We can’t talk about payroll without considering HR operations as a whole.

But if you want to jump straight to the good stuff, here are the top payroll providers I recommend:

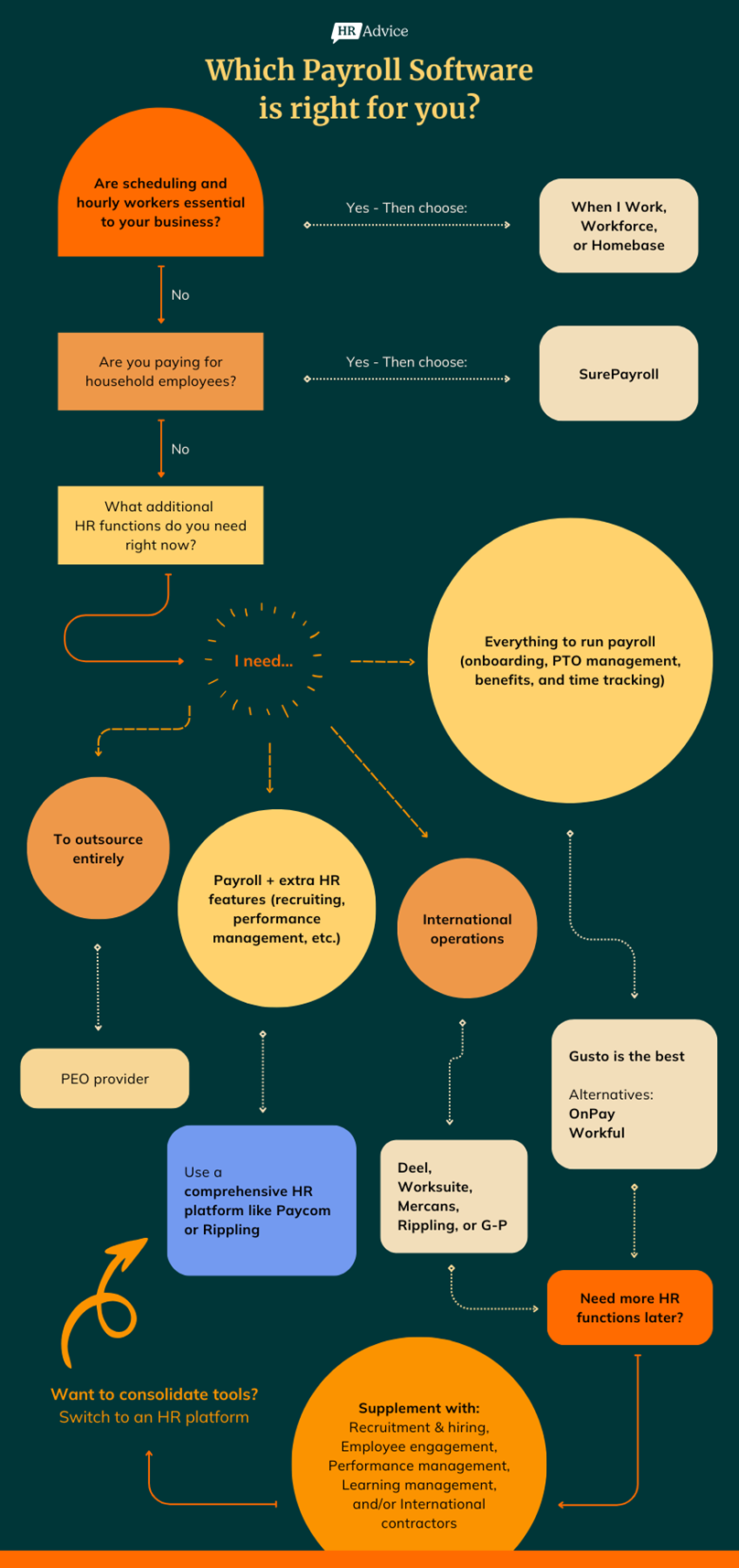

Payroll for new or small businesses: Gusto is the best, OnPay is a close second. Workful, Roll by ADP, and Patriot are other, not-as-great alternatives (jump to reviews).

Comprehensive HR platforms: Rippling is a tech-forward front runner with international options and Paycom is a great choice if you need relief from correction fees (jump to reviews).

