Form 944 is for employers that qualify to pay taxes once a year instead of quarterly. Only companies with a tax liability of $1,000 or less are eligible to file Form 944.

Form 944, Employer’s Annual Federal Tax Return, can simplify an employer’s payment of taxes by allowing them to file just one time rather than four times a year. This typically benefits small businesses with low payroll costs.

Only employers who have paid at least one employee for the year AND meet the following requirements can use Form 944:

- Did not file a tax return for the previous tax year

- Do not owe more than $1,000 in federal taxes, including what’s owed for Federal Insurance Contributions Act (FICA) tax

- Have approval from the IRS to file Form 944

Wait, Form 944 Requires Approval?

Yes. Any employer interested in filing Form 944 must first get approval from the IRS.

Why?

Most employers only qualify to file Form 941, Employer’s Quarterly Federal Tax Return. This form includes information about the company, the number of employees it paid, how much those employees made, and how much the company owes in taxes for those employees.

Companies can use the information on that form to determine how much they need to pay in quarterly taxes to meet the IRS’s usual requirement for most employers.

However, Form 944 is available to some employers, but only if they meet the requirements I outlined above. Most employers are not going to fit this criteria, so the IRS approves requests to file Form 944 to ensure that only eligible employers file it.

In fact, if the IRS notifies you that you’re required to file Form 944 rather than Form 941, you must do so.

If you haven’t received a written notice to file Form 944 but believe you’re eligible to do so, you can call the IRS or send a written request.

The IRS will review your previous tax filings and any new evidence you provide about your current tax status to determine your eligibility.

What’s Reported in a Form 944?

The IRS typically requires employers to pay their annual taxes through a quarterly system in which they estimate their tax responsibility for the year and split that amount into four payments. These payments are due on tax dates throughout the year in April, June, September, and January.

Not only does the quarterly system help the IRS manage and oversee business tax payments, but it also benefits companies with high tax liability. Paying throughout the year is typically more manageable than paying a lump sum when annual tax returns are due in April.

That’s why most companies use Form 941 to report their tax liability and determine how much they should pay for the upcoming year. This amount comprises all federal tax liability, including FICA taxes, which cover employees’ Social Security and Medicare tax withholdings.

Form 944 is for employers with a small payroll budget and maybe one full-time employee or a few part-time employees. This form has the same purpose as Form 941 in terms of determining how much tax liability the company has, but it doesn’t require employers to split their tax liability into four payments.

Form 944 includes the following major components:

- Amount of employee wages: This amount includes the total employee wages paid, plus tips, bonuses, and other forms of compensation.

- Federal income tax withheld: Employers must report the amount of federal taxes withheld from employee paychecks.

- Breakdown of FICA taxes: This part of the form helps employers calculate the total amount of FICA taxes to be withheld from employee paychecks, including qualified sick leave and family leave taxes.

- Adjustments: Employers can enter adjustments that may affect their tax liability to decrease the total amount of taxes owed.

- Credits: Certain credits an employer qualifies for can also be added to Form 944 to adjust their tax liability.

- Current year’s deposits: If a company is required to make semiweekly or monthly deposits for payroll taxes, they must enter the amount they’ve deposited for the year on Form 944 to determine how much they may owe.

- Balance due: After subtracting deposits, adjustments, and credits from an employer’s total tax liability, Form 944 presents the total balance due, if any.

Form 944 also leaves space for businesses that have closed or no longer have employees. If this is the case for your business, you can indicate on Form 944 the date you stopped paying wages and attach a statement including the contact information for your payroll recordkeeper and where your payroll forms and records are stored.

How to Fill Out Form 944

Approved businesses can download a copy of Form 944 from the IRS website. Below are the basic steps to fill it out. You can also find detailed information about each part of the form from the IRS.

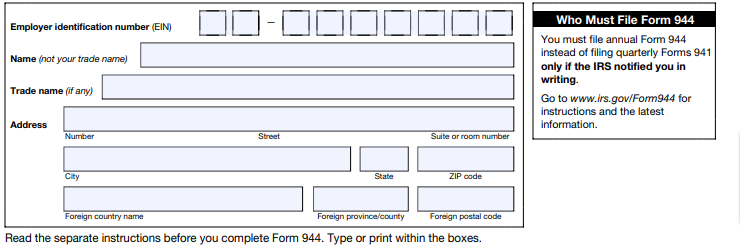

1. Fill Out Your Business’s Information

Start by filling out information about your business at the top of the form, including your Employer Identification Number (EIN), trade name, and address. This information should all be for the current tax year to match IRS records.

