There isn’t a law that requires PTO in Massachusetts. But there is a sick time law.

In Massachusetts, you’re required to offer one hour of earned sick leave for every 30 hours worked.

- If you have 11 or more employees, the sick time must be paid.

- If you have less than 11 employees, the sick time can be unpaid.

And employees must be able to use up to 40 hours of sick time per year.

If you offer a PTO policy that’s equivalent or better than the sick time law, that counts. You don’t need to offer an additional sick time policy on top of what you already have.

That’s the core of it. Like most sick leave laws, there are a bunch of details.

Massachusetts Sick Time Law Details

How Sick Time Can Be Used

Sick time can be applied to the standard stuff that sick time laws cover:

- Illness and injury

- Routine medical appointments

- To care for a sick spouse, child, parent, or spouse’s parent

- Domestic violence situations

Notice to Take Sick Time

Employers can ask for 7 days notice for scheduled sick time. In all other situations (like emergencies), the notice must be “reasonable.” Yes, that’s extremely vague.

When Sick Time Can Start Being Used

Once an employee has worked for 90 calendar days, they can begin using their sick time.

How Employee Counts Work

It includes all employees performing work for compensation on a full-time, part-time, or temporary basis.

Independent contractors do NOT count though.

Massachusetts is considered the primary place of work as long as the employee spends more time working in Massachusetts than any other state. Even if they only work 20% of the time in Massachusetts, Massachusetts is the primary place of work if no other state is more than 20% of the employee’s working time.

For determining the 11 employee threshold that requires you to pay out sick time, ALL employees count at your company even if they work in other states.

So if you have only 1 employee in Massachusetts but 11 employees in total, you must:

- Provide sick time to that 1 employee in Massachusetts

- That sick time must be paid

Sick Time Increments

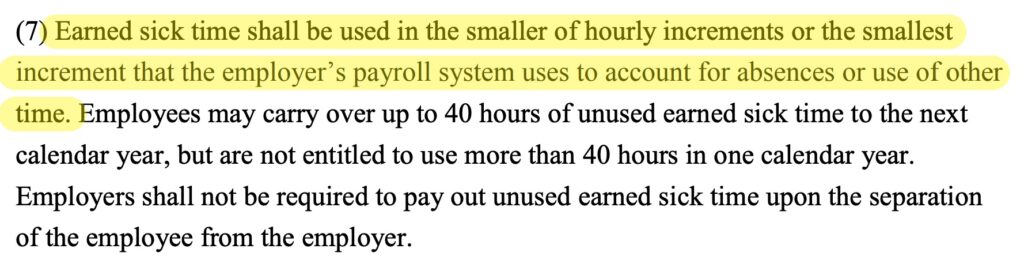

The exact regulation of the sick time law states:

The way I understand this is that if your payroll system allows sick leave in 1 hour increments, that’s what you have to do. Most payroll systems easily allow taking sick leave for just 1 hour. Other states allow companies to set their own policies, usually with a limit of 4 hours (half-day) or less.

Sick Time Documentation

The employer can ask for documentation when a sick time request is longer than 24 consecutive scheduled work hours (3 days). The employer must accept “any reasonable documentation signed by a health care provider” and can’t ask for details on the illness or domestic violence situation.

Accrual Requirements

Accrual must begin on the date of hire.

At a minimum, companies must provide each employee with one hour of sick time for every 30 hours worked. Additionally, the law states that employees can receive up to 40 hours of sick time per year.

Accrual does not have to happen on paid hours when the employee isn’t working. So if they take paid time off like parental leave, you’re not required to accrue sick time during that same period.

For any employees being paid by “fee-for-service,” they’ll also earn sick time based on “a reasonable measure of the time the employees work.“

Employers can stop accruals once an employee has earned 40 hours of sick time.

You can use a lump-sum sick time policy if you want. But it must be equivalent or better than the “1 hour of sick time per 30 hours worked” accrual model.

Sick Time Roll Over Requirements

There’s a few options for rollovers:

- For accrual sick time, at least 40 hours must roll over each year.

- If you provide a lump sum of 40 hours of sick time at the start of the benefit year, none of the previous sick time from the previous year has to roll over.

- If you provide lump sum sick time on a monthly basis, at least 40 hours must roll over each year.

- If you pay out unused sick time of 16 hours or more, you must provide 16 hours of unpaid sick time until it’s accrued.

