Using these steps and template, I can see the exact impact on my payroll budget of a complete reorganization in less than 20 minutes.

Planning for a single new role takes about 30 seconds.

It’s that quick.

Payroll Budget Template

I cleaned out the payroll budget we use, put it in a Google Sheet, and made it public. Feel free to make a copy of the template for yourself.

To make your own copy, open the payroll budget spreadsheet. Select File in the upper navigation bar, and choose the option Make a Copy. Rename the payroll budget, and click Make a Copy. Done!

Note: This payroll budget template is not appropriate for processing payroll. I have a separate guide for how to do payroll if you are looking for better ways to pay employees.

4 Steps to Create a Payroll Budget

Using our template, I’m going to walk you through how to customize it for your own company, step-by-step.

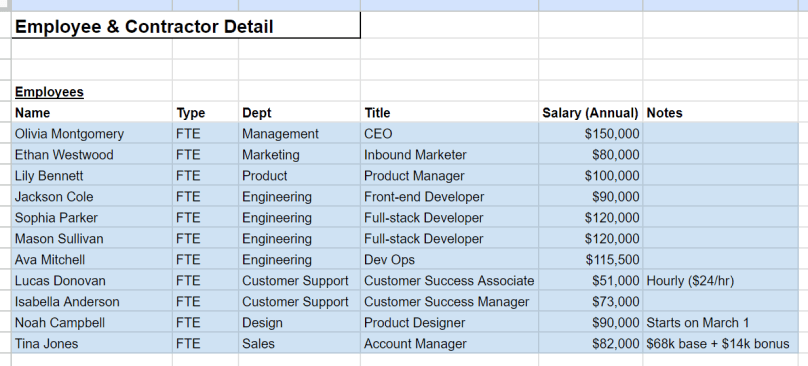

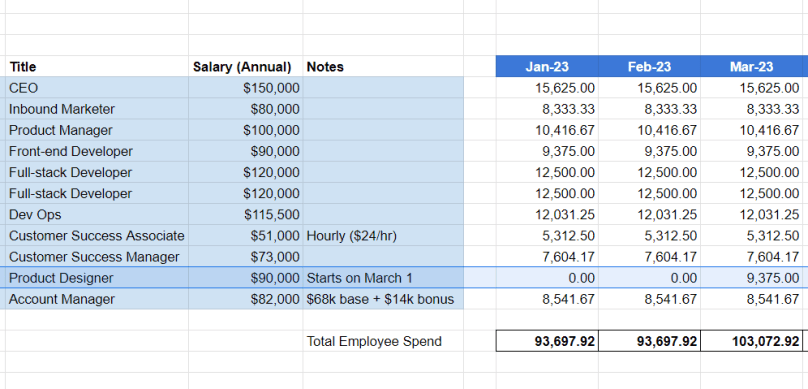

1. Get everyone’s annual salary

Start with full-time salaried workers. Get everyone’s annual salary information from wherever your payroll lives.

If you are using payroll software, which I highly recommend, this is as simple as going and grabbing the salary data.

In the Salary column of our template, put the employees’ total cash compensation, which includes:

- Annual base salary

- Variable pay (like tips, merit bonuses, commissions, etc.)

- Overtime pay (for hourly employees only)

- Company-wide bonuses (just estimate an average if there is variance in the bonuses)

You can use the optional Notes column to explain your estimate for hourly workers, record significant bonus compensation, and leave other small memos.

Most of the example employees in our payroll budget template earn a straight annual salary, but the exceptions are all clearly noted:

- The only employee earning variable pay is the Sales Account Manager, and both her base pay and merit bonus are recorded in the notes column.

- The Customer Success Associate is paid an hourly rate of $24. To estimate their annual salary, I multiplied their hourly rate by the standard 2,080 hours to get $49,920. The number 2,080 comes from 40 hours per week multiplied by 52 weeks. You can adjust where hourly workers are working less. In this case, the Associate is not earning overtime (although they would be entitled to it should they work more than 40 hours during a single week), but I added a little margin anyway and estimated $51,000.

Adding a little cushion to the budget by overestimating is a good idea. The less certain you are about the actual cost, the more cushion you should add.

If you have other big ticket costs that factor into people’s total compensation, include those in the notes.

Don’t over complicate it, though.

Forget the piddly stuff like gift cards and Doordash lunches. Yes, it’s compensation, but it’s not going to move the needle with regards to the payroll budget.

