Accurately calculating and processing payroll is crucial for a business. Timely payments keep your employees happy, motivated, and productive.

However, you also need to consider the different federal and state payroll regulations and ensure that you withhold the required taxes and consider any financial incentives and employee benefits while processing payroll.

This is why it’s best to use an online payroll service that automates your payroll and manages the whole process for you.

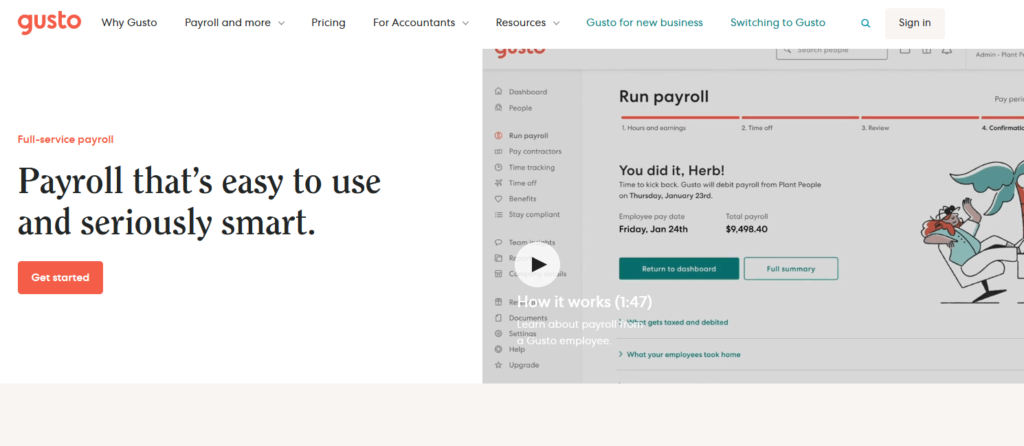

In this article, I’ll show you how to do payroll using Gusto, a modern and user-friendly payroll service.

I will also share other payroll services if Gusto is not the right fit for your business.

Let’s get started.

Step-By-Step Guide to Doing Payroll

Here’s the step-by-step process for doing payroll using Gusto.

Step 1: Complete Your Business Documentation

Before signing up for Gusto (or any other payroll service), you need to complete your business documentation so that you’re legally eligible for processing payroll.

Here are the steps you’ll need to take for this purpose.

- Get a valid Employer Identification Number (EIN) registered with the IRS to process payroll. The IRS uses EIN to identify business entities for tax purposes.

- Depending on your state, find whether your state tax identification number is the same as your EIN. If not, you’ll need to apply for it as well.

- Create a separate bank account for processing your payroll only.

Apart from these points, also consider any industry or state-specific regulations and documentation requirements for processing payroll. These may include:

State tax info

- State unemployment account number

- State unemployment tax rate

- (Depending on your state) Withholding account number, deposit schedule, Workers’ Compensation Insurance account number and rates, local tax account numbers

Signed documents

- IRS approved signatory

- Name and email for signatory (if not yourself)

Workers’ compensation

- Your existing workers’ comp policy details (Optional)

- Company and industry info

- Employee job details

If you’re an established business, you should already have most of this information ready and documented. But if you’re just starting, you’ll need to prepare them before moving to the next step.

Step 2: Sign Up For A Payroll Service (Gusto)

Now you’re ready to sign up for a payroll service and simplify your payroll process. We’ll use Gusto as our payroll service in this article, but there plenty of other world-class payroll services that you can consider depending on your business needs.

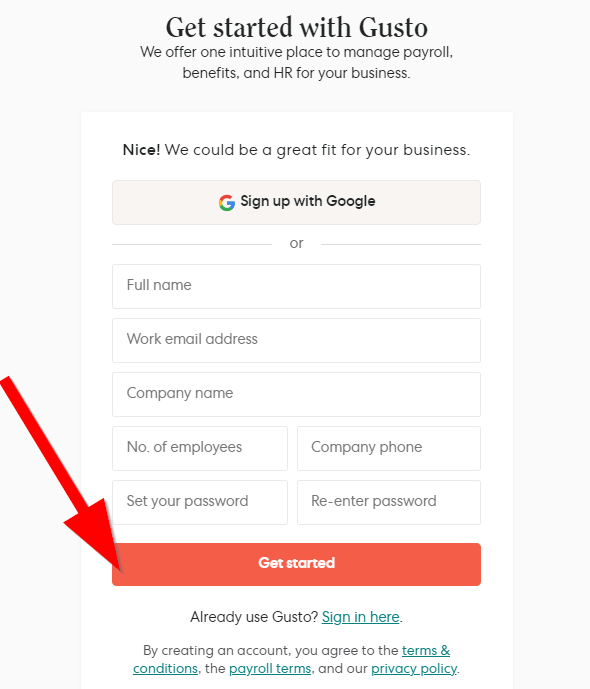

Visit the payroll section on Gusto’s official website and click Get Started to create your account.

