Compensation analysis saves vast amounts of money for companies over the long term.

I get why businesses put this off, especially in the early days.

I’ve been at startups where titles were loose, raises were ad hoc, and the roles were designed around people.

This system doesn’t scale, and you can’t fix it when it breaks. Well, you can. It’s just really painful.

Suddenly, it seems, certain employees are making way too much, others with the same workload are making too little. People are leaving, morale is down, and our recruiters can’t get qualified candidates to apply.

In retrospect, they weren’t sudden problems at all.

By applying basic compensation analysis across our company, we could have seen and prevented each one of these problems years before they happened.

The company I run today is much more stable because of those experiences.

Compensation analysis plays a key role in safeguarding our payroll budget, talent pipeline, and employee satisfaction.

I’ll explain how it works, why it’s so important for healthy growth, and where you can apply it to your organization to see the biggest possible impact.

What is Compensation Analysis?

Compensation analysis is looking at what you pay people and ensuring that it is in line with your company’s objectives. There are a variety of established analytical methods that allow HR to make objective determinations about things like:

- How much should we pay for a specific role?

- How does our salary compare to the market, or specific competitors?

- Are employees who do similar work similarly compensated?

With compensation analysis, you’ll be able to surface potential issues such as:

- Unsustainable payroll budgets

- Over-compensated roles and employees

- Under-compensated roles and employees

- Unexplained gaps in pay

These are huge potential liabilities that can burn you down the line.

Unfair pay can lead to a discrimination lawsuit, which is serious and potentially very expensive.

Even if people don’t take legal action, workplace morale will plummet after word gets out that people aren’t being paid consistently.

But it’s not just lawsuits you have to worry about. Waste is just as bad, and loose compensation practices are going to result in inefficiencies that compound over time and cost your company real money.

I get it. Comp analysis is tedious, especially if you are doing it well.

And I believe it’s worth it. Reigning in payroll bloat and protecting the budget creates a much healthier business.

Compensation analysis is very straightforward. Honestly, most of the time it boils down to a bunch of high school math and basic fact-checking. I cover everything you need to get started at the end of this post.

The hardest part is identifying the suspicious trends before they become a concrete problem on your company’s balance sheet.

I’ve lived through these nightmares so you don’t have to.

I’m going to show you exactly where to look for trouble brewing. The next section details five telltale signs and tremors in the workplace that, in my opinion, scream for immediate investigation using compensation analysis.

These aren’t full-blown problems–yet–and that’s the key.

To cut costs and really see growth, you have to be proactive. If you wait until the damage happens, then you are just cleaning up.

5 Places Compensation Analysis Cuts Costs and Grows Revenue

1. Turnover Feels High

Turnover is not necessarily a compensation problem.

But if it is, fixing anything besides compensation is a waste of time.

Pay is almost always a key factor in a person’s decision to take a job. So, it’s the first thing I’d check when someone elects to leave my company.

What if you’re not sure if turnover is related to compensation?

Exit interviews.

Before you run any numbers, use exit interviews to get insight into why people are leaving.

Ideally you are using exit interviews already, but if turnover seems to be spiking, there’s no better time to get started.

During the interview, my advice is: don’t ask people directly how they feel about their compensation.

I mean, you can, but 99 percent of people will say, “It’s fine,” when you ask them about their compensation. It’s not the truth, but it’s all they feel comfortable saying.

Instead, tweak the same question and ask it fairly bluntly: “How do you think everyone else feels about compensation?”

People are much more honest when they don’t have to talk about themselves.

You can use the same question tweak to ask how an employee thinks other people feel about benefits.

If it turns out that people say compensation really is driving turnover, then your analysis is easy.

I’d use compa ratios and updated market survey data to see how your salaries compare to competitors.

Are you a self-described market leader who is no longer offering top-tier compensation? It happens if you aren’t refreshing your salary ranges every year.

Importantly, compensation analysis helps you to rule out pay as the reason people are leaving. Maybe your analysis reveals that compensation is aligned with the market and your company philosophy.

