Once you work 40 hours in a week at Walmart, any additional hour worked will be paid out at 1.5 times your normal rate of pay. This is considered overtime pay.

Things do get more complicated than this. Federal law requires overtime pay start after 40 hours of work in a single week, paid out at “time and one-half.” But every state has their own rules too.

Walmart Overtime Pay: What’s the Federal Law?

The Fair Labor Standards Act (FLSA) regulates overtime pay and has the key overtime laws that companies need to follow. It requires employees who work more than 40 hours during a workweek to get paid overtime. Overtime pay must be at least 1.5 times their regular rate. So, an employee earning $30 per hour gets an overtime rate of $45 per overtime hour.

Some workers are exempt from the FLSA’s overtime requirements like many salaried employees. The FLSA generally exempts executive, administrative, professional, and computer professionals earning at $844 per week ($43,888 per year).

Most hourly workers and non-professionals are non-exempt from the FLSA. There’s a lot of details and nuance on exempt vs non-exempt employees.

As a rough rule at Walmart, salaried employees like management will be exempt but hourly associates and drivers are often non-exempt.

Walmart stores have varied hours, so Walmart has a company-wide policy to start its workweeks at 12:00 am on Saturday and end them at 11:59 pm on Friday. If a non-exempt Walmart employee works more than 40 hours during this period, they’re eligible for overtime pay for those extra hours.

Overtime is non-negotiable, Walmart has to stay on top of FLSA overtime rules to ensure its employees get paid properly.

Walmart Hasn’t Always Paid Overtime Correctly

Back in 2007, Walmart found errors in its own overtime calculations through an internal auditing process, volunteering to report that information to the United States Department of Labor (DOL). As a result, Walmart and the DOL agreed on a settlement for Walmart to provide retroactive pay owed to employees due to those miscalculations, plus interest.

After that incident, we can assume that Walmart has gotten stricter on its policies and calculations, especially when it comes to overtime.

But don’t assume that your overtime will get paid correctly at Walmart, or any other company for that matter. Every payroll system is built by people, and people make mistakes.

Always double check you pay stubs and ask your HR team questions if it doesn’t add up. Then if the situation isn’t immediately resolved, document those conversations (put notes into a document that can be dated) and look into filing a wage complaint with your state.

How to Maximize Your Overtime at Walmart

I’m going to be honest, you’re probably not going to be able to rack up much overtime at Walmart. Whether you can bank tons of overtime is highly dependent on the type of company you work for.

Walmart is one of those companies that has to be ruthless with costs. They provide low-price products at low prices. They make all their money on the scale of their operations and have to be ruthlessly efficient across the company.

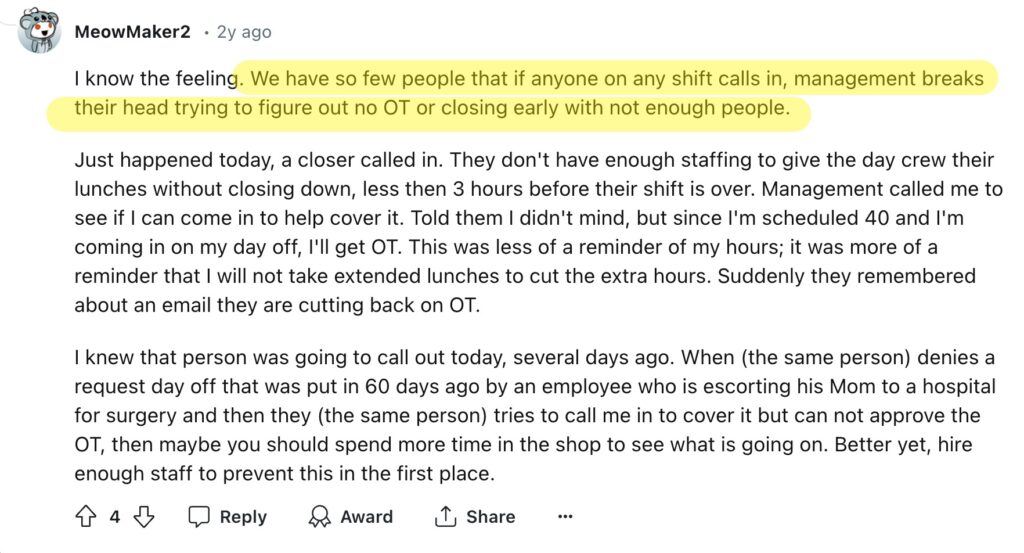

I’m not surprised to find reports that management does somersaults to avoid overtime:

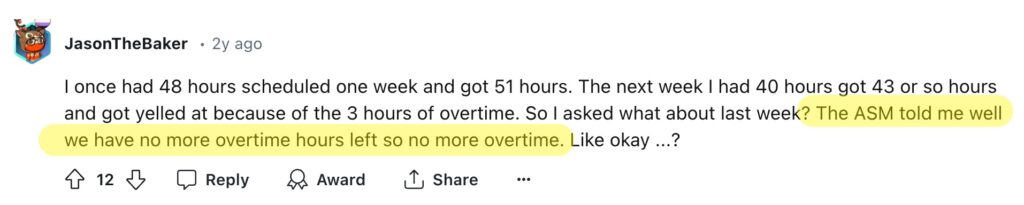

And this report alludes to a company policy that limits overtime hours that can be paid out in a given period:

If you’re at a short staffed store, you may be able to pick up a few overtime hours consistently. Be prepared to get pressured into taking longer lunch breaks (cutting down on overtime hours) and for shifts getting handed to other people.

I do have a few tips to increase your overtime at Walmart:

- When going for overtime, don’t take any PTO. PTO doesn’t count towards overtime hours. So if you work an extra 8 hour shift but also took 8 hours for PTO on a normal shift, you only worked 40 hours that week.

- Don’t brag about overtime. Managers address problems that get put in front of them, don’t remind anyone that you got overtime. Keep your head down and try to be in the right place to pick up more shifts when you can.

- Try to transfer to a store that’s chronically short staffed. This only works if there are other Walmart’s within a reasonable distance. And it can be a risky strategy, there might be a reason it’s short staffed. Like a horrible manager or a store in decline. The costs might not be worth the extra overtime.

- Be available when management is backed into a corner. If management can shuffle something around to avoid overtime they will. Keep an eye out for situations that stretches staffing to the limit like a batch of people quitting at once or the holidays. During these periods, take as many shifts as you can.

State Laws and Walmart Overtime Pay

Some states have chosen to extend overtime benefits beyond what’s required at the federal level.

The most common state-level regulation is daily overtime. With daily overtime, you start earning overtime pay after you work a certain number of hours in a single day. It’s usually 8 hours. So, an employee in a state with daily overtime might earn overtime for any hours worked past eight hours in one day.

Also, some states require overtime pay for hours worked on the 7th day of a consecutive seven-day work schedule.

Here’s some examples of state overtime laws:

- Alaska: In addition to the standard overtime pay for worked hours beyond 40 in one workweek, employees get paid 1.5 times their regular rate of pay for hours worked past eight hours in a work day.

- California: California employers must pay employees 1.5 times their regular rate for hours worked past eight and less than 12 in one work day and for the first eight hours worked on the 7th day if working a consecutive seven-day workweek. Also, employees earn double their regular rate for additional hours, like the 13th hour in one work day or the 9th hour on their 7th consecutive day of work.

- Colorado: Employees earn 1.5 times their regular pay rate for any hours over 12 hours worked during a work day. Employees working more than 40 hours during a workweek also receive overtime pay.

- Kentucky: If a Kentucky employee works seven consecutive days, they’re entitled to 1.5 times their regular rate as overtime pay for hours worked on the 7th day.

- Nevada: Nevada overtime is based on minimum wage. If an employee doesn’t make at least 1.5 times the minimum wage, they’re entitled to 1.5 times their regular rate as overtime pay for hours worked past eight hours in a 24-hour period. If they do make at least 1.5 times the minimum wage, the employee still gets overtime for hours worked past 40 in one workweek.

- Puerto Rico: The territory of Puerto Rico requires employers to pay overtime pay equal to 1.5 times an employee’s regular pay rate for hours worked past 40 in a workweek, eight in a work day, and on statutory rest days.

States have all sorts of quirks with their overtime laws. The exact overtime that you’re owed will be dependent on those specific laws. So look them up.

Overtime Pay Rates at Walmart

Walmart’s average hourly wage for its entry-level associates is over $17.50. Of course, this varies by state, depending on minimum wage requirements and cost of living. Walmart also announced in early 2024 that it plans to roll out pay increases across the board, boosting its average pay rate to $18 per hour.

The highest reported hourly salary for Walmart employees on Payscale is $21.64, although some Walmart employees state that Walmart caps hourly rates at around $25 per hour.

So hourly rates average between $17 and $25 on the high end. This is your best base scenario. That equates to an overtime pay rate of $25.50 to $37.50 for Walmart employees.

Realistically, I wouldn’t expect to be able to grab more than 5 hours of overtime in a given week every once in a while.

Even at the highest rate of $25/hr, that’s an extra $62.50 of pay in a week with 5 hours of overtime. Most will earn a lot less than this in overtime.

To grab a ton of overtime pay, you’ll need to switch companies.