Sign up with your Google account or fill in the signup form to get started with Gusto.

Click the link in the confirmation email sent to your email address to activate your account.

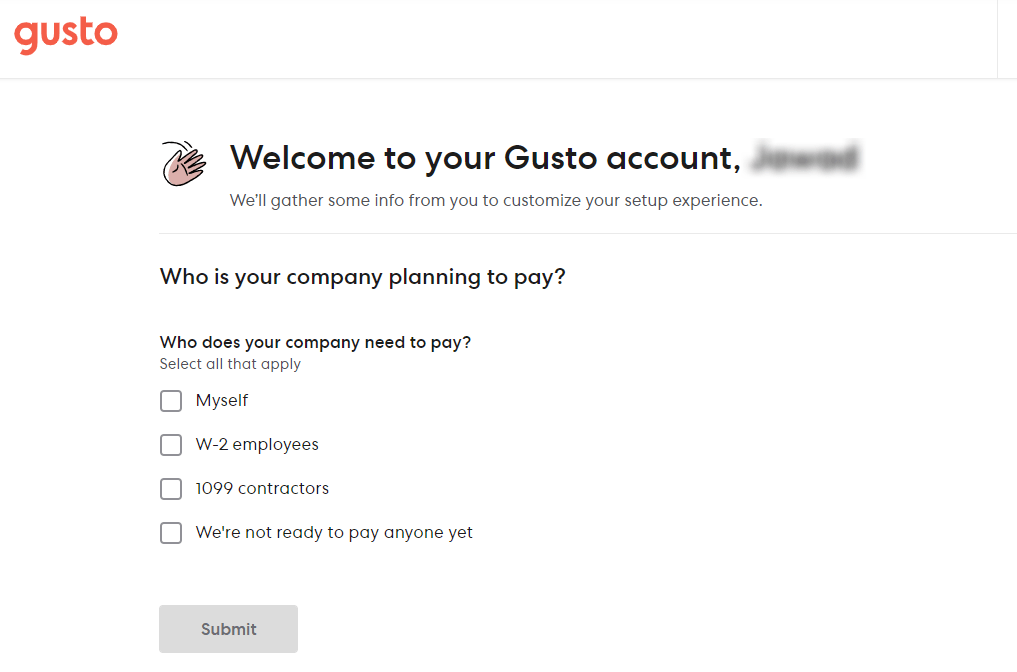

From here onwards, Gusto’s onboarding process will gather all the necessary payroll information required to set up your account. In the first step, choose the types of employees you want to pay using Gusto.

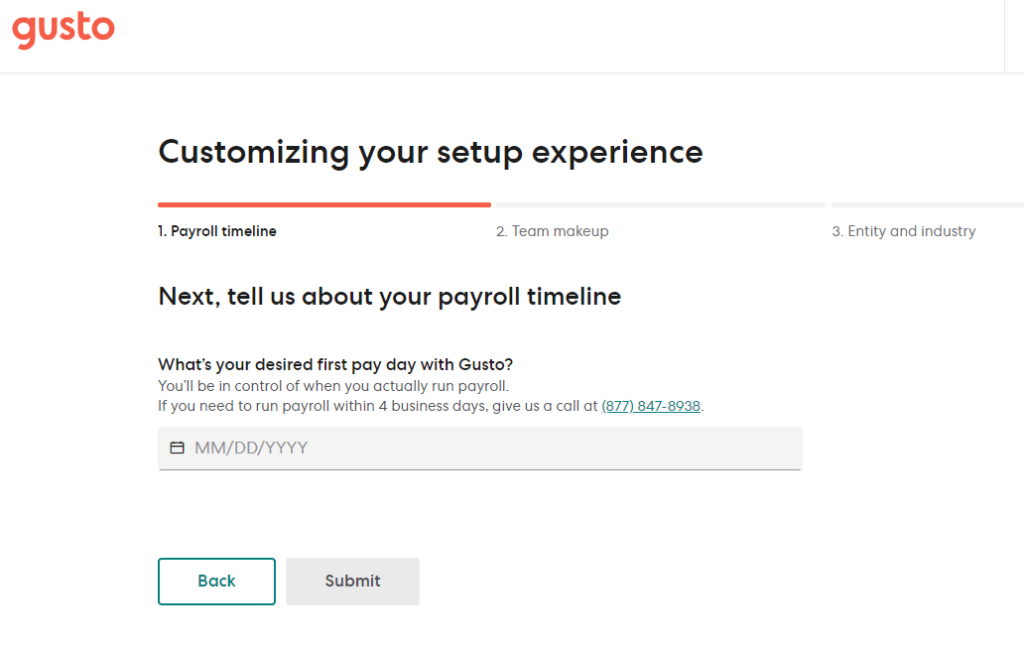

Click Submit to continue, then enter your payroll timeline or give it an estimated date when you plan to run payroll.

