OnPay is a top payroll service with a range of helpful features. It’s easy to use and lets businesses run payroll in minutes. The service allows companies to pay both W-2 employees and 1099 contractors. There’s a free initial setup included, and end-of-year tax forms are created at no cost.

Who Needs OnPay?

OnPay is perfect for companies that need to run unlimited monthly payroll or use multiple payroll schedules. Payments are made by direct deposit, debit card, or check. Best of all, direct deposit and debit card payments don’t bring any extra fees. In these circumstances, it can be a cost-effective solution for small and medium-sized businesses.

Large businesses might not get as much from OnPay as others would. For instance, with a $6-per-person-per-month charge, the service can quickly become expensive for companies with a larger number of employees and additional contractors. The bigger the company, the more the service will cost you, so keep this in mind.

The #1 Best Thing About OnPay

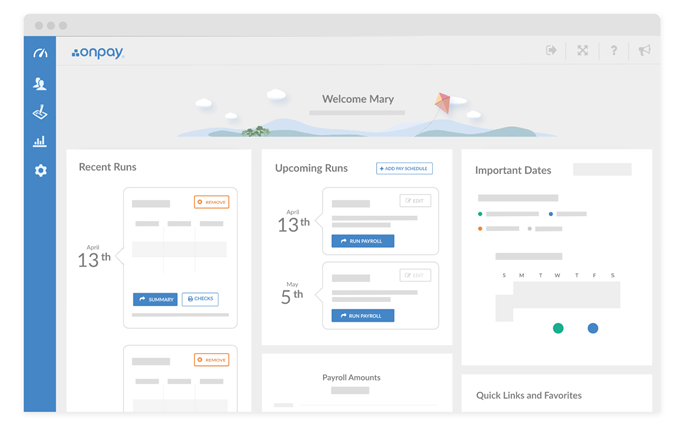

OnPay is known for its great ease of use, particularly with the initial setup process and interface. The setup itself is straightforward and can be completed within a day or less. The interface is intuitive, and few users have problems navigating it on a long-term basis. The user-friendly design overall highlights a payroll service that looks out for its customers.

OnPay Payroll

OnPay offers a full-service payroll platform. Below you’ll find the features and benefits of this service.

Features & Benefits

OnPay provides its users with a range of payroll features to help benefit their business.

One of the most significant parts of the payroll service is the unlimited monthly pay runs. This feature allows you to run payroll whenever you like, and you can select multiple payroll schedules for different employees. It’s essentially one price for an unlimited amount of use.

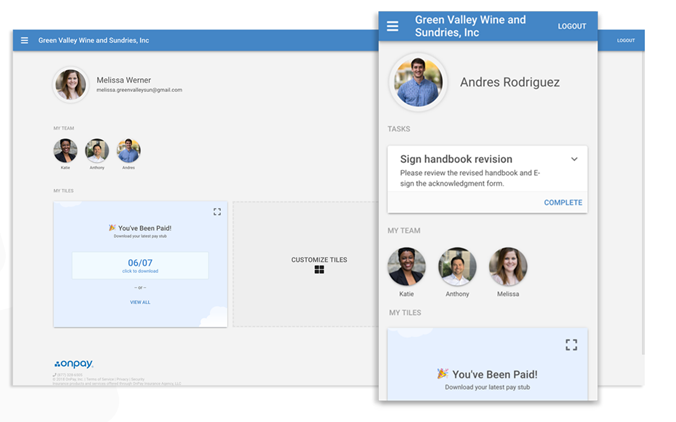

OnPay’s employee self-service capability allows your team to enter information and pull paystubs themselves, which encourages a sense of ownership.

On top of that, you can pay both W-2 employees and 1099 contractors—all through the central dashboard. Printable year-end tax forms are included at no extra cost.

The payroll service withholds state and federal payroll taxes every pay run, completes the relevant tax payments, and files Form 941 quarterly and Form 940 at the end of each year.

