Imagine a tax season so simple and stress-free that you could actually enjoy the holiday season in peace. No more sweating bullets during your New Year’s Eve party as you stress about sending out dozens of W-2s and 1099s before February hits.

With top-notch payroll management, this dream can be yours.

Payroll management is a big job. It includes making sure employees get their pay on time, keeping track of benefits, and staying on top of payroll tax requirements.

Being disciplined about payroll management all year long is the only way to make tax time a breeze. It’ll make every other aspect of your work life easier, too.

Core Responsibilities of Payroll Management

Before we dive into our tips for managing payroll, let’s look at the key responsibilities of payroll management.

Collect and Organize Records

From tax forms to direct deposit information to PTO logs, the payroll department handles a lot of records. In a typical hiring cycle, an employer will collect several payroll-related forms from a new hire, including:

- Employee’s name and Social Security number: You’ll need these to fill out the Form W-2, which you’ll file with the SSA and furnish to employees by January 31.

- Form I-9/Employment Eligibility Verification: Verifies an employee’s eligibility to work in the United States.

- Form W-4/Employee’s Withholding Certificate: Tells you how much federal income tax to withhold from the employee’s paycheck each pay period.

- Form W-9/Request for Taxpayer Identification Number and Certification: Gives you the information you need to run payroll if you work with freelancers and contractors.

- Employment agreement: The document that outlines the employee’s compensation and benefits.

- Direct deposit information: Allows you to enter employees into your payroll system and compensate them on time each pay period.

Your job is to store all these records securely and update them every year if needed. The Age Discrimination in Employment Act (ADEA), the Fair Labor Standards Act (FLSA), and other laws require employers to retain basic employee data and compensation records for three years.

Forms I-9 must be kept for three years after the date of hire or one year after the date of the employee’s termination.

Records related to employee benefits must be retained for at least six years. Or, in the case of pensions and retirement plans, for as long as the plans are relevant to the employee.

Making sure you follow all legal recordkeeping requirements is essential to payroll management. Whether you have one employee or 500, keeping these records meticulously organized is a must.

Nowadays, most records are electronically collected and filed. This means you need a secure, cloud-based system that can store these documents and sort them by employee.

A good payroll software system will help you do just that.

Prepare and Run Payroll

Every time payday approaches for your organization, you’ll need to run payroll. If it’s your first time running payroll, you’ll need to pick a payroll schedule. You must decide if you’ll pay employees every week, every two weeks, or every month.

Some states have laws that regulate payroll schedules, so make sure you pick one that complies with your local laws.

Next, you’ll calculate each employee’s gross pay. This is the amount each employee earns in a pay period before taxes and other deductions are applied. For salaried employees, this is easy—just divide their annual compensation by the number of pay periods in a year.

If someone gets paid $75,000 a year over 12 pay periods, they’d earn $6,250 per pay period.

Hourly employees are a little trickier. You’ll need to multiply the number of hours they worked, including shift differentials and overtime, by their hourly rate. This means you’ll need time sheets for each hourly employee.

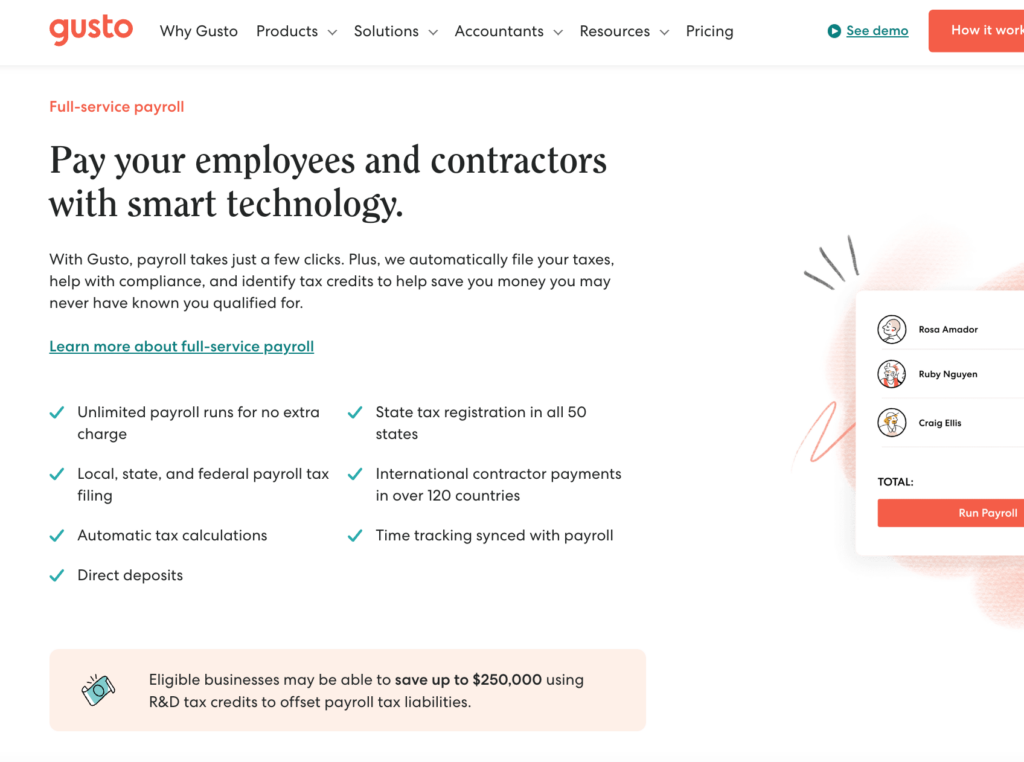

We recommend getting payroll software with an employee time tracking feature, like Gusto or ADP, to make this task much easier.