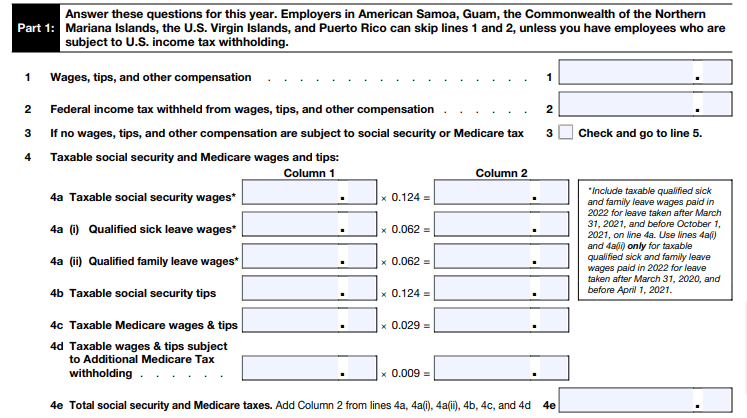

2. Answer Questions About Employee Wages and Withholding

Part 1 of Form 944 is the most detailed section. Here, you’ll input information about your employees’ wages and withholding, starting with all wages, tips, and commissions and the federal income tax you withheld from those earnings. You’ll also calculate FICA taxes based on the wages you paid in boxes 4a to 4e.

In box 6, enter any adjustments for the year, like group-term life insurance or sick pay, that may reduce your tax liability. Box 7 calculates your taxes with those adjustments.

In boxes 8a through 8g, you’ll add information about nonrefundable tax credits that could further offset your tax liability. Use box 9 to calculate your taxes with those credits included.

3. Fill In Your Deposits for the Year

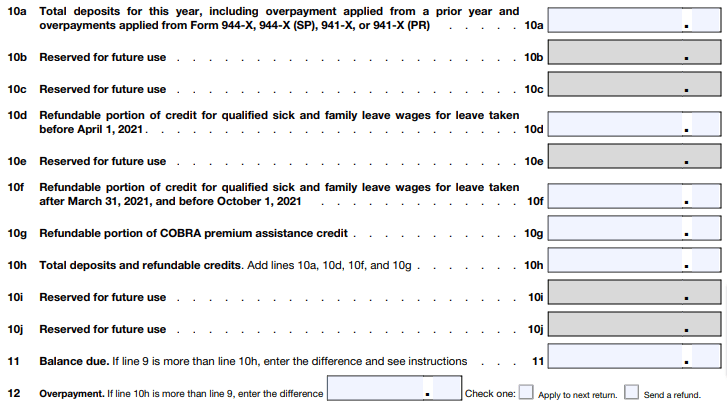

Starting with box 10a, enter the total amount in deposits you’ve made for the current tax year. Disregard the boxes marked as ‘Reserved for future use,’ and continue to boxes 11 and 12 to calculate your balance due or your overpayment.

If you have an overpayment, you can indicate in box 12 whether you’d like to apply it to next year’s taxes or receive a refund.

In Part 2, box 13, you’ll need to see if the amount you calculated in box 9 is above or below $2,500. If it’s under, skip this section. If it’s more, you’ll enter your tax liability for each month. However, semiweekly depositors must use Form 945-A instead of the boxes in Part 2.

4. Answer Relevant Questions About Your Business

Part 3 asks questions that may or may not be relevant to your business. Skip over any question that’s not relevant, including those reserved for future use.

5. Finalize and Sign the Form

Check over Form 944 to ensure you calculated everything correctly and filled in all required areas for your business. In Part 4, you can name a designee who’s allowed to speak with the IRS regarding your completed form, if desired.

Finalize the form by signing and printing your name and dating the form in Part 5. Be sure to also print your name, title, and phone number. Also, if someone else prepared this form for you, they’ll need to fill in their information below the signature area.

Ineligible for Form 944–What Next?

Most businesses ineligible for Form 944 need to complete Form 941 instead. Most employers also need to fill out Form 940, which reports the Federal Unemployment Tax Act (FUTA) tax.

Once your business crosses the bridge into more complex tax withholding and filing, consider using a payroll service that can organize and manage employee tax withholding based on federal, state, and local regulations.