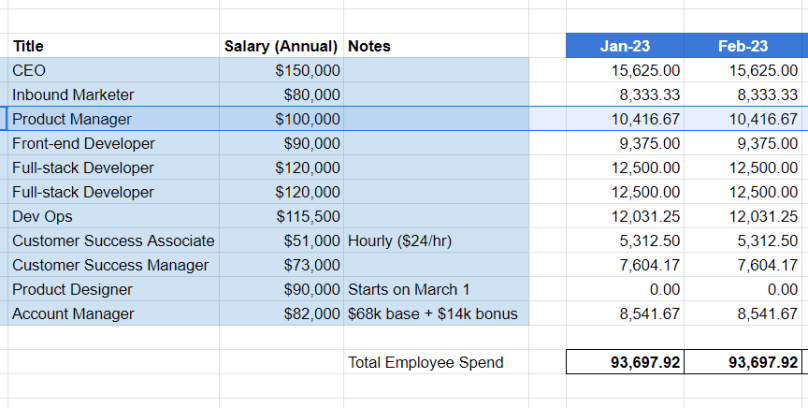

2. Use the 25 percent rule to get fully-loaded cost

Once you have everyone’s annual salary filled in, it’s time to calculate their “fully-loaded” cost.

Fully-loaded costs account for benefits, insurance, workers comp, taxes, sick leave, and everything else that the company pays sponsors.

These exact costs are so hard to estimate if you are not a career HR professional.

And it’s not worth it. What most people do, and how we have it set up in our payroll budget template, is to add 25 percent on top of annual salary costs.

This 25 percent rule covers all taxes and benefits.

All of the healthcare premiums, taxes, 401(k) contributions, fringe benefits, PTO, and so on. The 25 percent rule takes care of all of this–no need to dig into the individual costs of any of these forms of compensation.

This is a standard practice across the HR industry.

When estimating payroll costs, multiply each employee salary by 1.25. That’s it.

Our template already does this automatically. As soon as you add the annual salary, the fully-loaded cost gets added to each month. This fully-loaded cost is automated calculated in our template. It shows up in the monthly estimates.

For example, the highlighted Product Manager salary ($100,000) is multiplied by 1.25 to account for the extra 25 percent, and then divided by 12 to find the monthly cost of $10,416.67.

If you adjust the salary, the monthly numbers will automatically update.

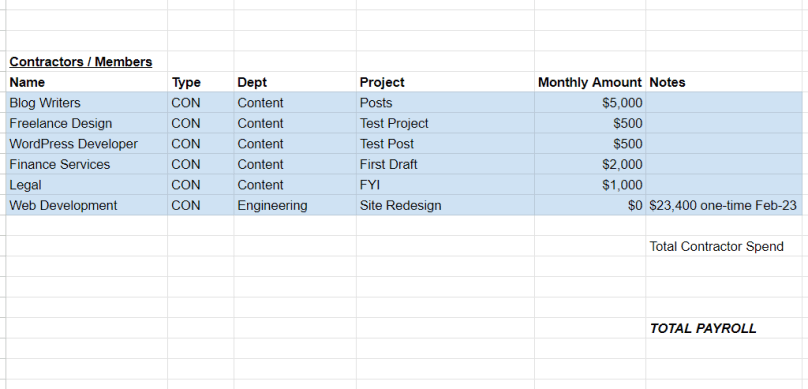

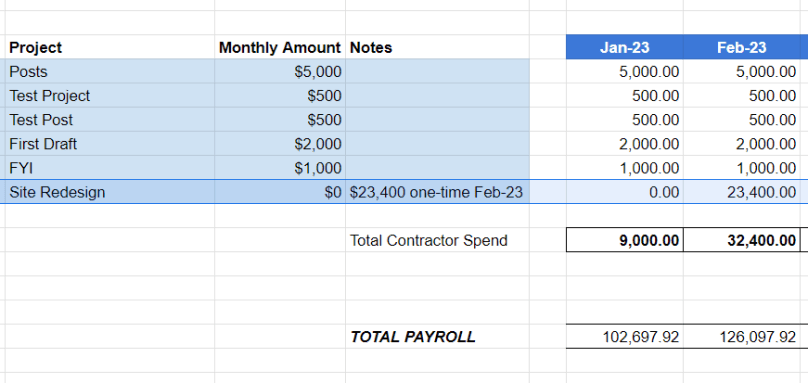

3. Add contractors to the payroll budget

Now it’s time to factor in the cost of contractors.

I like to do this in a separate section because contractor salaries are not subject to the 25 percent rule, which changes the monthly calculations.

Add contractors as individual line items, estimating the average monthly cost of their services.

This doesn’t have to be perfect, just get an average monthly average for what you have paid in the past.

