If you’re a Canadian employer or you have employees who live and work in the country, you’ll need to find CRA-compliant payroll software.

CRA stands for the Canada Revenue Agency, the Canadian federal government’s tax revenue service. The CRA oversees tax collection and enforces tax laws on a federal level.

But it also manages taxes for most of the country’s provinces and territories—except for Québec. In that province, Revenu Québec is the official government tax agency.

To make compliance with these tax agencies easy, payroll software should:

- Calculate Canada Pension Plan (CPP) contributions—or Québec Pension Plans (QPP) in Québec

- Automatically calculate taxes based on which range or province an employee lives in

- Help you remit taxes to the appropriate federal government agency on time

My Picks for the Best Payroll Software in Canada

I’ve rounded up the best CRA and Revenu Québec-compliant payroll software that I would use if I was building a business in Canada:

- Rise – Overall Best Payroll Software in Canada

- Wave Canada – Best Affordable Payroll for Small Businesses

- Deel – Best for Canadian Companies that Hire Internationally

- QuickBooks – Best Accounting Integration

The Top 4 Payroll Software in Canada

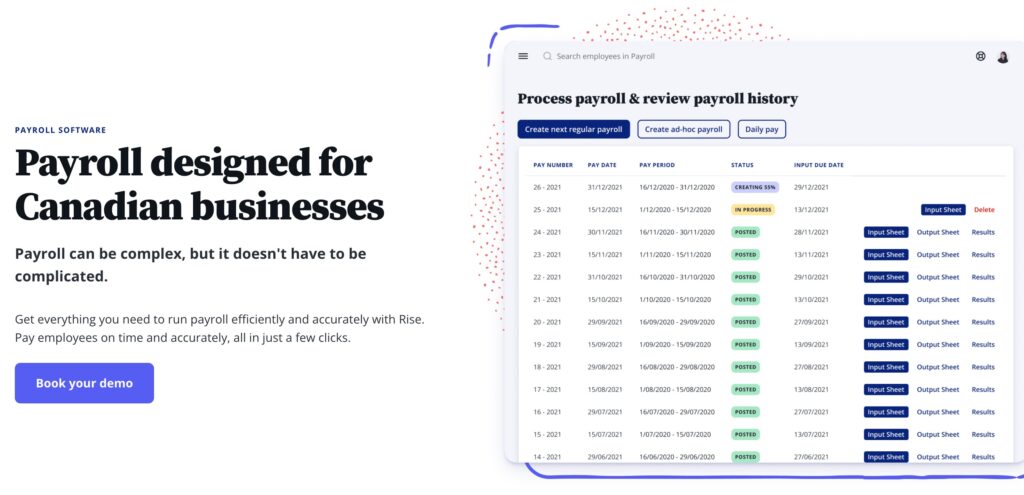

#1. Rise – Overall Best Payroll Software in Canada

Rise is a Canadian software service built to serve fellow Canucks. It bills itself as an all-in-one human resource management system ideal for any Canadian employer.

Here’s what you get:

- Full-service payroll

- Payment and filing of payroll taxes online to the CRA and Revenu Québec

- Calculation and filling out of T4 and RL-1 forms

- Record of employment (ROE) management

- Automatic workers’ comp tracking and calculating

- Employee self-service portal

- Time tracking

- Benefits management

- Direct deposit

- Phone support during business hours

Rise is proudly Canadian built and run—the team behind the software clearly knows their stuff. They offer everything you could want for wrapping your HR, benefits management, time tracking, and payroll into one bundle.

Rise Pricing

Rise’s pricing starts simple but most companies will have to upgrade or use an add-on.

- The basic plan starts at $8/month/employee for basic payroll, employee accounts, and employee investment accounts. This is on top of a base monthly fee.

- For leave management, you’ll have to upgrade to the Grow plan. Just about everyone should do this, I’d never separate payroll and leave management.

- And if you need time tracking, that’s a separate add-on.

So expect the pricing to increase.

That said, support by phone, email, and chat is available on ALL plans. This is super nice, most payroll providers severely limit support options.

See more on Rise’s pricing page.