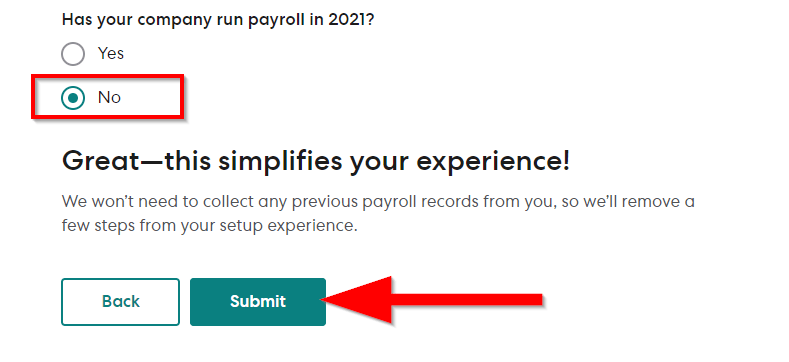

Next, Gusto asks you if you’ve run payroll before. If you have all your previous payroll records, choose Yes. Otherwise, select No to continue.

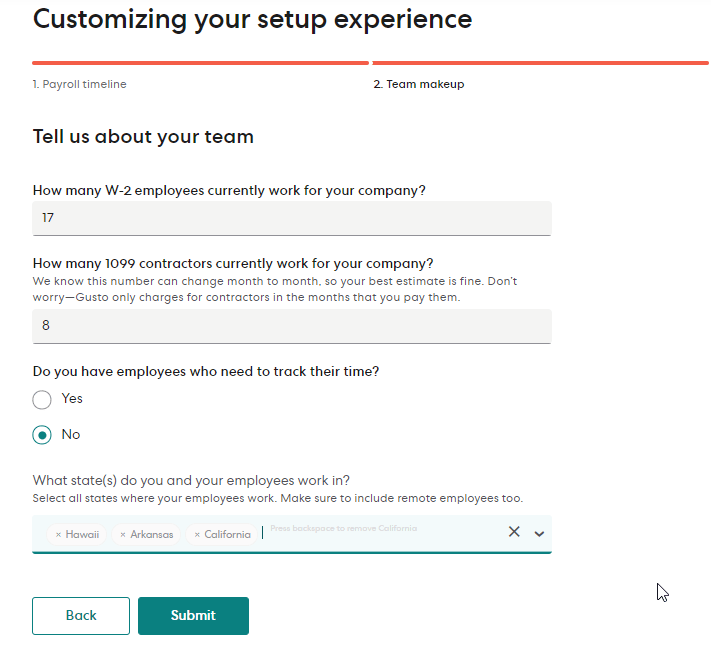

Click Submit to continue. Next, enter the number of full-time and contractual employees working for your company.

If you want to use Gusto’s time tracking solution as well (for an additional fee) enable time tracking. Otherwise, choose No.

At the end of this page, mention all the states in the US where your employees are based. Then, click Submit to continue.

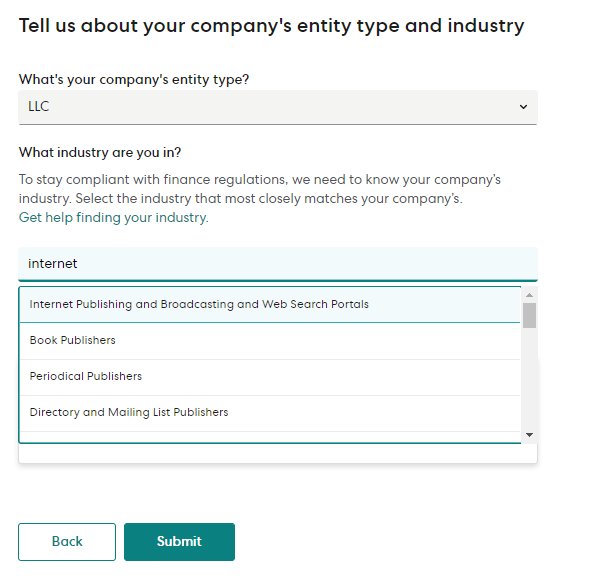

Next, choose your company’s entity type from the dropdown menu.

