Payroll is one of those weird product categories. When it’s working really well, it melds into the background.

When it doesn’t work well, you’ll get sucked into a labyrinth of state tax errors, being on hold for 3 hours at a time, and a circular set of recommendations that never resolves the problem. This will last for months, maybe a year. Or you’ll get a wage complaint and have to deal with your state’s labor department.

Payroll is no joke. One slip up can ruin your year.

I’ve had payroll companies completely screw things up, it’s not fun. My philosophy with payroll software: pick the option that will do it right.

My Picks for the Best Payroll Software

I’ve used a lot of payroll software across multiple businesses. If I was going to set up payroll today, here’s what I’d use.

- Best payroll for small businesses: Gusto

- Best value at the cheapest rate: OnPay

- Best comprehensive HR platform: Rippling

- Best international payroll software: Deel

- Best enterprise HR platform: ADP

- Best for advanced payroll teams: Paylocity

- Best scheduling with payroll tool: When I Work

- Best for household payroll: SurePayroll

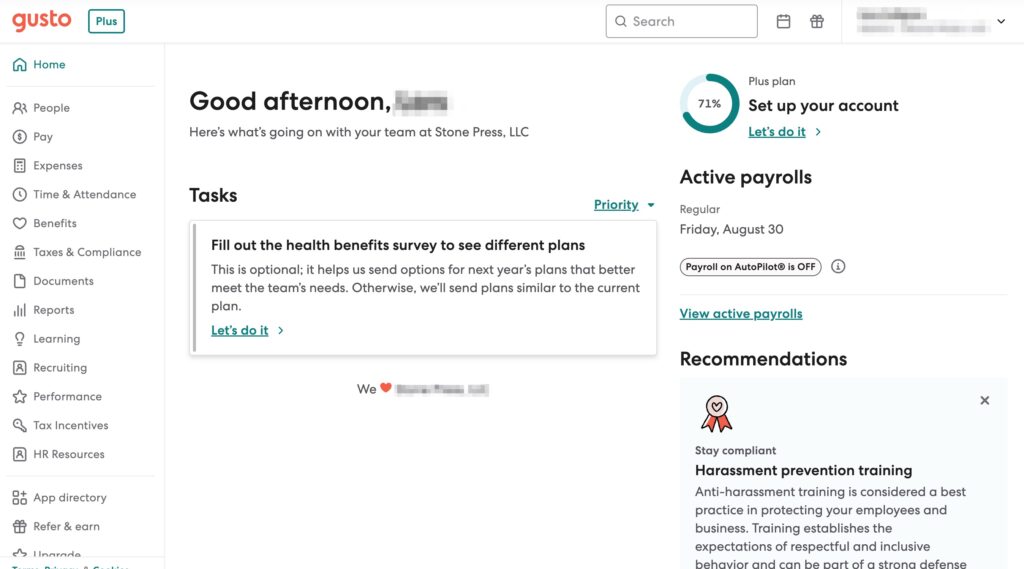

Gusto Review – Best Payroll for Small Business

Gusto is hands down the best place to start. And I’m not just saying that because I use it. Quite the opposite–I use it because it’s the best.

Gusto really is the best in most cases. Any small and medium-sized business should start there. I’d only consider other options if I had truly outgrown it, needed international payroll, needed more advanced scheduling, or had a household employee. Otherwise, start with Gusto.

It nails all the basics you need for payroll:

- The UI is very easy to use. Your HR team, managers, and employees will all be able to get their stuff done easily.

- Payroll is so easy. We employed people all over the US along with a huge number of contractors. And we never had an issue with it.

- Gusto took care of a ton of the state registration and filing stuff. You still have to do some of it on your own but Gusto helped a lot.

- Onboarding is super easy, for both employees and contractors.

- Setting up PTO policies was great.

- While the health insurance options were limited, they were good enough.

- The integrated 401K vendors were really solid. I consider myself an investing hobbyist and I was impressed with what they had.

Even if I only had one employee and didn’t need most of this, I’d still use Gusto. And I’d stay on Gusto until my whole Operations team was threatening to quit unless we got off it. It’s not perfect (nothing ever is) but it’s the best I’ve used by far.