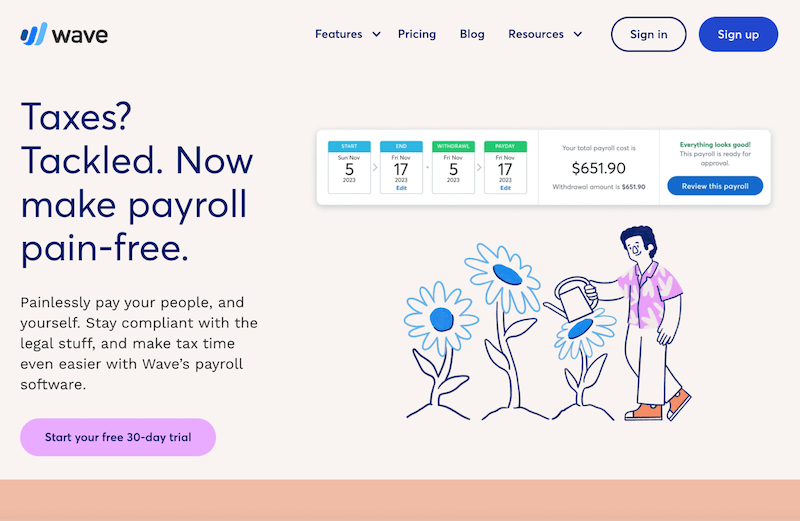

#2. Wave Canada – Best Affordable Payroll for Small Businesses

Wave is a Canadian payroll software company headquartered in Toronto, making it an easy pick for northern employers.

There’s one big caveat when it comes to Wave, though: for some reason, Wave doesn’t offer its services for Québec employers.

But if you live in any of Canada’s other 9 provinces or 3 territories, Wave is an excellent, affordable choice.

When you’re paying a handful of team members, you don’t need a complex, expensive payroll software to do the work for you. But you also don’t want to do it manually.

That’s where Wave comes in. This low-cost solution gives you the basic tools needed to accurate run payroll in (most of) Canada. It includes automated payments to the CRA, which is the biggest pro for Wave’s low price point.

Plus, Wave has a simple UI and seamlessly integrates with Wave’s accounting software.

Wave Pricing

For Canadian employers, Wave costs a base price of $25 a month plus $6 per employee or independent contractor. If you want to use Wave for accounting, too, you can do it free with Wave’s Accounting Starter Plan.

The company offers a 30-day free trial, so you can test its features risk-free. Learn more on Wave’s Canada pricing page.

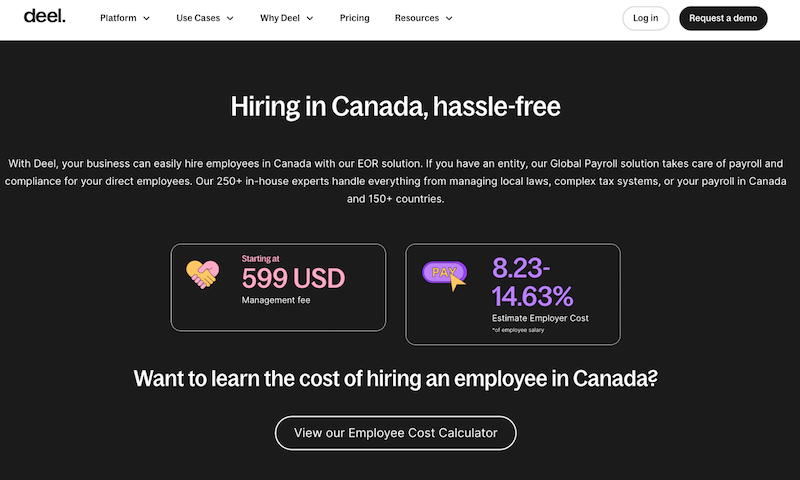

#3. Deel – Best for Canadian Companies that Hire Internationally

Deel is known for its employer of record (EOR) services that allow U.S.-based employers to quickly and easily make hires across the globe. But as of January 2021, Canadian employers get to do the same thing.

With Deel, Canadian employers get:

- Full-service payroll for employees and contractors in 150+ countries

- Employee benefits and deductions

- Local filing with the right authorities

- Salary and tax payments

- Locally compliant contracts

- Locally compliant onboarding and offboarding

- Employee self-service portal

- 24/7 live chat support

Deel is a solution you can use to pay both local and international employees. That’s what makes it so helpful for Canadian employers with team members in various places. That said, we do have to note that paying local employees with Deel wouldn’t be as easy as just using Wave or QuickBooks.

That’s because Deel Payroll costs $29 USD per employee per month.

But the service does take care of payroll for you, from pension fund contributions and healthcare benefits management to worker’s comp and taxes.

Deel will do the same for your non-Canada-based employers. The payroll service supports both independent contractors and overseas employees, although you’ll pay more for EOR services than IC management services. But it’s still pennies compared to what you’d pay to establish your own international business entity.