International payroll software: Deel and Worksuite are great for paying international contractors. Mercans is one of the few global payroll providers that doesn’t outsource to third-parties. Rippling and G-P are strong all-in-one international platforms if you want extra HR features. Papaya Global and Lano work well if you’re using multiple payroll tools and want to consolidate without switching (jump to reviews).

Dynamic scheduling tools: When I Work is great if you have fewer than 50 employees. Homebase is a better value if you have a lot of employees–it charges per location. And Workforce is a more robust HR platform than the other two while still focusing on intense scheduling and shift work (jump to reviews).

Running household payroll: SurePayroll is the clear winner (jump to review).

You Can’t Run Payroll Without Onboarding, Leave Management, Benefits, and Time Tracking Data

So, I only recommend payroll software that (at least) covers all of these functions.

Time tracking is optional–I don’t have hourly employees so I don’t need it. But if you use it, it’s best if it’s deeply integrated with payroll.

While it may seem too early to think about these things, you’ll be really glad you have them. Even with one missing piece, you could be stuck adding manual adjustments and deductions, importing timesheets, and emailing tax forms back and forth every time you run payroll or hire someone new.

At that point, you might as well use a spreadsheet. While there’s nothing wrong with doing it that way, you’re here because you want a better way to run payroll.

Don’t Use Payroll Software that Makes You Pay and File Taxes Yourself

This is a key component of any payroll solution worth your time and money. Straight up, you shouldn’t use a provider that doesn’t handle payroll taxes for you.

Full-service providers may cost a bit more, but staying on top of local, state, and federal tax requirements–even in one state–is next to impossible. Not to mention doing it for multiple states AND all the payroll forms you have to submit when you hire someone.

Doing it all yourself will cost you in other ways–mainly time and headache.

Solutions like Payroll4Free or Wave Payroll may sound great with their non-existent or incredibly low price tags. But they leave you with an even more expensive burden.

Wave is starting to introduce full-service payroll, but it’s only available in 14 states. You’re on your own for the rest of the country, so it’s not a great option for most people.

Even if you’re in a full-service state, there are cheaper and more comprehensive options out there.

Whether you’re paying one person or more than one hundred, centralizing payroll-adjacent functions and automated taxes will make the difference between seamless payroll processing and a never-ending nightmare.

It’s even more critical if you don’t have an HR department, let alone a dedicated HR person.

The smaller you are, the more important it is.

Focus On What You Know You Need

It’s important to think ahead to an extent, but don’t get caught up in what you might need someday.

Your needs will inevitably change in ways you can’t predict. If you try to think too far ahead, you’ll end up paying a lot of money for a bunch of features you never use.

Instead, handle those situations as they come. You can always switch to something more powerful and consolidate everything when you’re ready.

Every payroll provider falls into one of the following buckets:

- Payroll for new or small businesses

- Comprehensive HR platforms

- International payroll software

- Dynamic scheduling solutions

- Household payroll tools

- PEOs that do it all for you

I recommend most people start with something in the first bucket. Most people can also avoid the last one. Outsourcing to a PEO sounds good on paper, but it’s extremely limiting in practice–I won’t go into a ton of detail here, just know that standard, normal businesses don’t need it.

If you know which route is for you, click the appropriate link above to jump to my recommendations.

Otherwise, keep scrolling to learn more about each type of payroll software and which one’s right for your situation.

Payroll Software for New, Small, and Growing Businesses

The best tools for new or small businesses cover everything you need to run payroll, including employee onboarding, payroll compliance, benefits, leave management, and time tracking if you need it.

These tools seem simple, but that’s what makes them a dream to use, especially if you don’t have an HR pro in house.

Gusto’s the Best–OnPay Is a Close Second

Gusto is hands down the best place to start. And I’m not just saying that because I use it. Quite the opposite–I use it because it’s the best.

It nails all the basics you need for payroll really well. The interface is great for managers and employees, the support is better than the other’s we’ve tried, and it’s surprisingly not more expensive than other options that aren’t nearly as good.

Everything you need to start is available on the entry-level plan. At its most basic level, it’s nearly identical to OnPay, from the features you get to the price you pay.