Search for your industry by keyword or code. Choose as many as applicable, then click Submit to continue.

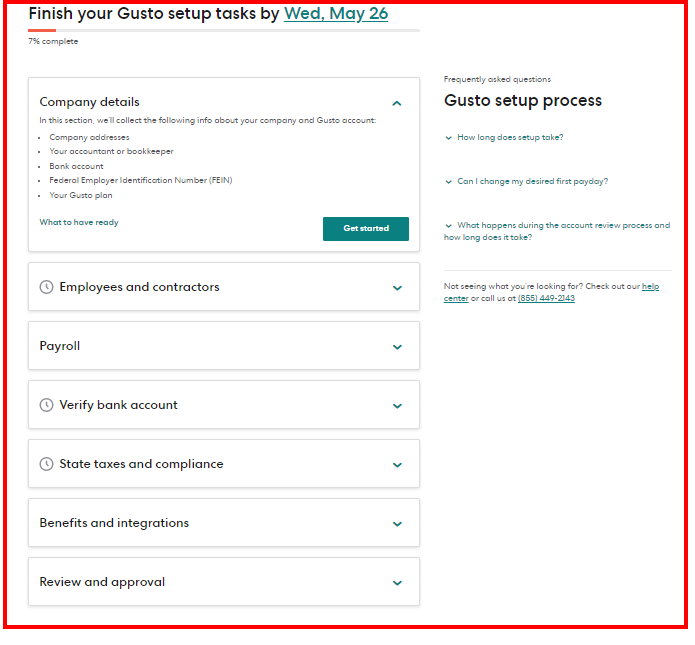

This completes your basic account set up in Gusto.

However, there’s still a long list of things to do. To make your job simpler, Gusto lists everything you need to do in chronological order.

To manage your payroll with Gusto, you’ll need to complete all these sections one by one.

Completing them means you’ll gather everything you need to legally process your company’s payroll.

Step 3: Complete Your Company Details

Now that your primary account setup is complete, you need to start completing the remaining sections one by one.

Start by completing your company details.

Here’s how to do it.

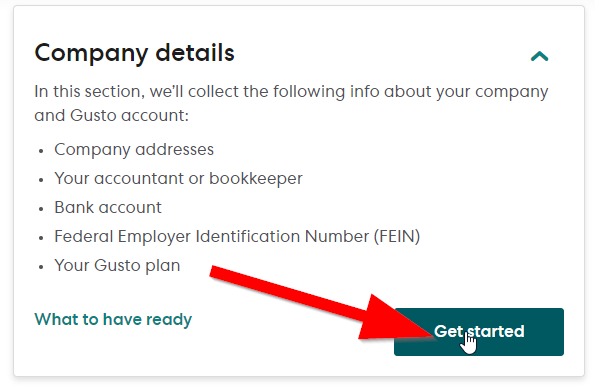

Go to the Company details section in your account dashboard and click Get Started

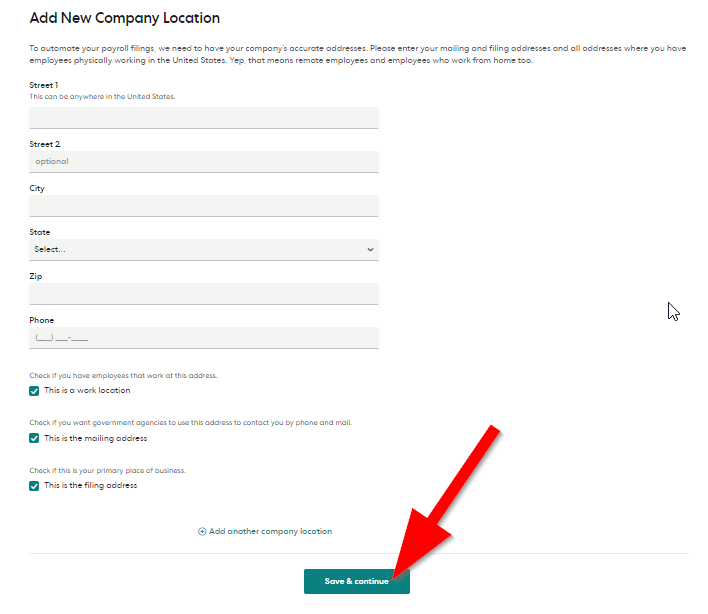

Enter your company’s complete street address and phone number.

Click Save & Continue.