I’d use it if I just had a couple of contractors. The business filings, contractor payments, and tax forms are more than worth the price.

Also, switching payroll systems is a HUGE pain. Being on a platform that can grow with me for a while is super important. I’d never sign up for a payroll software that was great with 5 employees but broke by 50 employees. Gusto will handle a few contractors at a reasonable price, or hundreds of employees without an issue. It goes the distance.

To be transparent and fair, I’ll share the most negative experience we had with Gusto.

We did a round of layoffs awhile back. Termed a bunch of folks. For benefits, I always try to go above and beyond for employees. So I prefer to extend health, vision, and dental through the end of the month. Gives folks some time to sort things out instead of having everything shut off the day of the termination.

Well, something got messed up. Health lasted until the end of the month but dental and vision both got canceled on the day of termination. Gusto pointed the finger at the benefits provider, the benefits provider pointed the finger at Gusto and us. We dug super deep to figure out what changed and if we missed something. Best we could tell, something changed in the policy after we signed up and no one would take ownership. And a few of our former employees were pissed, rightly so. It was a whole mess.

Like I said, Gusto isn’t perfect. But anyone that’s managed payroll will tell you that my horror story is pretty light in the grand scheme of things. I’ve had much worse experiences with other providers.

What I Really Like

- Running payroll is super easy, never had a problem with it.

- State registrations are as smooth as they possibly could be. Gusto handles as much of it as they possibly can and they’re never made a mistake with my registrations or tax filings.

- The benefits options are really solid. I’ve been happy with their health insurance plans, dental and vision, and 401K.

- Setting up PTO policies has been a snap.

- Pricing is completely reasonable to me, at least on the two lower plans.

- Can easily grow with a company to hundreds of employees.

What I Don’t Like

- Their support team used to be a lot better. For a while, I considered their team like an external HR consultant. Super helpful for a small business. Quality has really dropped in the last 2 years as they’ve grown. It’s still better than most payroll tools but it isn’t top-tier anymore.

- Since the support quality dropped, I’m not sure the price of the most expensive plan is worth it anymore.

- Sometimes the UI isn’t ideal. For example, PTO balances focus on current PTO, not projected PTO. So employees have a terrible time figuring out if they’ll have enough PTO when they want to take time off. There’s other little things like this across the app.

- Be careful with their pricing page, they have a discount that only lasts 3 months in order to show a lower price. 3 months is nothing, you’ll probably use your payroll software for years on end. I hate sneaky discounts like that.

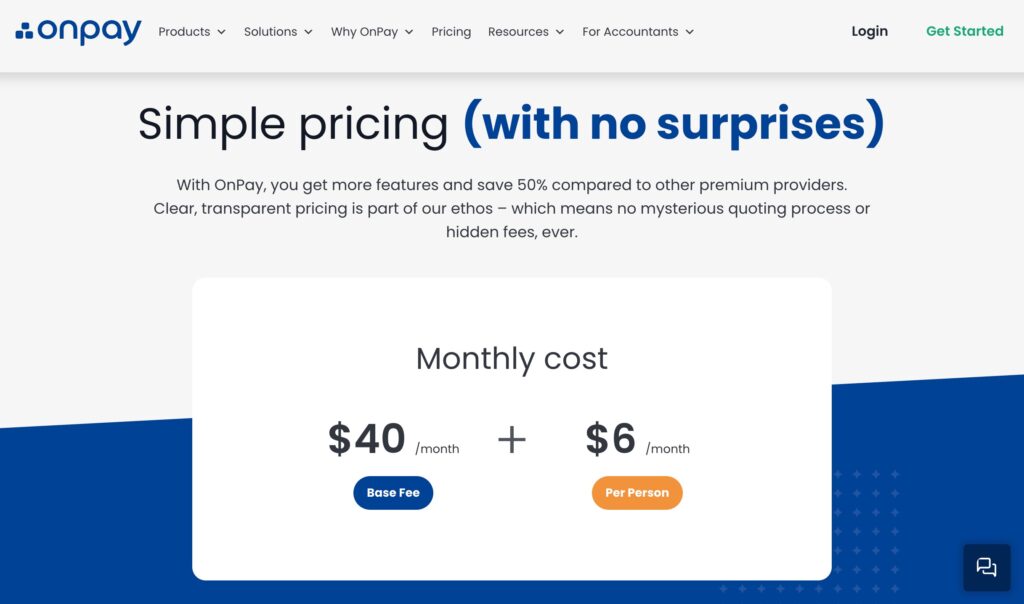

Onpay Review – Great Value at a Great Price

If I had to choose a small business payroll provider that wasn’t Gusto, I’d go with OnPay. It’s also one of the cheapest. You won’t find a better value to price ratio on this list.