OnPay claims it’s the simpler of the two, but that doesn’t paint the whole picture. At a glance, it is. It’s one price and you get everything. But if you dig deeper, you’ll realize nearly everything OnPay has to offer is available in Gusto’s cheapest plan.

The few exceptions are multi-state payroll, custom onboarding checklists, and advanced PTO management.

You’ll have to upgrade to Gusto’s middle tier to get these–but if you do, you’ll get those features and a lot more (including built-in time tracking, next-day direct deposit, performance reviews, employee surveys, and project tracking).

Gusto seems more complicated because it has more to offer.

But what truly makes Gusto the best is how easy it is to talk to a human who knows what they’re talking about.

Depending on your question, you may have to pay extra for the level of support you need. But it’s an easy upgrade and all you have to do is reach out. Onpay doesn’t offer this at all.

Even if you’re only paying 10 people, situations are still going to come up, especially if you don’t have in-house HR. With Gusto, you can get the 1:1 help you need, whether it has to do with compliance, a messy situation, choosing a benefits package, or questions about local law.

They truly feel like an extension of my business I didn’t know I needed until I faced a situation I didn’t know how to handle.

If that happens to you, you’ll be glad you have the option.

Less-than-Ideal Alternatives

There are tons of other options out there, but none of them are as good as Gusto and OnPay. They’re all missing something that’s critical to payroll, but may work for certain situations.

Workful is missing benefits administration, but it has advanced document management and extensive reporting.

Roll by ADP has an interesting chat-like interface that lets you run payroll by asking an AI assistant to do it for you. It’s a fun and unique play on payroll, but it doesn’t offer benefits or PTO management.

Patriot is a few dollars cheaper than Gusto, but you’ll quickly rack up a ton of additional fees if you pay employees or contractors in multiple states–it’s an additional $12 per month per state. It also doesn’t offer benefits, time tracking, or the extra HR features you’d get with Gusto.

Avoid Square, QuickBooks, and Others Like Them

Brands that specialize in other types of software, like Square for payment processing and QuickBooks for accounting, bank on you starting with their flagship products and eventually needing to pay someone.

They add a barebones payroll module to hook you in and get you to pay them more money.

To make matters worse, there are dozens of blogs out there that say if you’re already using Square or QuickBooks, it’s a no brainer to add payroll.

I think that’s terrible advice. Rarely, if ever, are these types of tools the right way to go.

We use QuickBooks for accounting, but would never use its payroll services.

Payroll isn’t their main focus and it never will be, so they’ll always be playing catch up–if they even try to do payroll well at all.

Square is probably the worst offender. It’s onboarding is nonexistent–for something so critical to payroll and easy to implement, you’d think they’d do something about it. Instead, it forces its users to gather documents and sign them outside the system, then upload them one at a time.

You have to do it all manually–it’s archaic and there’s no reason to do it that way.

It may not seem like that big of a deal, but you can pay a few dollars more and get a much better experience with Gusto or OnPay.

I’d go so far as to say that if you’re using Square for payroll, you should stop.

QuickBooks is probably fine if you’re already using its payroll services. But I don’t recommend it for anyone else. It’s more expensive than others and offers less functionality.

Comprehensive HR Platforms–Most People Don’t Start Here

HR, HCM, HRMS, and HRIS software come with features beyond payroll-adjacent essentials. The distinction between these types of tools really doesn’t matter. What you need to know is that they cover advanced HR functions for things like recruiting, reporting, asset management, employee engagement, and performance tracking.

This sounds good on paper, but these tools often shine in one area and underperform in others.

If you want the best of the best in any specific area, you’re better off going with a dedicated tool that specializes in it rather than trying to get it all under one roof.

However, these types of tools are fine if you don’t need anything highly specialized or are simply looking to consolidate your tool stack.

Paycom and Rippling are Tech-First HR Leaders

Paycom’s a standout provider in this category because of its “employees do their own payroll” approach. It’s AI-powered tool, called Beti, puts the power in your team’s hands and checks their work for you.

Beti’s so good, in fact, that Paycom’s expected earnings for 2024 were cut in half after they released it. This caused a massive drop (around 40%) in the stock price.

That sounds like a bad thing–and it is from a business perspective–but it’s actually a really good thing for its users. Paycom used to make a ton of money on people like you paying payroll correction fees.