Toxic managers, over-scoped roles, and lack of career paths are all potential drivers of high turnover.

Between exit interviews and compensation analysis, you’ll know what to do to solve your turnover problem.

2. Publishing Salary Ranges Makes You Nervous

Some cities and localities have already passed pay transparency laws, and there is a push in Congress to take these laws nationwide.

Basically, these laws call for employers to post salary ranges with open job descriptions and make that data available to anyone who asks for it. There are some variations from state to state, but the idea is that employer salary ranges are essentially an open book.

Of course pay transparency is good, right?

Sure, if you have great compensation discipline. Then it’s no issue making salary ranges public, or sharing wage range information with employees and applicants.

Now if compensation is less systematic, pay transparency becomes a massive liability.

What if an employee requests wage ranges and finds out that people they work with are paid a lot more for the same job?

Should there be no systematic reasoning behind this pay disparity, the employee is not going to assume good things, to put it lightly.

You just don’t need these potential landmines getting in the way of your organization’s mission.

If you have the slightest fear that HR would have a hard time explaining why people make what they make, then it is time for a pay equity audit.

It’s a painstaking process, but in the end, you will be able to see for sure whether or not pay gaps are explained by gender, race, or other factors that should not be influencing compensation.

I would run a pay equity audit by employee 50. If you have 100, 200 employees and you have never run a pay equity audit, I would make it a priority.

I would also strongly consider getting legal counsel. Get real advice, don’t wing this. We’re definitely not attorneys so get real legal advice from someone who is.

If you have any reservations about making salary information more transparent, it’s a sign that compensation needs to be brought under control.

3. Individual Contributors Are Compensated Like Executives

This is a bad sign of unsustainable compensation practices. Full stop. Getting expectations, titles, and compensation re-aligned should be a top priority.

I can hear the objections already.

But she’s a 10x engineer. He’s our top earning sales rep.

No.

There are rare, and I really mean rare, cases where incredibly talented people are justifiably worth high six figures–but it’s almost never the case.

Nor is it a sustainable path to put in front of employees with the same individual contributor title.

It’s a common story, very understandable. I’ve seen it happen and had to deal with the consequences multiple times.

Lack of compensation discipline in the early days leads to problems down the line.

Here’s a very plausible story:

- A startup hires a strong marketing specialist with experience for $80k.

- The job is a perfect fit and they become a top performer.

- Each year, the specialist receives a 10 percent raise.

- In year three, they’re promoted to senior marketing specialist with a $20k pay raise.

- By year five, the startup is paying $141k for a marketing specialist.

- By year six, this marketing specialist will cost more than $150k.

That’s director level money that you are spending on someone who you could replace for a lot less.

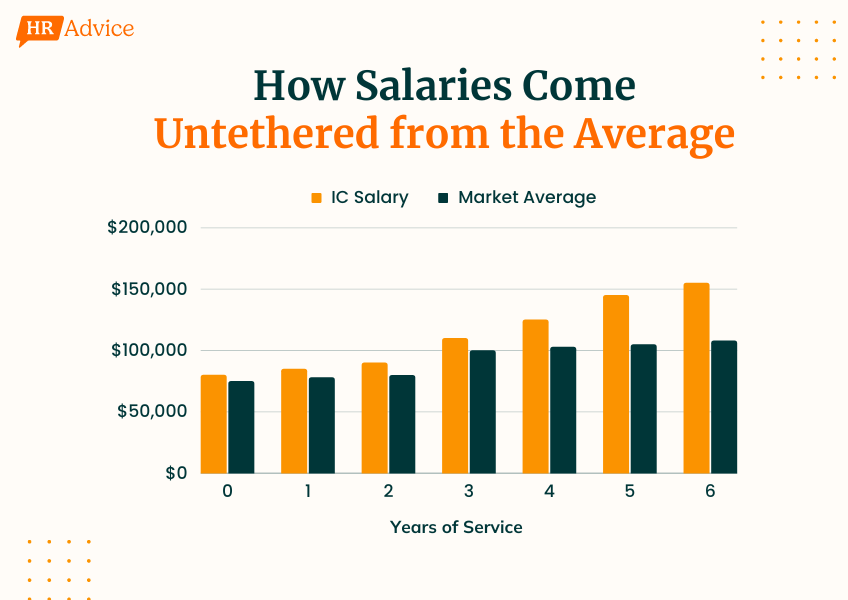

You can see how the IC salary breaks away from the market average in the chart below:

In this example, the market average increases by 3 percent each year, and jumps up $20k in year three to account for the promotion. Even with those adjustments, the IC salary pulls away on an unsustainable trajectory.

You can immediately see the compensation analysis that didn’t happen. Some time in the first three years, whoever is in charge of signing the checks didn’t recognize how badly the lack of compensation discipline was going to burn them in years four to six.

Now they are paying $150k for a $100k role.

If this isn’t an isolated incident, and other employees are similarly overpaid, this company is in serious trouble.

The earlier you create salary ranges, the better. There has to be a ceiling, otherwise you wind up spending way too much on someone.

This can only end badly, but I know exactly how it happens.

True startups hire individuals they need at a price that works. Teams and titles are loose in favor of just getting the work done.

In the first few years, companies overlook key forms of compensation analysis like:

- Refreshing salary ranges

- Creating salary levels

- Updating job descriptions

As I said it’s understandable–why create salary levels when we only have 2 engineers?

I’ll tell you why: Because four or five years out, you might be paying those engineers twice as much for the same work.

You don’t want to be paying $150k for a $100k role. You’ve just seen how that exact scenario can happen without guardrails.

Compensation analysis will help you set meaningful boundaries for salaries and protect your payroll budget.

4. Job Descriptions Are Loose

When job descriptions start to drift away from the actual work people are doing, it causes a ton of problems.

We had this very issue a few years back.

Based on our job description, we hired editors based on their ability to improve writing and help create unique content.

Trouble was, they actually spent as much as 50% of their time formatting content for WordPress: optimizing images, adding alt text, inserting jump links, and so on.

Yes, we did ask for WordPress experience in the job description, but that was too loose. It was really a cop out. It didn’t accurately reflect the work we needed done.

We needed to let our editors edit and hire for a separate role.

In the first six months after we hired our first WordPress producer, our content backlog dropped from around 2,100 outstanding content requests to single digits.

We stopped paying the wrong people to do the work, and the chaos ceased.

Our content budget actually dropped. We thought we needed to hire a dozen editors, but it turns out a handful of producers works much better.

And do you know how much easier it is to hire quality editors when you can assure them they won’t be fighting with WordPress?

Job descriptions have to be tight–title, duties, skills, and compensation have to be aligned. They have to make sense with the market.

Otherwise, recruiting the right people is going to be harder and backfilling people who leave is a nightmare.

Here’s where I’d look for loose and problematic aspects of job descriptions:

- Title: Non-standard titles are worth a second look. It’s okay to have a few unique roles, but at least 80% should be standard enough that they are easy to backfill.

- Duties: These must be essential and must be accurate. Adding new duties when called for is good, but you have to cull the list down to what is still essential. Otherwise you are adding scope to an already full-time role. If there are essential duties missing, that’s going to make it impossible to hire correctly.

- Required skills: Sometimes the nice-to-have skills make their way onto this list, which will deter candidates who could actually fill the role. If it is not a skill that every person for the role is going to use, it doesn’t need to be on the job description.

- Salary ranges: These need to be refreshed every year. Even with updates, these ranges can be significantly off when the job title and duties don’t align.

Tightening up your job descriptions helps recruit better candidates. They know you have done your homework, they can read the essential duties and imagine themselves in the role.

Experienced candidates, the people you really want to hire, they know what a terribly scoped role looks like. They’re going to be turned off right away.