At first, I assumed their pricing page was a trick. “It can’t really be that simple.” Well, it is. You get:

- Multi-state payroll

- Access to great benefits providers like Guideline and NEXT (I’ve used both)

- Onboarding, employee accounts, document management, etc

- PTO and time tracking

Everything you’d expect in a modern payroll suite. And the pricing really is $40 + $6/person per month. In comparison, Gusto’s multi-state payroll plan is $80 + $12/person per month. For a 20 person company, Onpay is $160/month compared to Gusto at $320.

So Onpay is about half the price of Gusto.

If cost is a concern, Onpay is going to be your best option as a small business. No question.

What I Really Like

- The pricing. I do love how simple the pricing is. There’s no games. No tricky discounts, no complicated plans. No pushy upsells.

- It’s a fully featured payroll suite, you’ll get everything you need for your small business.

- I was really happy with our 401K provider (Guideline) and love that Onpay also uses them.

What I Don’t Like

- The pricing is a bit too good to be true. I’d be really worried that a new executive will join and start pushing more aggressive pricing plans. Every SaaS company does this sooner or later. While pricing might be great today, I have no idea how long that’ll last.

- A payroll provider with great support is worth its weight in gold. It’ll help you avoid getting in trouble with state agencies, wage complaints, or launching bad HR policies. But at prices this low, I’d be very skeptical about Onpay’s ability to provide great HR support over the long term.

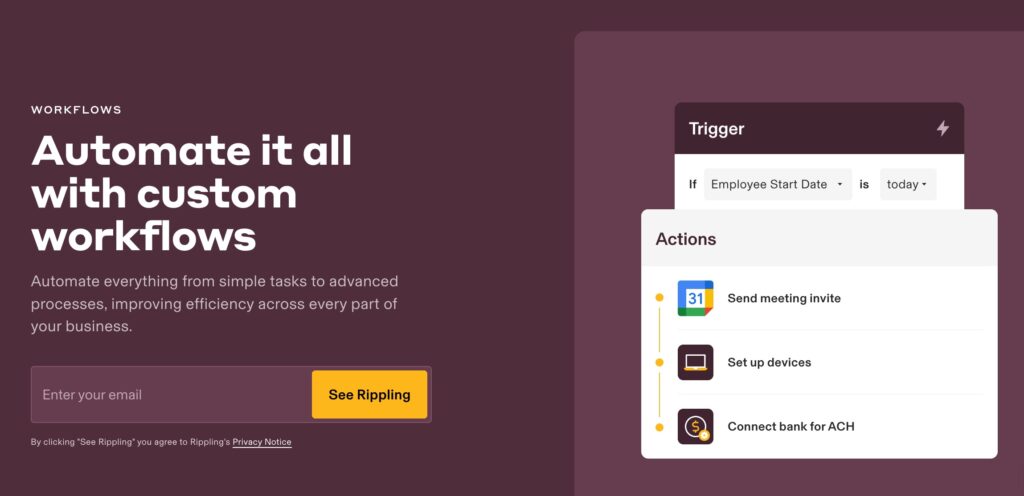

Rippling Review – Best Comprehensive HR Platform

Rippling is another disruptor in this category for centralizing HR, IT, and finance on top of an automation engine and powerful analytics. Other providers have tried, but none of them match the elegant simplicity of Rippling’s all-in-one platform.

If I was going to upgrade beyond Gusto, this is probably what I’d switch to.

What do you get in Rippling that you can’t get in a smaller tool? Stuff like:

- Custom workflow management.

- Headcount planning.

