Today, businesses have a ton of great options for payroll services. Gusto and QuickBooks payroll are two brands that you are likely to encounter as you search for a solution that is trusted and modern.

Gusto is one of the best options for small businesses. It’s relatively inexpensive and includes core HR features that help employees onboard, setup direct deposit, and enroll in employee benefits on their own.

It’s one of the easiest payroll services for employers to set up and use, and our top choice for most new and small businesses. Check out our complete review of the best payroll software and services here.

QuickBooks Payroll, on the other hand, didn’t make our top list. But that doesn’t mean it’s not worth considering, particularly for people already using QuickBooks accounting software.

Our guide will discuss the key differences and similarities of these services. By the end, you’ll have a better idea of which is better for you.

Three Ways Gusto and QuickBooks Payroll Are Similar

Here are three ways Gusto and QuickBooks Payroll are largely the same.

Gusto vs. QuickBooks Payroll Features

Both Gusto and QuickBooks Payroll provide automatic payroll and tax processing, as well as the groundwork required for year-end tax reports.

The similarities also extend to the online delivery of Form W2s for employees and 1099s for independent contractors.

That said, Gusto goes further here: the service covers state, federal taxes, and even local taxes, and the payroll automation side of things covers pay processing for salaried and hourly workers.

QuickBooks Payroll’s automated payroll is only for salaried employees. So if you’re a business that pays both types of workers, you need to keep that in mind.

Yet QuickBooks Payroll is directly connected to QuickBooks Online—one of the most popular pieces of accounting software. If you’re a business that already uses the software, QuickBooks Payroll will probably be better for you.

Which product does better here? In a nutshell: Gusto offers more payroll features.

Gusto vs. QuickBooks Payroll Employee Benefits

Both Gusto and QuickBooks Payroll give you access to a self-service portal that employees can use to view their benefits online.

Each service additionally provides access to experts who can advise you on HR and general compliance. They are very much the same in these areas.

Yet Gusto features a more extensive range of employee benefits options. It has flexible spending accounts and commuter benefits, in addition to health insurance—although this is limited to explicit states. If you’re a business that needs to access a broader range of employee benefits options, Gusto is most likely more suitable.

QuickBooks Payroll does include health insurance plans, but it doesn’t have commuter benefits and flexible spending accounts. However, if you’re a company that requires health insurance that employees can use across all US states, QuickBooks Payroll is for you.

Which product does better here? In a nutshell: Gusto offers more employee benefit-focused features.

Gusto vs. QuickBooks Payroll Accessibility & Integrations

Both services offer a user-friendly and intuitive platform for users to navigate and use.

The similarities don’t stop there, though. Gusto and QuickBooks Payroll also both offer dedicated phone support, detailed how-to guides, and access to expert HR advisors.

Gusto doesn’t feature a mobile app (for employers, they do offer one for employees), whereas QuickBooks Payroll offers a fully functional app on iOS and Android. The app is also free, and if you’re a business that needs to manage payroll out and about, QuickBooks Payroll is more suitable.

But Gusto has a more significant number of integrations that improve its useability, including FreshBooks, Xero, Clover, Upserve, and many more.

If you’re a business that relies on integrations and would need them to complete payroll, then Gusto is a better bet.

QuickBooks Payroll integrates with QuickBooks Time (formerly TSheets), QuickBooks, and additional Intuit products. It’s a better choice for small businesses that want more focus on the accounting side of things.

Which product does better here? In a nutshell: lack of a mobile app aside, Gusto offers more integrations and, thus, more options.

Three Major Differences Between Gusto and QuickBooks Payroll

Here are three key ways Gusto and QuickBooks Payroll are different.

Gusto: Lack of Extra Fees

Gusto may be the more expensive option overall, but there are more features available for your money. Not to mention that you don’t get charged extra fees.

QuickBooks Payroll can charge extra fees for some features that Gusto doesn’t. For example, the service charges for multiple state tax filings, 1099 filings, and direct contractor deposits.

With Gusto, these are all included in its first paid plan for the same price. We’ll go into these paid plans in more detail a bit later on.