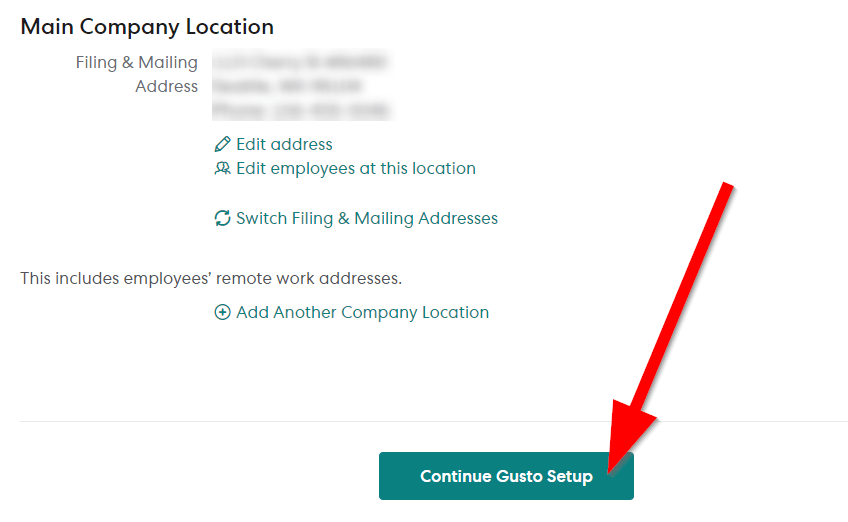

In the next step, review your address and click Continue Gusto Setup if all the information is correct.

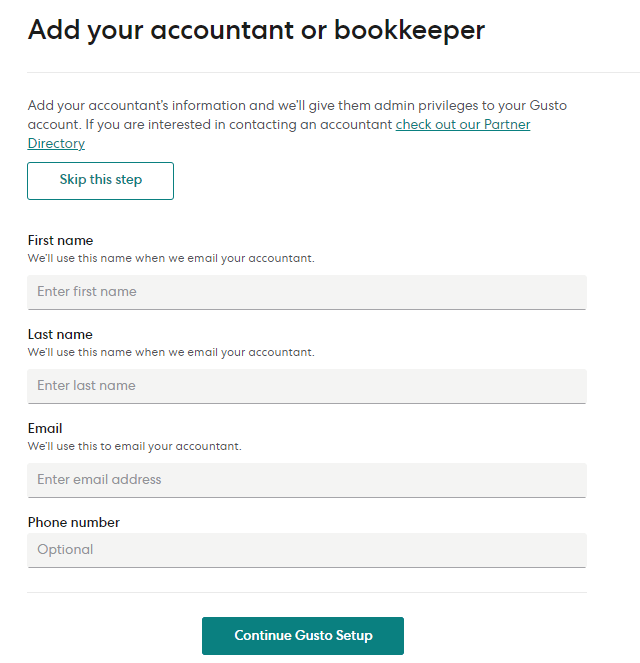

If you have an accountant who will manage your Gusto account, enter their details so that Gusto can create their account. Skip this step if you’ll manage the account yourself.

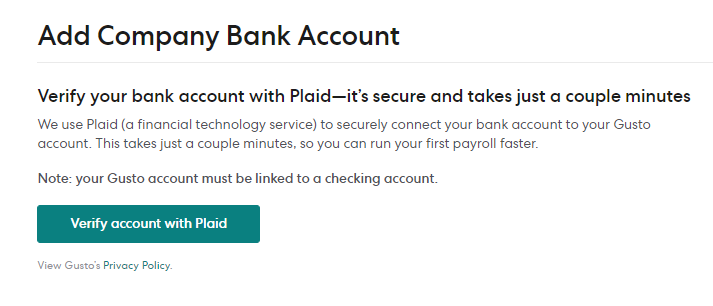

Next, you need to verify your bank account with Plaid (a verification service) or manual verification. Make sure the bank account you link with Gusto is dedicated to payroll only.

