for 4 weeks at 40 hours per week.

- The employee worked 160 hours in total

- Your sick leave rate is 0.025 hours per hour worked.

- (160 worked hours) x 0.025 = 4 sick leave hours

Sick leave policies are usually defined by the sick leave hours accrued for each hour worked. Like this: 0.025 hours of sick time per hour worked.

That equals 1 hour of sick time for every 40 hours worked which is 52 hours of sick time per year.

To estimate how many sick days someone will get per year, use the HR standard of 2,080 working hours per year (52 weeks at 40 hours/week).

Tricky Details When Calculating Sick Time

The base sick leave formula is pretty simple, but there’s a few things that make it more complicated.

Earning Sick Time While on Paid Leave

Do employees earn sick time while taking any type of paid leave? Usually, but not always. I go into a ton of depth on how PTO accrues while taking PTO here. The short answer is that it’s entirely up to your company but they probably don’t know. This is easy to mess up in any payroll system and your company can easily miss this.

I always set up my payroll systems so that employees accrue leave for all hours even if they’re on paid leave.

But companies don’t have to do this. Every sick leave law that I’ve looked at only requires sick leave to accrue for “hours worked.” Since paid leave doesn’t count as “hours worked,” companies can do whatever they want here.

All the types of paid leave that can impact sick time:

- PTO and vacation leave

- Bereavement

- Parental leave

- Company holidays

How Overtime Impacts Sick Time Accruals

Most sick leave laws require that sick leave accrue during “hours worked” and overtime is considered working hours.

Whenever overtime happens, sick leave must accrue as normal.

Projecting Sick Time Accruals

When someone puts in a sick time request for the future, do we calculate only the hours they’ve already accrued or project the number of hours that they’ll have when their sick time leave begins?

I always do the projection.

But this is a common trap for payroll and PTO tools. Many will default to only showing how many accrued hours someone currently has. Then everyone is left wondering if there will be enough by the time someone needs to take time off.

If you’re doing the projection by hand, only include sick time hours that will have been accrued by the last payroll cycle before the leave request starts. Technically, new sick time isn’t available until each payroll cycle completes and the hours show up on the paystub. Although, if sick leave overlaps the end of a pay cycle, new sick time hours could become available before the leave ends.

Going Negative with Sick Time

Any PTO balance can go negative. Well, it can if you want. There’s a number of approaches on how you can handle negative PTO and sick leave.

Some companies have a standing policy that any employee can go negative up to a certain amount. Others deny all negative PTO requests regardless of the circumstance. I prefer to take a case-by-case approach.

Just keep in mind that negative sick leave balance could impact your calculations.

Always Check Your State’s Sick Leave Laws

Although the federal government does not have regulations for sick leave, states can define their own laws. Some cities and counties also have their own sick leave policies.

Washington has what I consider to be a standard sick time law. It includes:

- 1 hour of sick time for every 40 hours worked

- Sick time pay must be equal to normal hours worked

- Employees can start using sick time after 90 days of employment

- Sick time can be used for illness and injuries, mental health, doctors or dentist visits, school and daycare closures, and preventive care.

- Employees aren’t responsible for getting their shift covered.

- You can’t force employees to work a makeup shift.

- Any sick leave balances of 40 hours or less must carry over each year.

Many states like Georgia don’t have any sick leave laws. So companies can set any sick leave accrual amount that they want, or have no sick time at all.

Otherwise, the only leave policy that every company needs to be aware of is the Federal Family and Medical Leave Act. It only guarantees up to 12 weeks of unpaid leave for an injury/illness, the birth of a child, or to take care of a family member.

While the leave is unpaid from an FMLA request, the same job or an equivalent job is guaranteed upon return.

How to Calculate Sick Time Accruals Across Multiple States

What if your company has multiple locations across different states? And how does it work if they have different sick time accrual laws?

I’ve had to deal with this exact problem when I built a fully remote company that got up to 25 employees. We had employees all over the country.

Here’s what you’re required to do:

- Most sick leave laws require that sick leave is accrued while an employee is performing work within that jurisdiction. If you wanted, you could keep track of the location of all worked hours and only accrue sick leave hours for each employee when they’re doing work in that location.

Sounds like a complete admin nightmare to me.

Here’s the MUCH easier option:

- Find the state with the most intense sick leave or PTO law that applies to your company. California is usually a good place to start. Make sure your sick leave policies meet this standard, then make that sick leave policy available to every employee.

States don’t get mad if your policies are better than their laws. By offering a “best in class” policy to everyone, you don’t have to keep track of every separate sick leave law.

