If you need accurate compensation data, go with Payscale. But you’ll have to pay $6-10K.

Glassdoor is free but I’d be extremely skeptical of any data. I’d only use it for quick checks and rough ranges. I’d never use it for anything serious.

So why is Payscale more accurate than Glassdoor? It comes down to the data source. Payscale gets some of its data from HR-reported payrolls. That’s real payroll. It does have other data sources but I avoid those.

Glassdoor, on the other hand, collects data from one source: random people on the internet. And we all know how reliable the internet can be.

Payscale Overview – Expensive But More Reliable

Payscale is one of the main compensation benchmarking tools. Most folks will use them or Salary.com.

By the way, Payscale is also referred to as Payfactors. They used to be separate companies and then they merged. Payscale is the company, Payfactors is the product. And people use the names interchangeably.

Here’s how it works:

- You sign up for an annual plan. You’ll have to get a quote from a sales rep and it’ll be in the $6-10K range depending on the exact package.

- You’ll get access to your software and can start searching for roles.

- You have some choice over the data set, I ONLY use the HR-reporting payroll data. I never use the employee data.

- You’ll decide what types of companies you want to pull compensation for (company size, location, industry, etc).

- Search for a list of roles by keyword. You’ll have to look at the role descriptions closely to find the right role. People use titles very differently so you have to match based on the exact duties.

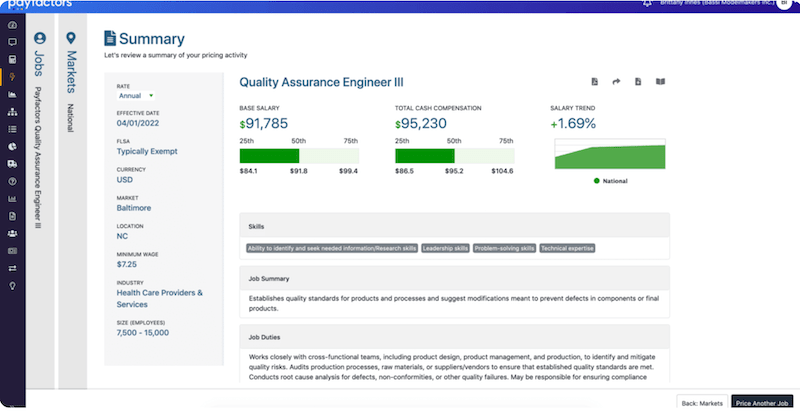

When you’re done, you’ll get a report like this:

You can do this for as many roles as you want.

It works really well when Leadership wants compensation recommendations for roles on a regular basis. Even though I’ve found plenty of issues with benchmarking data, it feels VERY official. Executives won’t push back on compensation ranges once they see the data. “Look! Here’s a fancy report from an expensive data source! It must be real!” “Ah, yes, yes, very official looking! Proceed!”

The biggest benefit of Payscale is that it’ll help settle compensation debates really fast. Even if the data isn’t 100% accurate.

The pros I experienced when using Payscale:

- Payscale lets you pick your data source and restrict your data to only payroll-reported data. This is extremely important to me.

- The UI is reasonable enough. It’s not great but it is one of the better one’s in the benchmarking category.

- Support is really strong, they’ll help you get set up and answer any question you have. Definitely go with them if support is important to you.

- Everyone believes in the data which is nice when you need to get a bunch of approvals.

The cons I experienced:

- The cost is on the higher end for the category. All the other popular options are cheaper.

- The data isn’t perfect. In general, expect ranges to be off by 10% in either direction. I have more details here.

Glassdoor Overview – Free But Not Reliable

Glassdoor started as an employee review site. Kind of like Yelp for companies. Recently, they’ve expanded into all sorts of career categories. It’s become a bit of a mess.

But let’s focus on their compensation features.

You can search for roles and companies, this is what the Software Engineer compensation looks like for Seattle, WA:

Here’s the bad part.

If you try to use Glassdoor as a new user, you’ll get locked out. You might be able to view one page before seeing this:

It’s a forced login popup. You cannot continue viewing the site until creating an account.

Fine, they want users. The bad part comes up later. You’ll add a bunch of info like your name, title, and company. Then you get hit with this:

They force you to enter your compensation in order to use the site. There’s no way around it that I know of.

What percentage of users do you think enter in their real compensation? I know it’s not 100% because I gave a fake salary and role when creating my account. I’m pretty confident other people are entering fake comp too. Compensation is very personal, that’s a lot to ask for when you’re forcing people to create an account on their first visit.

Because of how they collect their data, I would not trust compensation data from Glassdoor at all. At best, it’s an extremely rough range.

As for their paid plan, I talked with their sales reps years ago. At the time, they were pushing services to help promote and maintain your company profile on their site. I’m not sure what they offer today around compensation benchmarking but I can’t imagine it’s any good based on how they collect their data.

The pros I experienced when using Glassdoor:

- It’s free. Hard to beat free.

- The UI is super easy to use. It’s a modern web app company with an easy to use UI.

The cons I experienced:

- The data is completely unreliable. I’d never use it for anything serious.

- I hate how the whole site locks you out until you’ve given a bunch of personal data. Gives me a terrible impression of the company.

- There isn’t a reliable way to compare role scope. One of the hardest parts of compensation benchmarking is getting the role comparisons right. Titles have a huge variance, you need to go through the detailed responsibilities to match comp. Glassdoor doesn’t have any of this.

Payscale vs Glassdoor – Which is Best?

If you need real compensation data, use Payscale. They have real data. It’s not perfect but it’s a lot better than a website that’s pilfering users for personal data on a forced signup.

Yes, Glassdoor is free if you jump through their hoops and create an account. You could make the case that it’s worth it to get a rough sense of a new role that you’re opening. That’s true.

But if I was trying to get a rough sense of where the market was at on a new role, I’d just go to the job boards. With all the pay transparency laws, a ton of companies now post salaries for new jobs. If you spend 15 minutes on a job board, you’ll have a pretty good idea of what the pay for a role should be. That’s completely free and I’d argue it’s much better data than Glassdoor.

Payscale is one of the better benchmarking companies. And if you want free data, just check job boards. Ignore Glassdoor altogether.