It’s worth mentioning there are no additional fees if you need OnPay to handle taxes for employees in more than one state. The software can run payroll in all 50 states. Businesses in that specific scenario stand to benefit the most here.

You’ll be able to pay employees whichever way they prefer, and there’s no further fee for direct deposit or debit card payments—you can print physical checks too. You can even set more than one pay schedule or use different pay rates for specific employees for no extra charge.

You can deduct garnishments with ease and set rules or goals for when they should stop. All garnishments are automatically recorded in paystubs and expense reports.

We’re also pleased to say that OnPay is optimized for mobile payroll. As long as you have a strong enough connection, there are few limits to what you can do with the software. It’s notably quick to process payroll and feels like a native experience on the go, although it does lack a dedicated mobile app.

All of these features add up to form a payroll service that’s best suited for small and medium-sized businesses, certainly if you need to pay both W-2 employees and 1099 contractors or handle taxes for employees in more than one state.

Larger businesses won’t get as much from the service as the price can quickly add up per employee.

Pros

- OnPay is ideal for processing pay for both employees and independent contractors. End-of-year tax forms are created at no additional cost.

- There are no additional fees if you need the service to handle taxes for employees in more than one state. The software can run payroll in all 50 states.

Cons

- The payroll service can become expensive for companies with a larger number of employees or contractors.

- OnPay does charge $5.00 per person to print, seal, and mail end-of-year tax forms to employees and contractors. It’s not a dealbreaker, but worth keeping in mind.

Pricing & Plans

OnPay is different from some other payroll services as it doesn’t feature tiered plans. Instead, it offers a single fee for payroll processing, including all of the key features we’ve mentioned—unlimited monthly pay runs, filing of your W-2s and 1099s, payroll in multiple states, and more.

The pricing structure is undoubtedly a move that will be welcomed by the majority of small and medium-sized companies, certainly those that find themselves caught between paid plans.

The service starts at $40per month for the base fee plus $6 per month per person.

For example, it would come to $70 a month as the total price for five people in your company. To process payroll for 30 individuals, you would be looking at $220 a month. OnPay also clarifies that you’re only billed for workers who are paid in a given month. The monthly billing costs 50% less than per-pay-run pricing.

That said, because of the $6 per person pricing, things can quickly add up if you have more people to pay. This isn’t altogether different from other payroll software options, it’s just something to keep in mind.

Visit OnPay for complete pricing information, as the company often runs promotions for new businesses, and you may be able to get a good deal.

OnPay HR

OnPay includes dedicated HR in the same payroll software. Below you’ll find the features and benefits of this service.

Features & Benefits

OnPay doesn’t charge anything extra for its HR features—it’s all included with the same payroll service, which is an attractive offering.

First off, you’ll be able to ask new employees to effectively onboard themselves. They can enter some basic information, fill out their profile, and e-sign HR documents as required. You can add onboarding tasks for teammates such as setting up new members’ computers, planning their orientation, and everything else they’ll need to get started.

You can provide a warm welcome to new team members with a customizable offer letter and can create and customize checklists of documents and tasks for specific events or employee types.

Built-in HR document templates are available, and you can import your own contracts if needed. Regardless of the format, all of these documents are customizable, and you can send them out for signatures on the same platform.

What’s more, we have in-app messaging where you can send employees reminders, performance reviews, or disciplinary notes, and secure document storage. Documents such as onboarding and tax forms are found within the vault with a quick search.

With PTO, all requests and approvals are managed within the software, and admins and managers can see an employee’s PTO calendar. There, they’ll track vacation time and can set up three different accrual rates for specific classes of employees.

Employees will have access to a handy org chart that details how the company is structured. For example, new employees will need to identify managers for PTO approvals, and this feature easily allows them to do it.

Of course, the larger the company, the more useful this will be. For instance, if you’re a team of seven, there’s a good chance an employee won’t take long to work out who the managers are and who they need to talk to for PTO.

These HR features are more than welcome, and we think they would be best suited to small and medium-sized businesses.