So how do these employees and ICs get paid?

Deel offers 15 payout methods, including cryptocurrency, Wise, Revolut, and over 150 local currencies.

You can fund everything in CAD and employees will receive payments however they want them.

Deel Pricing

Deel lists its pricing in USD, not CAD. Contractor management starts at $49 USD per month. Employer of record (EOR) services begin at $599 a month. Payroll for US employees costs $19 per employee each month. For a US professional employer organization (PEO)—aka payroll in any US state—you’ll pay $79 per employee each month.

It’s definitely not cheap. But neither is unintentionally breaking some obscure law in another country because you didn’t follow their rules.

Learn more about Deel’s pricing here.

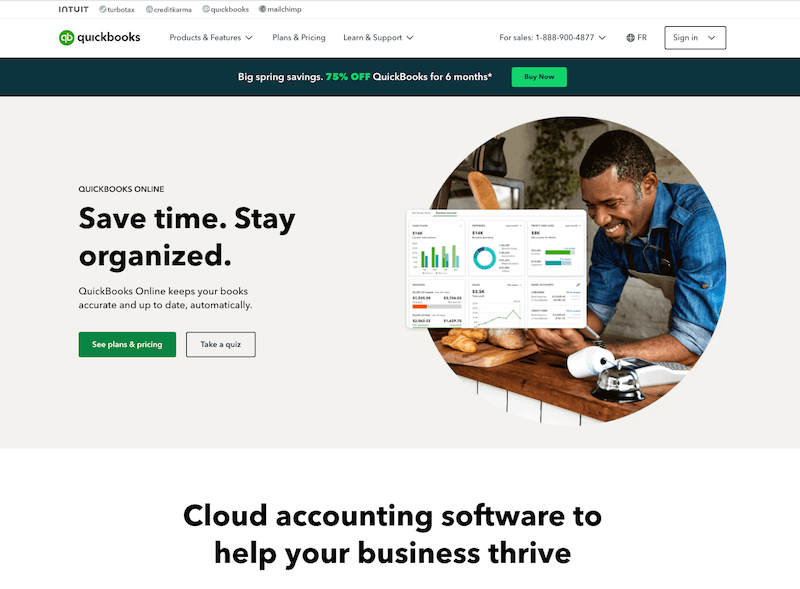

#4. QuickBooks – Best Accounting Integration

QuickBooks Online Canada is CRA-certified for commercial tax preparation in Canada. It’s also an extensive accounting and payroll software. This makes QuickBooks Canada a powerhouse in making payroll and tax time a snap for Canadian employers.

Here’s what’s included with QuickBooks Canada:

- Full-service payroll (as an add-on to a QuickBooks Accounting plan)

- Unlimited payroll runs

- Payment and filing of payroll taxes online to the CRA or Revenu Québec

- Calculation and filling out of T4 and RL-1 forms

- Record of employment (ROE) management

- Automatic workers’ comp tracking and calculating for Québec, Ontario, and British Columbia

- Employee self-service portal

- Free guided setup call

- 2-day direct deposit

You really can’t go wrong with QuickBooks Canada if you need accounting, payroll, and tax prep software all rolled into one service.

The CRA’s endorsement makes it an easy pick for just about any Canadian employer. In addition to the features listed above, you can switch the site to French if you’re a Quebecer.

The software is pricier than other choices, though. And unless you pay extra for priority support, customer service options are slim. You also have to pay for a more expensive plan if you want features like time-tracking, shift scheduling, and access to the mobile app.

That said, the QuickBooks UI isn’t the best. I’ve always found it confusing. So this option is ideal for a payroll manager that’s embedded in the finance team and needs a really solid integration between payroll and bookkeeping. If you have a standard HR Manager running payroll, or need a more comprehensive HR software, I’d look at other options.

QuickBooks Canada Pricing

When you sign up for QuickBooks Canada, your first step will be to pick between two accounting plans: Easy Start, which costs $24 a month, or Essentials, which costs $54 a month. Be careful looking at the prices on their pricing page, they have a limited time discount added to them. I always like to focus on the real pricing once any discount period ends.

You’ll then be taken to the payroll processing add-on. This begins at $25 a month plus $4/employee per month. But if you want the mobile app, time tracking, and priority support, you’ll need to pick the mid-tier plan: $55/month plus $8/employee per month.

You can also test-run everything with a 30-day free trial.

Learn more on QuickBooks Canada’s pricing page.