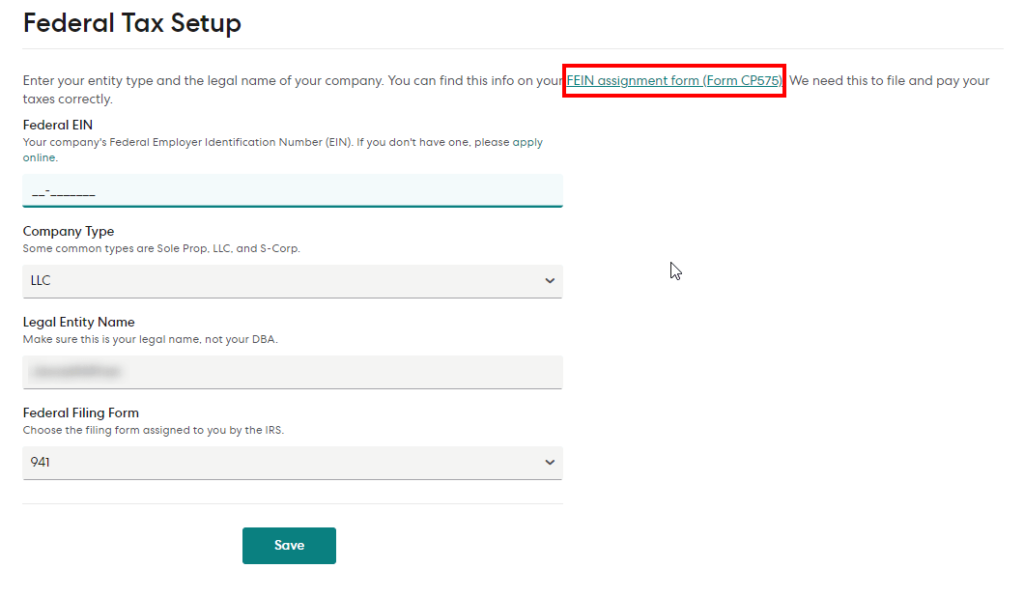

If you have your EIN ready, as I mentioned in Step 1, enter it in your tax details. If you don’t have an EIN (also called FEIN), click on the FEIN link to generate one for your business before moving forward.

Click Save to continue.

You’ve now completed your company information. But before you move forward, you’ll need to choose a subscription plan.

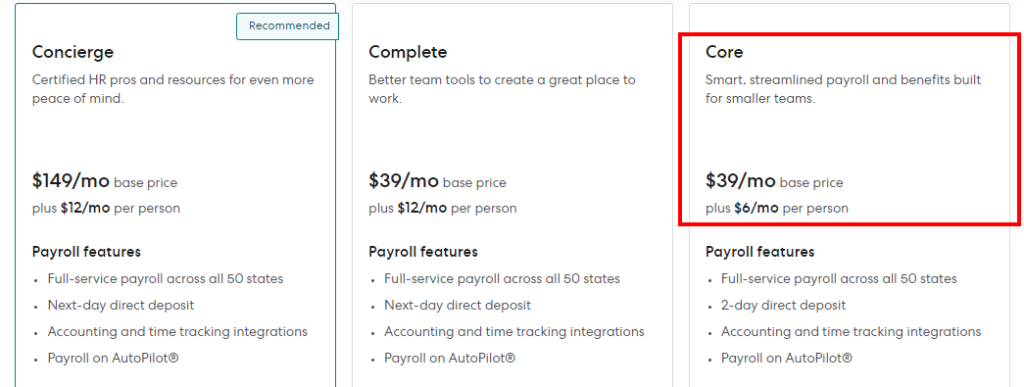

If you’re looking for an end-to-end payroll solution, go for the Concierge plan that starts from $149/month + $12/month per person. But if you’re looking for basic payroll features only, go for the Core plan that starts from $39/month + $6/month per person.

Don’t worry, you don’t need to pay immediately.

Once you choose a plan, you’re ready to move to the next step.

Step 4: Collect Employee Payroll Documents

You’ll need to submit specific information in Gusto about your full-time and contractual employees in this step.

Here’s the information you’ll need for every employee in either of these categories.

W-2 employees (Full-time)

- Employee full names and email addresses

- Start dates

- Salary info

- Work locations

1099 contractors

- Contractor full names and email addresses

- Compensation info

- Work locations

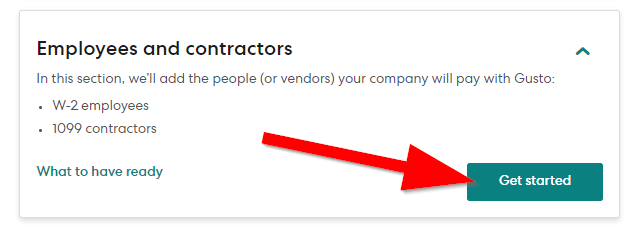

Go to Employees and Contractors in your account dashboard and click Get Started.