Those who need a convenient way of managing their HR—and payroll—in one offering and happen to use contractors and employees will benefit the most.

Pros

- HR templates, e-signing, and dedicated resources, as well as org charts and a company roster, are available for no additional cost on top of the payroll software.

- The employee portal lets employees complete their onboarding, track their PTO, and more, saving much-needed time elsewhere.

Cons

- PTO accruals can be challenging to understand and need to be more straightforward for all users.

- While you can see an employee’s hire date, it doesn’t automatically calculate their length of time with the company inside the profile.

Pricing & Plans

OnPay doesn’t use pricing tiers or offer multiple plans–so the pricing for its HR features is the same as it is for its payroll software. To use the HR features then, it’s $40 a month for the base fee plus $6 a month per person.

It’s a great deal, and one which we think will be appealing for small and medium-sized companies. The same free month of use is, of course, part of this.

OnPay Employee Benefits

OnPay allows you to integrate payroll with employee benefits. Below you’ll find the features and benefits of this service.

Features & Benefits

Employee benefits are an essential part of the overall package, and OnPay allows you to integrate them with payroll without hassle.

Through OnPay, you’ll be able to offer medical, dental, and vision, as well as retirement plans, life and disability coverage, and pay-as-you-go workers’ comp plans.

Health and dental benefits are available in all 50 states, and the service will help you choose the best plan for you. It’s worth noting that any premiums are automatically deducted from payroll.

There’s also the ability to choose plans from top providers like Aetna, United Healthcare, Guardian, Humana, Anthem, Sun Life, and Blue Cross Blue Shield.

The service has partnered with Vestwell, Guideline, and America’s Best 401(k) to make it easy to offer low-fee retirement plans as well.

OnPay can even pull your employee census data for insurance quotes and offers in-house licensed brokers for added peace of mind.

Pros

- Medical, dental, and vision, with retirement plans, life and disability coverage, and pay-as-you-go workers’ comp plans, are all included.

- A host of top providers and in-house licensed brokers is available to help companies make the best choices.

Cons

- While offering a mobile-friendly website, there is no dedicated mobile app to manage employee benefits when on the go.

- The service doesn’t allow an employee to have multiple worker’s comp codes.

Pricing & Plans

OnPay doesn’t use paid plans, so the pricing to integrate payroll with employee benefits is the same.

To use the employee benefits features, it’s $40 a month for the base fee plus $6 a month per person.

What Do Users Think of OnPay?

Most users of OnPay are very optimistic about the software. They mention the ease of use and a large number of helpful features as particular highlights. The customer service is also favorably reviewed, with most commenting that it was both prompt and efficient at solving the problem they had.

Although most users like OnPay a great deal, some have noted a slowdown while navigating the interface. Some users think finding information on the platform could be more straightforward. Others believe it takes time to get used to the software. That said, most believe OnPay is intuitive from the start.

How OnPay Measures Up To The Competition

The top competitors OnPay is up against are Gusto and Paychex. We thought both of these were excellent payroll services.

That said, OnPay compared favorably to these two competitors and made our top picks for being best for both employees and contractors. OnPay’s simple and upfront pricing is similar to what Gusto offers, along with the range of employee benefits available. Both OnPay and Gusto are also known for their ease of use.

Compared to Paychex, OnPay measures up well with its HR services for small businesses, but Paychex will definitely be a better option for mature or complex businesses. With pricing, OnPay has the edge because Paychex doesn’t list its prices directly. That said, Paychex does offer an exclusive payroll fraud hotline.

Overall though, it’s clear OnPay more than holds its own, with the differences between competitors coming down to a user’s personal needs.

In fact, we put together a payroll software and services buying guide which covers a range of popular options and the specific business scenarios in they work best.

Do We Recommend OnPay?

Yes. OnPay is a great payroll service with many valuable features. It’s easy to use, allows you to pay both W-2 employees and 1099 contractors, and there’s a free initial setup included.

Upfront, straightforward pricing, and top-notch HR features round off a compelling package that’s ideal for small businesses.