Today, far fewer people make mistakes, so that major revenue stream diminished overnight.

Rippling is another disruptor in this category for centralizing HR, IT, and finance on top of an automation engine and powerful analytics. Other providers have tried, but none of them match the elegant simplicity of Rippling’s all-in-one platform.

If we were going to switch now, this is probably what we’d switch to.

While Paycom and Rippling stand out from the rest for different reasons, there are tons of other options out there.

Diving into the intricacies and daylight between them is too much to get into here. If you’re interested in going this route, check out my complete reviews of the best HR software to learn more about them.

International Payroll Software and Services

Paying international contractors and employees adds a whole new level of complexity to running payroll.

There are more than 30 popular international payroll tools, which is far too many to cover in this post. But here’s what I recommend for different scenarios.

Only Paying International Contractors? Go with Deel or Worksuite

I use Deel and am super happy with it–however, Worksuite offers most of the same functionality. Both help with contractor compliance, getting the right documents signed in onboarding, and generating localized contacts.

They also give your contractors multiple ways to receive payments, depending on what they prefer.

Just about every international payroll provider has features for contractors–so the above recommendation only applies if you’re not hiring FTEs at all.

Mercans Stands Out In a Big Way

Rather than working with a large network of third-party vendors around the world (as most international providers do), Mercans has an in-house team in every country it operates in.

With third parties, you’re at their mercy and often have to wait longer for onboarding and answers to your questions, plus they all have their own processes you’ll have to follow.

All-In-One International HR: Rippling and G-P Are the Front Runners

Rippling’s one of the few HRIS solutions to elegantly bring HR, IT, and finance together. On the HR side, it includes a full suite of HR tools, from talent, learning, and performance management to compensation benchmarking and recruiting for global teams.

G-P stands out for its growing library of expansion modules you can add on top of full HR functionality.

From advanced growth insights to a suite of compliant documents you can (legally) steal, it’s fully customizable based on what you need.

Papaya Global and Lano Are Paving the Way for Payroll Consolidation

If you’re already using multiple tools for payroll in different countries, you can use Papaya Global or Lano’s consolidation plans to bring them all together.

They make it possible to run company-wide payroll in one place–they essentially let you bring your existing providers.

Dynamic Scheduling Software + Payroll Add-Ons

If scheduling is a critical piece of your business, typical payroll software won’t do. Sure, some of them may have basic scheduling, but they pale in comparison to what restaurants, healthcare, retail, field services, and other types of fast-paced businesses need.

All of the providers I recommend are first and foremost scheduling tools. They specialize in it and give you everything you need, including:

- Leave management

- Drag-and-drop schedule building

- Scheduling rules and automations

- Labor planning and resource management

- Support for multiple locations and job sites

- Advanced shift management

- Overtime and PTO tracking

- Help with labor laws, PTO laws, and compliance

They all also have time tracking and attendance, basic communications features, and best of all, deeply integrated payroll add-ons.

Without this, you’re stuck manually importing timesheets, calculating things yourself, and making corrections for every run. But when the two work together, it’s all smoothly automated for fewer mistakes and less time wasted running payroll.

When I Work, Homebase, and Workforce Are the Clear Winners

When I Work is specifically for businesses with fewer than 50 employees.

Its standard scheduling plan starts at just $2.50 per employee per month. You can also add time and attendance for an additional $1.50 per month if you need it. Full-service payroll isn’t included in the price, but you’ll have to reach out for a custom quote.

On the flip side, Homebase doesn’t charge by the number of employees, but by the number of locations you have.

There’s a free plan for less than 20 employees. The cheapest plan is $20 per location per month and supports unlimited employees, so it’s an incredible value if you have a ton of employees.

For full-service payroll, it’s an additional $39 + $6 per employee per month.

Workforce is the way to go if you need full HRIS software with integrated scheduling and payroll in one. Pricing isn’t publicly available.

Paying Household Employees: SurePayroll Is the Way to Go

SurePayroll is hands down the best option for paying household employees, like nannies, housekeepers, personal chefs, or babysitters.

It has everything you need to ensure you’re following all the regulations without the bulk of a bunch of features you don’t need.