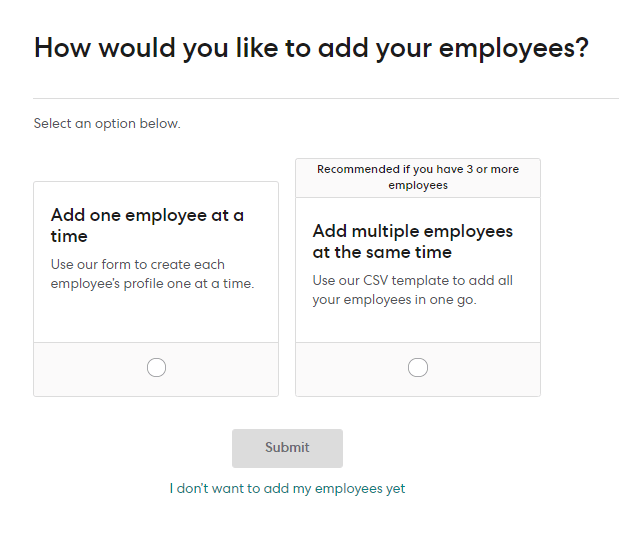

You can add employees one by one or by uploading a CSV file that contains the complete data of multiple employees.

Add as many employees as you want and move to the next section.

You will also enter any specific employee benefits or exclusive project-based incentives, either for all your employees or particular individuals, in this step.

Step 5: Create Your Payroll Schedule

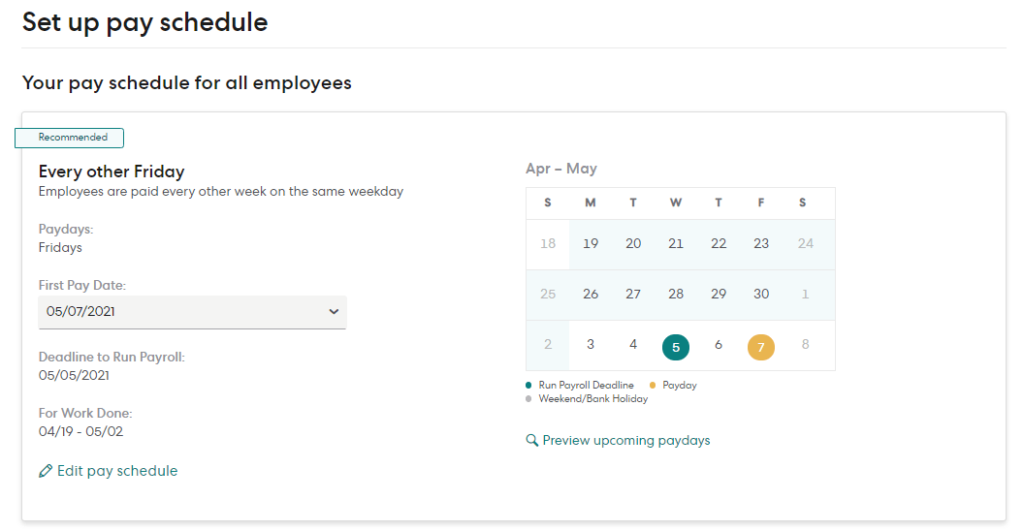

In this section, you’ll need to enter your payroll schedule in Gusto.

Specifically, you’ll need the following details.

- Pay period

- Pay dates

- Desired date of the first payroll with Gusto

You can create a single payroll schedule for all your employees or chose different dates for hourly workers and salaried employees.

Gusto will use this schedule to process your payroll for one-time and recurring payouts.

Step 5: Track And Manage Work Hours

Now that you’ve gathered all the basic account information and documents, it’s time to start tracking your employees’ working hours and time-offs to accurately calculate your monthly or weekly payroll.

Salaried employees usually have fixed working hours and salaries. Calculating their hours is much easier as compared to contractors who work on an hourly or project basis.

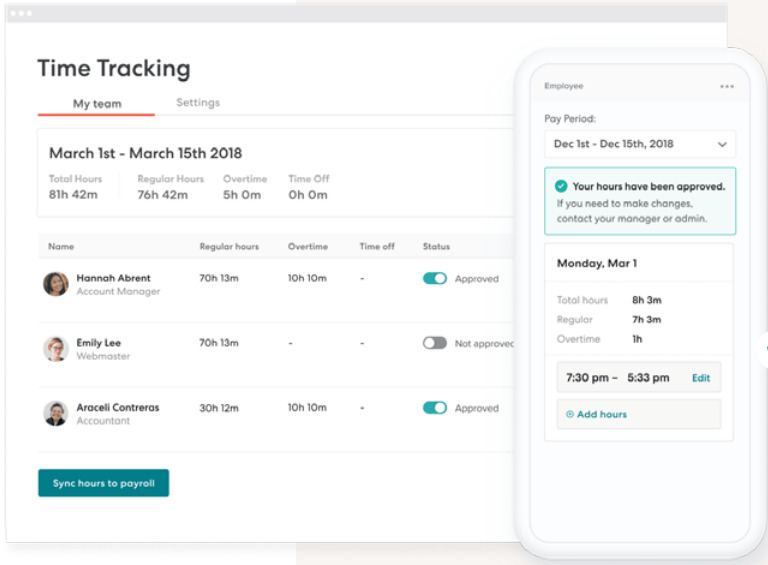

If you already have a time tracking system in place, you’ll need to integrate it with Gusto. Otherwise, you can use Gusto’s time tracking tools as well.