- If paying out less than 16 hours of unused sick time, you must provide equivalent amounts of unpaid sick time until it’s accrued

Sick Time Payout Requirements

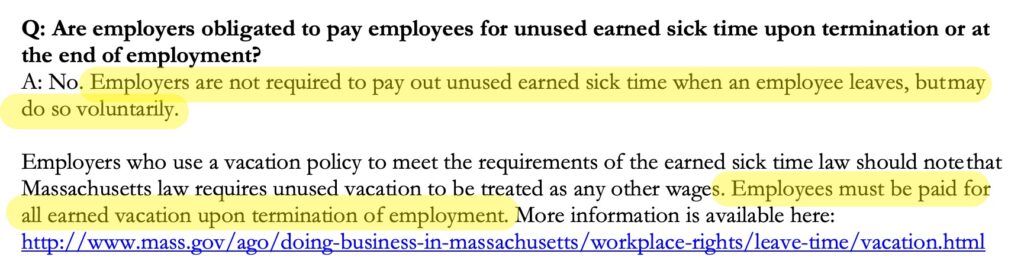

When employees leave, the company is NOT required to pay out unused sick time.

BUT if you have a PTO or vacation policy that takes the place of a sick time policy, you DO have to pay out unused vacation time when an employee leaves:

Regardless, I always recommend that companies pay out all unused accrued paid time off. Many states require this and it’s a standard across the HR industry.

Other Massachusetts Paid Leave Laws

Massachusetts has a bunch of different paid and unpaid leave laws that every employer should be aware of:

- Vacation Leave: vacation leave isn’t required in Massachusetts but it is considered wages. So make sure you’re paying out any earned vacation time. Also be careful about taking it away, review the regulations to make sure you’re good.

- Small necessities leave: companies with 50 or more employees must allow employees to take up to 24 hours of unpaid leave every 12 months for child’s school activities, child’s dental or doctor appointments, and elder relatives care appointments.

- Domestic violence and abusive situation leave: if an employee or family member is in a domestic violence or other abusive situation, they can take up to 15 days of pair or unpaid leave in a 12 month period. There’s lots of specifics on this one so make sure to dig into it.

- Day of rest: employees must have a day off after 6 consecutive days of work.

- Time off to vote: employees in manufacturing, mechanical or retail industries must be able to get unpaid time off during the first 2 hours when voting opens. If they request it.

- Parental Leave and Pregnant Workers: Up to 8 weeks of unpaid, job-protected leave after the birth or adoption of a child.

What I’d Change About Massachusetts PTO Laws

While I’m glad that Massachusetts has a sick leave law, there are a few things I’d like to see that would have a massive impact on employees.

Switch Sick Leave to PTO

Nevada is one of the leading states that requires real PTO, not just sick leave.

While sick leave is a start, I don’t think it’s good enough. Why are we asking people to justify their leave? Why have any requirements that people get documentation? What about situations that carry social stigma? People earned the leave, let them take it when they want. The accrual rates aren’t that much anyway.

Switching to a PTO law would simplify the regulation immensely.

Remove the 11 Employee Threshold for Paid Leave

I strongly believe that a sick leave or PTO policy should be paid leave. Regardless of company size.

I’ve managed a lot of P&Ls in my career. For companies below and above these employee thresholds. PTO and paid leave never made an impact on any of my budgets. Hiring, severance, and healthcare certainly does. But switching sick leave from unpaid to paid? A drop in the bucket.

I think it’s ridiculous that we allow employees at small companies to not have access to paid sick time. Even if there’s only one employee.

Remove the 90 Calendar Requirement to Use Leave

Accidents and illness don’t conveniently wait 90 days after you start a new job. If you need to use sick time, you need to use it. People don’t get to schedule time off for being sick. Preventing folks from being able to use the few hours they’ve earned when they really need it is unnecessarily cruel.

And an accrual system naturally limits someone’s ability to exploit leave when they join a new company. It’s a core benefit of using accrual instead of a lump-sum model. Since you’re accruing hours, you can’t really exploit the model. The 90-day requirement doesn’t add any extra protection for employers, it just harms employees.

Simplify the Roll Over Options

The rollover options are way too complicated in Massachusetts.

I really like what Colorado has done. They take the stance that paid time off cannot be taken away from employees for any reason.

Not only is it the right thing to do, it simplifies everything immensely.

Trusted Resources that I Used

When you’re digging into Massachusetts PTO and sick time laws, start with these resources:

- Earned Sick Time: A great overview page that covers the Massachusetts sick time law. You’ll find tons of easy-to-understand resources here.

- Breaks and Time Off: A great list of every type of leave that you need to offer to Massachusetts employees.

- Earned Sick Time FAQ: Use this doc if you need to verify that your policy is good enough. Tons of details and easy to understand.

- Earned Sick Time Law: The actual law if you want to dig into the specifics.

- Earned Sick Time Regulations: From the Attorney General, lots of other specifics are here.