Payroll software will also help you with the next step: figuring out everyone’s deductions, allowances, and withholdings. That’s where staying organized with everyone’s tax forms and benefits documents comes in handy.

After taxes, insurance, and benefits are deducted from an employee’s gross pay, you’ll have their net pay. Document gross pay, deductions, and net pay on a pay stub and fork that cash over to your employees via direct deposit or a check.

You’ll keep a copy of the pay stub for yourself and send a copy to each employee, too. Make sure you upload these records onto a secure cloud storage area.

Whatever you do, avoid doing any of this process manually. The olden days of paper records and file cabinets are long gone. The right software can run payroll far better than any human can—and it’ll help you stay organized and ready for tax time.

Withhold and Pay Taxes

As the payroll manager, you’re responsible for withholding federal income, Medicare, and Social Security taxes from each employee’s paycheck. You must also set aside the employer’s share of these taxes from your business’s income.

You’ll then pay both the employee and employer share of these taxes directly to the IRS. For most businesses, taxes are due to the IRS via an electronic funds transfer (EFT) a few days after a payday.

The IRS Publication 15 section called Depositing Taxes can help you figure out when you need to hand that money over.

Along with the taxes you split with your employees, you’ll also need to make sure your organization pays:

- Federal unemployment tax (FUTA)

- State unemployment tax (SUTA)

- State unemployment insurance (SUI)

The easiest way to pay these taxes is to submit them via the Electronic Federal Tax Payment System (EFTPS). Some payroll software services save you time by paying taxes automatically on your behalf.

Manage Employee Benefits

A large part of managing payroll is keeping track of employee benefits.

You’ll need to keep track of:

- Paid time off (PTO) usage

- Retirement contributions from the employee and the employer

- Health/life/dental/vision insurance premiums paid

- Flex Spending Account (FSA) or Health Savings Account (HSA) contributions/deductions

All records relating to benefits must be stored for at least six years, usually longer.

Ensure Legal Compliance

A large part of payroll management is making sure your business follows all local, state, and federal payroll regulations.

These include, but aren’t limited to:

- The Fair Labor Standards Act (FLSA)

- Federal Insurance Contributions Act (FICA)

- Federal Unemployment Tax Act (FUTA)

- Equal Pay Act (EPA)

- Lilly Ledbetter Fair Pay Act

- Immigration Reform and Control Act

- (IRCA)

- Immigration and Nationality Act (INA)

- Age Discrimination in Employment Act (ADEA)

- Service Contract Act

- Davis-Bacon Act

- Walsh-Healey Act

- Family Medical Leave Act (FMLA)

And these are just some of the U.S. laws. If you have international employees or contractors, you’ve got a slew of additional laws to comply with.

Compliance mistakes with any one of these laws can cost your business a ton of time and money, especially if lawsuits are involved.

But of course, there are dozens of laws to pay attention to, if not more. How can you make sure your organization follows all of them?

Here’s where a payroll management system saves you yet again.

A good payroll software service will offer a suite of tools and automations that help you follow the laws relevant to your organization. ADP offers a SmartCompliance tool that keeps track of ever-changing local, state, and federal laws for you, for instance.

Gusto offers comprehensive guides to state laws, along with software that helps you track and manage compliance.

You’ll still need to know the laws and keep the information in your system updated. But trust us—life will be far easier with trusty payroll software in your corner.

Tips for Strategic Payroll Management

1. Use a Simple Payroll Budget

Don’t let the idea of a payroll budget overwhelm you. You don’t need to spend hours tallying every potential expense.

All you need to do is map out a simple payroll budget. On a spreadsheet, write down this information for each employee:

- Name

- Type (full-time, part-time, contractor)

- Department

- Title

- Annual base salary, including total expected from hourly wage

- Notes on things like bonuses/whether a person is paid hourly

The next step is to add 25% to each annual salary. All you have to do is multiply each annual salary number by 1.25.

For most businesses, this extra 25% covers everything from the cost of employee benefits to PTO to taxes. Over time, you can finetune your budget and fill in the details of what you actually spend to get a more accurate percentage. But for most organizations, 25% is the magic number.

See our guide to a simple payroll budget for step-by-step instructions and a free template.

2. Keep Employee Data Updated

Employee information changes all the time. People get new bank accounts, change their last names, and move to different addresses. As a payroll management team, your job is to make sure this information is accurate.