It gives you a time tracking dashboard that gives you a bird’s eye view of your team’s working hours. You can dive deeper into the timesheets of individual employees and contractors as well.

Step 6: Calculate Your Payroll

You now have everything you need to calculate your employee payroll.

Since you’re using Gusto, you don’t need to do these calculations manually. You’ve already entered the required data and timesheets based on which Gusto will calculate the payroll.

But to give you an idea, here are the two main factors you need to calculate.

Gross Payroll

This is the total pay according to your employee’s contract. For salaried employees, this would include the salary plus any overtime during the payroll period. For contractors, the gross payroll will be calculated according to their hourly rate.

Payroll Deductions

The deductions will include any applicable federal and state taxes, employee benefits, unapproved off-time, and any other penalties according to your employee’s contract.

Thankfully, you don’t need to worry too much about the taxes of any other deductions because Gusto will do all the heavy lifting for you.

Step 7: Execute Your Payroll

You’ve gathered all the necessary information, entered it into your payroll software, and calculated your payroll.

It’s now time to process the payroll.

Again, you don’t need to do anything in this step because Gusto, your payroll service, has calculated the exact amount you need to pay your employees, the amount of taxes you need to deduct, plus any other deductions.

It will simply process the payroll on your given schedule and notify you with a detailed payroll report.

You only need to ensure that your payroll bank account has sufficient funds to process the payroll.

This brings us to the end of the payroll process.

I’ve shared an overview of all the high-level steps, which should give you an idea of how a payroll service simplifies your payroll processing.

3 Top Benefits of Doing Payroll With A Payroll Service

A payroll service makes your job easier in several ways. Here are some of the top business benefits of using the right payroll service.

Automates The Whole Payroll Process

A payroll service fully automates your payroll process and saves you from hours of manual work. This significantly reduces human error in payroll processing and simplifies complex calculations such as employee benefits and taxes.

Manages Your Monthly And Annual Reports

Since your payroll service has all the relevant data, it automatically creates periodic annual reports that you can submit to the relevant tax authorities when needed.

Provides You Legal Assistance

Most payroll services also assist you with the different legalities involved in payroll processing. They help you navigate through different HR policies, labor laws, taxes, and any other compliance requirements from your business.

3 Biggest Challenges With Doing Payroll & How To Troubleshoot Them

Payroll processing is a crucial and challenging task for businesses. Here are the most common challenges companies face while processing payroll.

Managing Global Payroll

Payroll processing becomes much more complex when you have remote employees working in different countries worldwide. A global team means you need to comply with different policies and laws in multiple countries and constantly track them for any changes.

Thankfully, international payroll services (like Gusto and several others) take care of this complex task by managing compliance in different countries for you.

Managing Employee Records

As your workforce grows and new employees join different hierarchical positions, managing their payroll records becomes a complex job.

A payroll service gathers all this information from you and ensures proper management of employee payroll records.

Calculating Benefits And Deductions

Different roles in a company can have different benefits, incentives, or tax requirements. Calculating them becomes even more difficult when you’re working with remote teams with various local laws.

Once again, a payrolls service takes care of this issue that would be hard to resolve manually.

Other Options For Doing Payroll

If you think Gusto is not the right solution for you, there are several other ways you can manage your payroll.

Manually Doing Payroll

If you’re running a small business with basic payroll requirements, you can do the payroll yourself. This will save you money but require several hours every month for manual payroll calculations.

Hiring An Accountant

A slightly better option is to hire an accountant to manage your payroll. They have the required expertise and legal understanding to execute your payroll correctly. However, human errors are still a possibility.

Using A Different Payroll Service

You should invest in a payroll service for flawless payroll processing, especially if your business is growing fast or works with large distributed teams and freelancers.

Apart from Gusto, there are several other world-class payroll services that you can consider.

Here’s our picks and what they’re best at:

- Gusto – Best for overall ease of use

- Paychex – Best versatility

- ADP – Best for HR integration

- OnPay – Best for both employees and contractors

- Rippling – Best for payroll automation