Strong candidates also have a rough sense of the market. A great candidate will see off-market salary ranges as a red flag.

Loose job descriptions also lead to brittle companies. You get the situation where one person leaves and a whole program collapses.

Whatever that person did was not tied to a job description, and now you can’t replicate the role.

Everyone leaves eventually. You want a tight job description that allows you to backfill easily.

Many of these problems can be solved by reviewing job descriptions every year. The most effective way to time this is to review JDs after performance reviews.

During performance reviews, you’re going to get a lot of current information about what people are really working on. Make the JD part of that conversation. What do the employees think needs to be changed?

Armed with this insight, you can clean up and tighten your JDs. This is going to make it easier to set appropriate compensation for the role, get the right people to apply, and keep your best people on board.

5. Your Offers Don’t Close Candidates

If you find that candidates are walking away at the finish line, it’s a bright neon invitation to run a compensation analysis on the role, if not the organization.

I would go out and get fresh market survey data on salaries and benefits.

Focus on direct compensation first–this is really what employees care about. How do you compare to the market overall in terms of base pay?

If you are way low compared to the market, there’s your issue. Reset your benchmarks and take a look at how this change is going to impact current employees. Bumping up base pay can trigger salary compression, which is a real problem.

What if you are right where you want to be in terms of the market average according to the latest survey data?

It may be the case that your direct competitors are all located in cities with a high cost of living, and you’re actually lowballing the really talented people.

You could take a look at the benefits package compared to the competition as well. Salary is much more important, but if you’re lagging benefits too much it’s not going to help.

This is a case where compensation analysis is going to save time and effort on recruiting while yielding better results.

What You Need To Start Compensation Analysis

There’s four things you need to bring to the table in order to conduct a compensation analysis:

- Approved compensation objectives

- Accurate job descriptions

- Accurate internal payroll and demographic data

- Recent survey data

Let’s go through them one by one, because this is where most people get tripped up.

There’s no sort of general compensation analysis–you might be looking at the whole organization, but there is going to be something specific that you are looking for, or some objective that you are trying to realize.

Before you dig in, you absolutely need approved compensation objectives from the CFO or whoever’s ultimately going to rubber stamp the recommendations.

For example, there’s no sense in testing the viability of 3% raises when it’s off the table this year.

You need to understand your company’s compensation philosophy–are you lagging, matching, or leading the market? This is going to determine what data you look at and the conclusions you draw.

With approval for the direction and objectives of your compensation analysis, it’s time to start collecting the data.

Accurate job descriptions are so important. If you have a muddled idea of what someone actually does for work, there’s no prayer of compensating them appropriately.

If JD’s have been updated in the last year, that might be okay–-but what does updated mean?

Does that mean the manager glanced at it and said if it ain’t broke don’t fix it? A few updates like that and you’ll find that JD’s have little basis in reality.

Remedying inaccurate job descriptions is done through job analysis and job evaluations where you, employees, and managers cross-check the JD with the facts on the ground.

This is its own form of compensation analysis, which you may have to do before embarking on other types in order to produce meaningful analyses.

Along with tight JDs, you’ll want accurate internal payroll and demographic data.Comb through this data and make sure that it truly reflects the current state of affairs.

Managers don’t always update employee profiles when people switch offices, jump to different teams, get promoted, and so on.

Errors here upset analysis down the line, so be meticulous in verifying the data.

If you are using payroll software, all of this is done automatically, so you barely have to think about it.

With most forms of compensation analysis, you’ll also need recent survey data about other companies in your market, what they pay employees, how much they spend on benefits, and so on. You get this from any of the popular compensation benchmarking tools out there. Access typically costs $3-10K per year.

Just bear in mind that benchmarking tools are better for giving you a ballpark salary rather than making fine-grained analysis.

Some of the recommendations that follow from compensation analysis are going to ruffle feathers. They may straight up anger people.

Start by getting your leadership team aligned. From there, you can work on the rollout plan. In general, it’s best to have hard conversations earlier rather than later.