If you’re a company that wants everything listed and included in one plan, Gusto is most likely better suited to you. For instance, some small businesses will be on tight budgets. They need to know what they’re paying for covers everything—extra fees may push them over the edge.

Equally, you may only want to pay for the features you need and take each extra fee as it comes. For instance, you might be a small company that doesn’t need to file taxes in multiple states.

QuickBooks Payroll: Accounting Tools

QuickBooks Payroll has tools for tracking sales, sales tax, and inventory management that Gusto does not.

With QuickBooks Payroll, you’ll be able to track projects at a much more granular level. Job costing, profitability–it will likely be harder to get a clean read on these with Gusto.

Not every company is going to need these features, or want them lumped in with their payroll software, but it’s a clear difference between the two products that is worth calling out.

Gusto: Wider Variety of Features

There may be quite a few fundamental similarities between the two regarding features, such as managing deductions, garnishments, and the reporting tools on offer. Still, Gusto provides a far wider variety of them compared to QuickBooks Payroll.

There’s more available for small businesses that want an all-in-one HR solution with extra features like employee offers and onboarding, time-off requests, employee surveys, and organization charts.

Gusto sorts out the reading and signing of required documents and covers specific areas such as sick leave policy and dress code. There are also options for disciplinary actions and warnings, making it feel like a comprehensive HR tool that also completes your payroll with ease—think of it like two platforms in one.

There’s a strong HR focus with Gusto then, and it establishes this through its features. QuickBooks Payroll doesn’t offer some of these more HR-focused features.

If you’re a small business that needs a robust suite of HR features, Gusto is most likely a better fit for you. Of course, if you want to process payroll and only offer health insurance as an employee benefit—across all US states—QuickBooks may be a better fit.

Gusto Products & Pricing

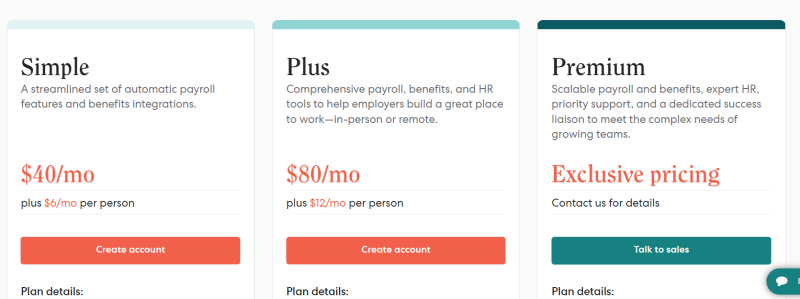

Below you can find the pricing and plans available for Gusto.

Gusto Simple Plan Pricing

Gusto’s Simple plan is ideal for smaller businesses with basic salaries, wages, and payment schedules and comes in at $40 a month for the base price plus $6 a month per person. The starting plan offers a full-service payroll, including health benefits administration and employee self-service, along with dedicated profiles.

There are also accounting and time tracking integrations where you can sync hours with payroll automatically and employee benefits, including medical, dental, and vision insurance. You can use employee profiles to organize your company into departments for easier reporting—a feature QuickBooks Payroll doesn’t offer.

Gusto Plus Plan Pricing

Gusto’s Plus plan is perfect for growing businesses and starts at $80 a month for the base price plus $12 a month per person. This second plan offers everything in the first plan besides next-day direct deposits, time tracking and PTO management, and project tracking with workforce costings.

On top of that are hiring and onboarding tools such as offer letter templates, onboarding checklists, and hiring documents. Team management tools like employee surveys and custom team-signed birthday cards are available. Employee surveys are a vital offering to measure employee happiness over time. Another extra that you won’t find on QuickBooks Payroll.

Gusto Premium Plan Pricing

The final plan on Gusto is the Premium tier. You will have to reach out to Gusto for a custom quote for a Premium tier plan, which comes with a much more comprehensive suite of HR support and direct communication channels.