Here’s a list of some of the personal information that often gets mixed up or outdated:

- Legal name changes

- Direct deposit information

- Phone number

- Emergency contact information

- Updated employment contracts

- Mailing/physical/email address

- Education level

- Background check information

- Salary data

- Employment length

Keeping employee data up-to-date helps you avoid potentially costly or time-consuming mistakes. Like paying an employee a salary from 2023 when it’s now 2024 and their updated contract reflects higher annual pay. Or sending a pay stub to an outdated email address. Or calling an incorrect phone number to verify payment details.

To keep all records up to date, review them every quarter and make any necessary adjustments. You can also commit to making necessary changes the moment you learn about them instead of putting them off until later.

So let’s say an employee sends you updated direct deposit information. You’re up to your ears in tax-related paperwork and the next payroll won’t run for three weeks. What’s the harm in waiting?

The harm is you’ll probably forget until it’s too late to update the banking information for the next payroll. This will cause you extra stress as you work out how to pay the employee on time and get payroll ready to go out to all the other employees on your team.

If you can’t make a change right away because you’re out to lunch or at home for the evening, set an alarm in your phone to do it as soon as you get back to your desk.

3. Use a Payroll Service

If you haven’t already noticed, we highly recommend using a payroll service to manage your payroll. Whether you outsource it to a third party or use software that does most of the work for you, there’s no reason to do it all yourself manually.

Yes, you’ll have to pay a fee to use a payroll service. But any fee is worth its weight in gold if it helps you avoid legal issues born of innocent compliance mistakes or payment snafus. And that’s exactly what payroll services do.

There’s an ideal payroll software program out there for every type of business. We recommend signing up for one that integrates with your time clock software. Even better if it also automates things like paying taxes and producing tax forms.

4. Get Help With All Things Tax-Related

It’s early January, the start of tax season for businesses.

You’ve done the work to make sure all employee data is up-to-date. Your meticulous record-keeping means that documents like Form I-9, W-4, and W-2 are organized and ready for tax season.

Now all that’s left is to generate tax forms and prepare to file taxes on behalf of your business.

For this, you should use tax preparation software—if it isn’t already included as a feature in your payroll software.

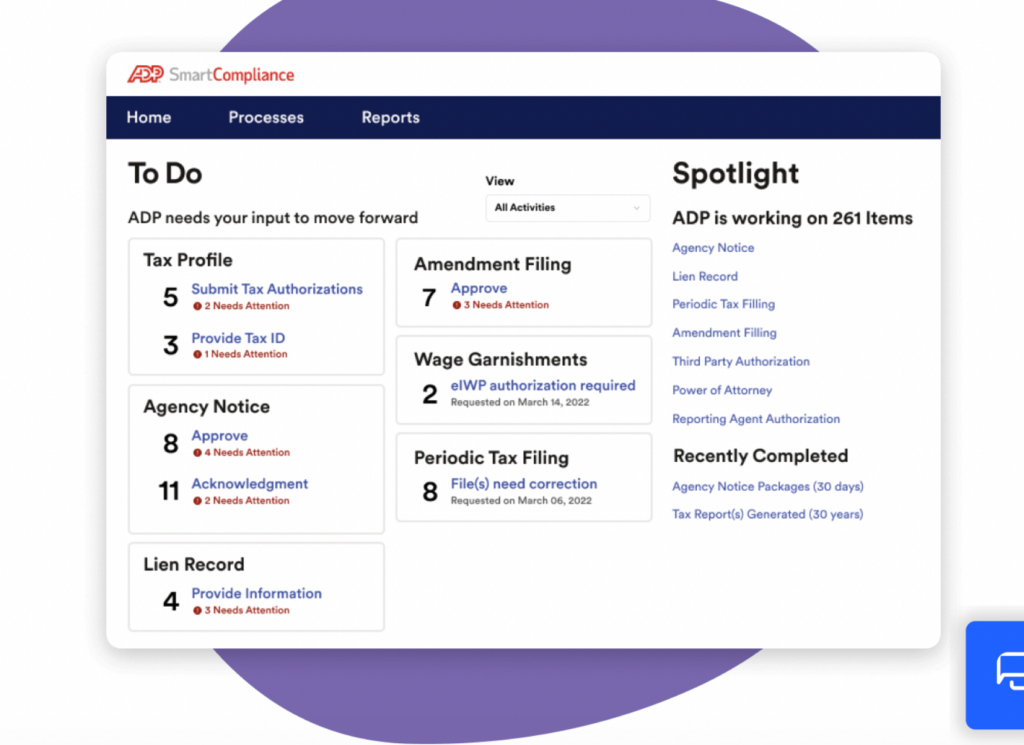

One of our favorite payroll software services, ADP, offers a SmartCompliance feature that keeps track of every nitty-gritty tax-related detail.

Everything is organized into an easy-to-use dashboard that eases the mental load of worrying about tax responsibilities.

We also recommend hiring an accountant to look over your tax information before you file a return each year.

With detailed payroll management, good payroll software, and a Certified Public Accountant (CPA) audit, tax time will be a breeze.