- Compensation band planning and management.

- Real performance management.

- Deep integrations to help with overall security (SSO, 1Password, Yubikey, etc).

- Device management.

- Integrated expense and corporate card management.

- Employee surveys and engagement.

Small business payroll tools might technically have some of these features but they’re neglected. At a mid-large size business, they won’t cut it at all.

There is one glaring product gap that I need to call out. Rippling’s leave management is nonexistent. Which is kind of crazy. What kind of payroll tool hasn’t figured out PTO? Even though I’d be most willing to upgrade to Rippling from another payroll tool, this might be a deal breaker for me. It’s so basic and I hope they add it soon.

I’m also hearing a lot of complaints about Rippling’s support. It’s extremely limited. Don’t expect any help once you get into the tool. Even worse, employees can’t contact Rippling support. So if they have a single problem with the platform, they’ll hit up your HR team. Then THEY have to contact Rippling. Super annoying.

One last word of warning: do not get Rippling if you’re less than 100 employees. It’s overkill and will cost way too much. Only switch to it after you’re outgrown another payroll provider.

What I Really Like

- Rippling really does have it all. When you’re ready to outgrow your small business payroll platform, Rippling is the next logical step.

- The UI is fantastic. They’re new and have their tech figured out.

What I Don’t Like

- This is enterprise pricing territory. They say that pricing starts at $8/month/user but that’s nonsense. It’s a classic product suite where every extra “product” is another upcharge. Every additional product means an upsell. And there’s no way to get a ballpark price without going through multiple sales calls. If you’re worried about the price, you’re already not their ideal customer. I’d expect to spend at least 5 figures per year.

- Expect upsells every time you turn around. Their sales team is on top of it which means you’ll get pushed hard on product access, contracts, and upgrades. Be ready to fight over your annual renewals.

- Support is nonexistent. You’d think they’d have a solid services division to sell additional packages here but they don’t. At least not yet. So don’t expect much help if you need it.

- Terrible leave management. Assume you need to manage PTO outside Rippling.

- Employees can’t contact support at Rippling, only your HR admins can. That means your HR team gets stuck with helping all your employees with everything related to the platform.

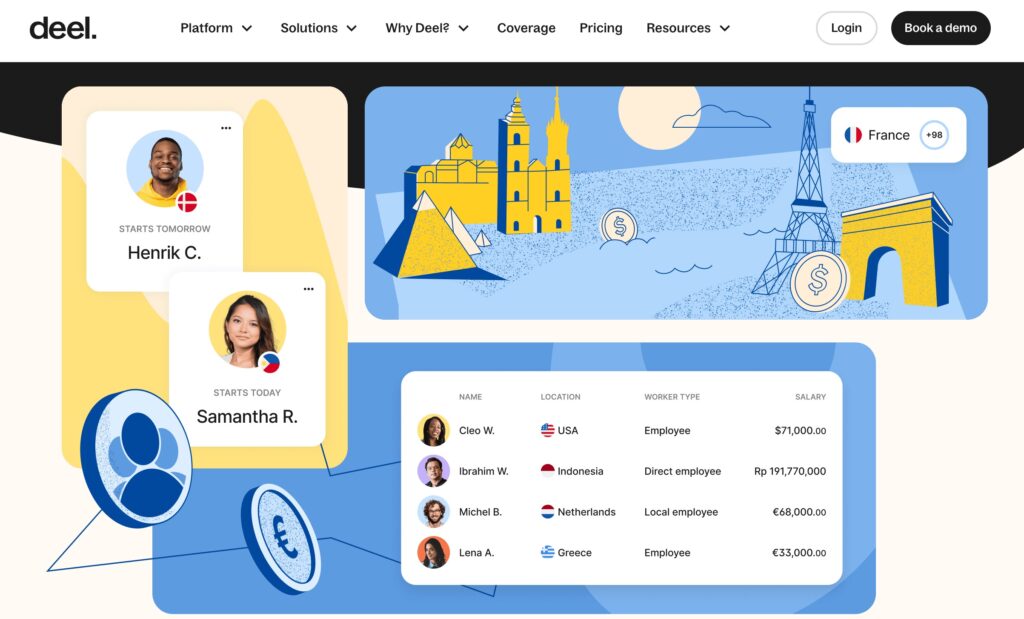

Deel Review – Best International Payroll Software

I’ve used Deel extensively with hiring international contractors. It helps with contractor compliance, getting the right documents signed in onboarding, generating localized contacts, and getting everyone paid.