For me, trying to manage different sick leave or PTO accrual rates is a complete waste of everyone’s time. Instead, come up with a policy that works everywhere even if that means being a bit more generous with your sick leave. You’ll save yourself tons of time by avoiding HR headaches and useless admin work.

Amazon has different PTO policies for their employees in California. It boggles my mind that they haven’t rolled out a uniform policy nation-wide.

How to Make Sick Leave Accrual Even Easier to Calculate

Many companies will offer multiple types of leave that could accrue:

- Vacation days

- Personal days

- Sick days

You could have different accrual rates for all three types. But I strongly recommend against it.

My advice? Lump personal time, vacation time, and sick time into a single PTO policy.

That gives you one accrual policy rate to manage. Instead of having multiple accrual rates and multiple paid time off balances, you have just one.

It’s a lot better for employees. We’ve all had a friend tell us to “call in sick!” in order to attend a fun event or goof off. Let’s stop the charade and just let employees take their paid time off for any reason. They’re adults.

And are we really going to ask grown adults to get a doctor’s note when they’re sick? We’re not in second grade anymore.

It’s better for employees, it’s better for you, and it’s easier to manage.

Document Your Sick Leave Accrual Policy

However you decide to calculate sick time, be sure to document it.

Not only do some states require that all PTO policies get communicated to employees, documentation will also reduce the number of sick leave calculation mistakes.

Sick leave calculations are easy to get wrong. You want a source of truth on the rate of sick leave accruals, when it’s earned, and how it can be used.

Then whenever there’s confusion, everyone can look at the same document to resolve the issue. And perform calculations in the same way.

I usually use an internal company wiki for this, like Coda or Confluence.

Don’t Track Sick Accrual By Hand, Use Payroll Software

Tracking sick leave accrual by hand is a horrible idea.

Some states like Colorado have extremely strict rules around PTO (which includes sick time) and how it can never be taken away from employees. Doing things by hand is a recipe for disaster, a simple clerical error could end up with a wage complaint with your state’s Department of Labor.

I strongly recommend using payroll software to handle this task for you.

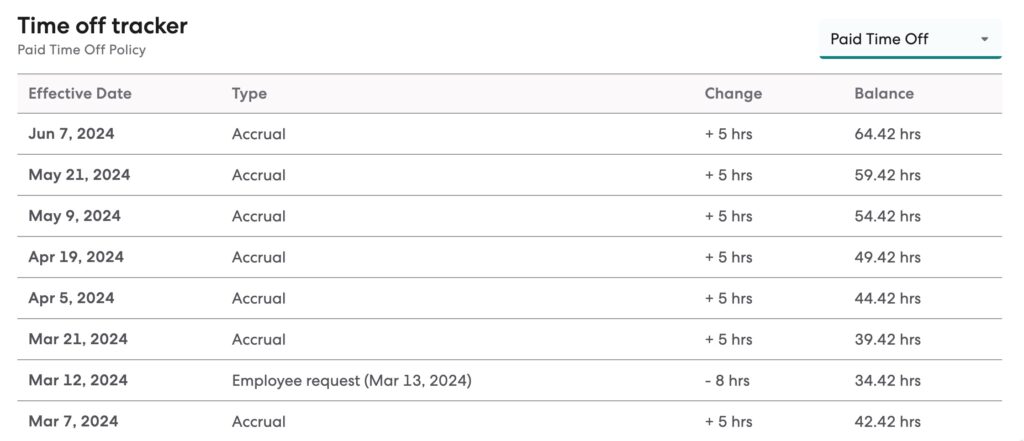

Here’s what the PTO records in Gusto look like:

That view gets updated every time payroll is run. Everything is automatic.

Payroll tools solve a bunch of sick leave accrual headaches automatically:

- Mistakes from calculations will become extremely rare, software is always better than humans for doing recurring calculations.

- Every employee has an updated record of their sick leave after every payroll. Many states have requirements that sick leave and PTO records are regularly maintained.

- Accrued hours even get added to the employee’s pay stubs so there’s never any chance of confusion.

- The software has built-in sick leave and approval requests. These take 30 seconds to resolve.

- You have a dashboard that shows all the sick leave requests that have been approved. This is great for planning shifts and major projects.

- Employees can easily look up their available hours within their account and plan future leave.

I’d never regularly calculate sick leave by hand. The only time I do this is if I need a quick projection to see if there will be enough sick leave available in the future. Otherwise, I use my payroll software.