In this example, you can see that we estimated $500 per month for freelance design and WordPress developer test projects. $6,000 per year is little over what we have spent in the past, so that’s what we use to derive a $500 per month budget for each test project.

For contractor budgeting purposes, just get a decent yearly average, add some margin, and the template will break it out monthly.

It might also be a good idea to group contractors who do the same type of work into a single line item. The payroll budget example in our template lists “Blog Writers” as a single line item, even though we have a handful of individual freelancers. This makes it a lot easier to manage everything.

What if we have a contractor for a one-off project?

This happens, and it’s easy to account for in your budget.

You can see the example in our template where web development services were rendered one-time for a website redesign:

To add one-off contractor services, set the monthly amount “0”, and add the actual cost during the month (or months) it is going to occur.

You really only have to worry about this for expensive, one-off projects. These kinds of projects do come up, and this is an easy way to make sure that everyone understands exactly where the extra payroll costs are coming from.

4. Estimate role and comp changes throughout the year

Now that you have a monthly budget for the entire year, you can start to map out some of the new payroll costs you expect to shoulder in the coming months.

This doesn’t have to be exhaustive, but you should include items that are going to have a material impact on payroll, such as:

- New hires

- Promotions

- Retirements

- Annual raises

In the template, there is a Product Designer slated to start on March 1. To add that in correctly, I added in their salary and then zeroed out the specific monthly costs for January and February. Now the budget will track them from March 1 moving forward.

You can use this same tactic to forecast costs for open roles that you expect to fill later in the year.

I recommend budgeting the maximum possible salary for each role when you are estimating salaries for open roles. The new hires almost certainly won’t make that kind of money to start, but you can be sure they won’t be paid more than your estimate.

This will keep you under budget, which is way better than the alternative.

Same thing when you are estimating the cost of annual raises. Assume everyone gets the max possible raise.

Obviously you don’t want to do that, but by budgeting in the max for raises, you know you won’t go over your projected cost.

This might sound too overcautious, and maybe it turns out to be.

So what?

I’d rather be under budget on payroll than over it any day.

Making the Payroll Budget Template Your Own

Feel free to customize the template further, or tweak it to fit your company better. Whatever works.

Just remember that your payroll budget does not have to be perfect in order to provide useful answers to questions like:

- What a new hire will actually cost the company?

- How much does a 3 percent raise across the company cost?

- How much will a reorganization cost?

- How much does a promotion cost?

You can budget for one new hire or 20 new hires. It’s only going to take a few minutes to get clear costs for the year mapped out.

Over time, you’ll be able to uplevel the accuracy of your budget by replacing estimates with actual payroll data. Eventually, you’ll want to tie this budget into your other costs, compare it to revenue, and estimate profits.

Improving the Accuracy of Your Payroll Budget

Each month, you should take the opportunity to review your budget in light of the actual numbers.

Basically, you just want to replace your estimates with the actual numbers. For full-time salaried employees, this will be a straight copy paste from your payroll software or your bookkeeping.

For hourly employees, you may still be estimating averages if their hours worked fluctuates a lot. Over time, you can identify trends and seasonality that makes your estimates more accurate.

Typically, contractors are where we really have to review our budget every month. Is the budget coming in high or low? Should we keep things as they are?

The other thing you should do monthly is get synced up on any personnel changes. Is anyone getting hired, leaving, promoted, and so on.

Don’t Process Payroll With a Budget Spreadsheet

One last thing.

We use a Google Sheet to manage our entire budget. It’s easy, fast, and keeps us on the right track.

But what I would never do is use a spreadsheet to process payroll.

It’s too messy and the stakes are too high.

When you process payroll, you have to be exactly accurate, 100 percent of the time, with every calculation. Tracking state taxes, city taxes, healthcare costs, PTO–there’s a lot that goes into every paycheck.

Even if you only have a single employee, I would still use a payroll service to process payroll.

There are a handful of really great, dependable payroll services that I can recommend. It does not cost a lot, and the time-saved alone is worth it.

When there is an issue with how many hours someone worked or an employee forgot to update something, you can hassle the payroll service. They’ll fix it for you and complete the required documentation.

Good payroll services are very reasonable. I’ve used Gusto across multiple companies as a full-service payroll and it’s great. Employees love using Gusto, that’s not an overstatement. It’s easy. We rarely have issues. It also handles things like benefits, PTO, and onboarding.

I have the exact steps on how I prefer to set up payroll, if you want to take a closer look.

Anyway, my advice is to let a payroll service handle all of the messy record-keeping. Let them keep up with changing payroll laws in 50 states.