I don’t have personal experience with SurePayroll, but someone close to me does and they have nothing but great things to say about it. They’ve also tried other providers, all of which have been acquired by SurePayroll.

So, even if you try to go with something else, you’ll likely end up with it eventually.

PEO Solutions–Most People Don’t Need This

I don’t recommend PEOs for most businesses. They’re not bad by any means, but most regular, normal companies don’t need it.

These types of agreements are structured on co-employment models—the provider shares responsibility, liability, and risks with you. In exchange, they force you to adopt their policies to protect themselves.

Most PEOs offer the same services. It’s really more about choosing a company you align and work well with. Check out my full post on the best PEO services if you want to learn more about my top recommendations.

If you don’t want to enter into a full PEO agreement, you can also consider outsourcing payroll instead.

What Matters Most When Choosing a Payroll Provider

There’s a lot of noise around payroll.

It’s deep integration into HR software makes it convoluted and extremely confusing to make sense of.

My advice is to go through the following list, mark down the things you have to have, what you’d like to have, and what you can ignore.

- Benefits administration — This covers all aspects of offering and managing employee benefits, like health insurance, retirement plans, and other perks

- Employee self-service portal — Employees can onboard themselves, set up their own account, access pay stubs, see their tax forms, request time off, etc. Lifetime access is a solid bonus

- Self-service onboarding — This goes beyond a simple form to fill out. It includes quick, compliant, and hassle-free integration of new hires into the payroll system

- Document vault with e-signing — You can sign and securely store documents without leaving the platform

- PTO management — Comprehensive, flexible, and user-friendly tools to manage all components of employee paid time off, from accrual calculations to time off requests

- Time-tracking — A built-in system for tracking time to clients, projects, or tasks for hourly employees. If it’s not built in, it should integrate directly with your time tracker

- Support for the states you work in — The ability to meet compliance requirements, calculate taxes, file tax forms, and process payments in all the states you work in. Many providers charge extra fees for certain things if you work across multiple states

- Contractor payments — You can onboard and pay contractors just as easily as you would an employee

- International operations — Compliance, onboarding, and localized support for employees or contractors outside the United States

- Automated tax filing and payments — All providers help calculate taxes, but some of the barebones providers don’t pay and file them for you. Furthermore, some can only do so in certain states

- Accounting software integrations — The ability to connect and sync your payroll with accounting. These integrations come in all shapes and sizes

- Household employees — Handle payments to household employees, which typically require specialized taxes and compliance rules

- Complex scheduling — You get what you need to build and manage detailed employee schedules. This is particularly useful for shift work and large teams of hourly employees

There are also a few other things to keep in mind, including the user experience, customer service, availability and cost of consultations, the overall price (including processing fees, set up fees, and other hidden costs), and the company’s future outlook.

I’ve listed these separately because they’re really personal preferences more than anything else. If you’re stuck between two or three options, use these to narrow it down to your favorite.

Methodology + Why You Can Trust HRAdvice

I started with Gusto to run payroll because I was only paying US-based employees and contractors. When I needed recruiting features, I added Workable. Most recently, I invested in Deel to pay international freelancers.

I didn’t know that I’d need all those things when I chose Gusto. But I was happy with it and didn’t want to switch to something else, so I added new tools to get the job done.

Eventually I’ll upgrade to something more all-inclusive to consolidate down to one platform.

We have one person taking care of all things HR for the company, but a full team depending on us to take care of them.

I understand the weight of making the right choice.

The advice here comes from my experience choosing and implementing various payroll solutions over the last five years.

I didn’t dive this deep just because I wanted to. Nothing I read online was really helping me when I needed it–I had to get lost in the weeds to make sure I made the best decision for my team.

For me, the hardest part was making sense of an industry that’s intentionally vague and confusing. Everyone says something different and there are so many options, it really was incredibly overwhelming.

So, I put together this guide–the exact thing I wish I had at the beginning.

Aside from that, I don’t sell placements on my site or move brands around based on how much they pay me. Partnerships and affiliate payouts make absolutely no impact on what I say or the order in which I present brands. In fact, the people in charge of these partnerships aren’t allowed to change what I publish.

My team operates the site with full editorial integrity and we value truly helpful content over making money.