You’ll get access to the HR resource center, including custom employee handbooks, job description templates, other HR guides, and policy templates. Proactive compliance updates provide you with alerts for federal or state law changes. There’s also a direct and priority line to a team of experts—they’re available to discuss benefits, payroll, and other HR matters.

QuickBooks Payroll Products & Pricing

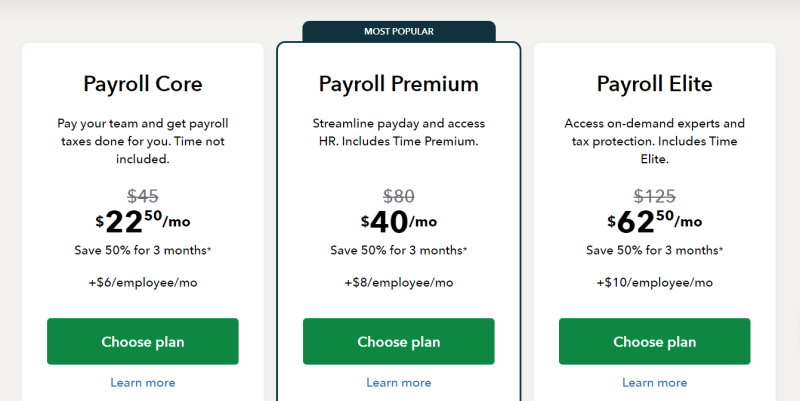

Below you can find the pricing and plans available for QuickBooks Payroll.

QuickBooks Payroll Core Plan Pricing

QuickBooks Payroll’s Core plan for small businesses is about covering the basics to ensure you can pay your team and have your payroll taxes done for you. Currently, for three months, you’ll have access to it for $22.50 a month plus $6 per employee per month. The usual base price here is $45 a month, but QuickBooks runs frequent promotions, so it’s worth keeping that in mind.

The plan gives you access to full-service payroll. That includes automated taxes and forms and the auto payroll we’ve mentioned earlier. Automated payroll is only for salaried employees, not hourly workers like Gusto offers. There are also health benefits for your team, 401(k) plans, and expert product support available via phone or email.

QuickBooks Payroll Premium Plan Pricing

QuickBooks Payroll’s Premium plan is for growing businesses. It allows you to manage your team and payday with HR support and employee services. It usually comes in at $80 for the base price per month, but currently, it’s $40 a month for three months plus the $8 per employee per month.

You’ll get everything in the first plan plus same-day direct deposits, workers’ comp administration, and the HR support center. The expert review feature means that after you set up your payroll, a QuickBooks expert will check your work to make sure everything is ready to go. The HR support center is available from this plan, unlike Gusto, who only offers it on its final tier.

QuickBooks Payroll Elite Plan Pricing

The final plan is the Elite tier that gives you access to on-demand experts to shorten the payday process. It typically starts at $125 for the base price per month, but that’s now reduced to $62.50 a month for three months plus $10 per employee per month. This plan is for growing businesses that want as much support as possible with QuickBooks Payroll.

You’ll get access to the expert setup feature, where a QuickBooks payroll expert will complete your setup for you once you have provided the required information. On top of that is 24/7 expert product support and an exclusive tax penalty protection feature where if you receive an IRS penalty, QuickBooks will pay the penalty fees and interest up to $25,000 each year.

Gusto vs. QuickBooks Payroll: Which Is Best?

Most people want to know a definite “winner” when it comes to which product is best. The simple answer is: a lot of that depends on different needs and circumstances.

That said, Gusto does have the edge over QuickBooks Payroll in a few more areas, and that’s why it made our top list in the end.

Essentially, Gusto is better for small businesses that want a comprehensive payroll and HR solution with professional HR support.

QuickBooks Payroll is better for small businesses that need to provide health insurance to employees across all states and use QuickBooks accounting software.

To make your final decision, weigh up the number of your employees, the need for HR support, what employee benefits you require, and the integrations available.

QuickBooks users will most likely want to use QuickBooks Payroll. However, if you need more employee benefits, integrations, and you’re solely paying contractors, Gusto is more than worthy of your consideration.