They give your contractors multiple ways to receive payments, depending on what they prefer. Anybody that’s managed a team of 10+ contractors knows how painful this gets. Without a tool to manage international contractors, you’ll have 5 different payment methods and every contractor wants something different. Deel does a great job at consolidating all that stuff.

There have also been a lot of new regulations around documentation requirements for international contractors. Most companies will have to get this sorted way earlier than they used to. I would never do this manually. Deel handled all this stuff superbly.

At a previous company, I did hire multiple international employees. This was before tools like Deel existed. The process was so painful and so expensive that I vowed never to hire international employees again. Since then, I’ve mandated that my companies only hire US-based employees. So I haven’t used the international employee part of Deel. Old global hiring providers used to upcharge employee comp by 20-50% depending on the company. So Deel’s pricing of $500/month per international employee seems like a great price to me. If I had to expand internationally, I would definitely give this route a try.

I do have to say, my team hated the UI of Deel. It was way overbuilt for our needs. Everything had to get approved multiple times from multiple people. It wasn’t a deal breaker but it didn’t take long for folks to start grumbling about it. I saw it first hand myself. “Again? I have to approve this thing again?!” It got old fast.

What I Really Like

- Pricing is reasonable. It is higher than normal payroll at $50/contractor/month and $500/employee/month but international hiring is a mess. Deel is working for every last penny.

- Does a great job at sorting out the regulations around hiring internationally. All that stuff got solved for us and we never had a problem.

- International payments were so much easier once we switched to Deel. Tons of headaches instantly went away.

What I Don’t Like

- The UI has its issues, it could be streamlined. A lot of the workflows could be simplified and our employees did regularly complain about it. Pretty sure all our contractors hated it too. But they put up with it so they could get paid.

- Overall, the product is designed for larger companies that are managing hundreds of contractors. It’ll work if you only have a doze or so, but it’s overbuilt.

ADP Review – Best Enterprise HR Platform

ADP is one of the juggernauts of payroll. They’ve been around forever and are one of the true enterprise payroll solutions. There’s a dizzying range of products and covers every payroll related product you could possibly want.

I’m going to be completely honest, I don’t have much experience with payroll at this level. I dug around quite a bit and I found tons of horror stories about ADP. But to be fair, I also found tons of horror stories about their main competitors like Paycor and Paychex. Which is pretty typical with the enterprise level of any product category.

Here’s my real recommendation for this category:

- Avoid jumping to enterprise payroll for as long as you can. Even if it’s painful with your current tool, recognize that switching will not reduce the pain. You’ll just swap one pain for another.

- Only move to the enterprise level if you absolutely have to.

- If it’s time to move to enterprise, you’ll likely have a full-time person completely dedicated to payroll already. If not, you can probably wait.

- If you’re going to make the jump, don’t listen to some rinky-dink website (mine or others), listen to the HR professionals on your team. They’ve already used a number of tools in this category, take their recommendations seriously.

ADP will likely be in the short list of enterprise products that you do a bake-off with.

What I Really Like

- The product suite is extremely comprehensive. There’s a product for everything. It’s so comprehensive that it will take your team months to figure out the ideal setup. If you have a complicated payroll setup, there’s likely a way to pull it off.

- ADP has been around forever which means tons of HR professionals have deep experience with it. Oftentimes at the enterprise level, there isn’t a perfect tool. They all have problems. It’s about knowing the tool you have and knowing how to make it work. If your team has experience with ADP and is willing to adopt it again, that’s a very good reason to go with it.

What I Don’t Like

- Support seems to have taken a dive over the last few years. Some folks get lucky with a good rep but I’m seeing a lot of complaints. I’d expect to be on your own once you’ve onboarded.

- ADP does position itself as a good solution for smaller companies, I strongly disagree with that. Stay away unless you have hundreds, preferably thousands of employees.

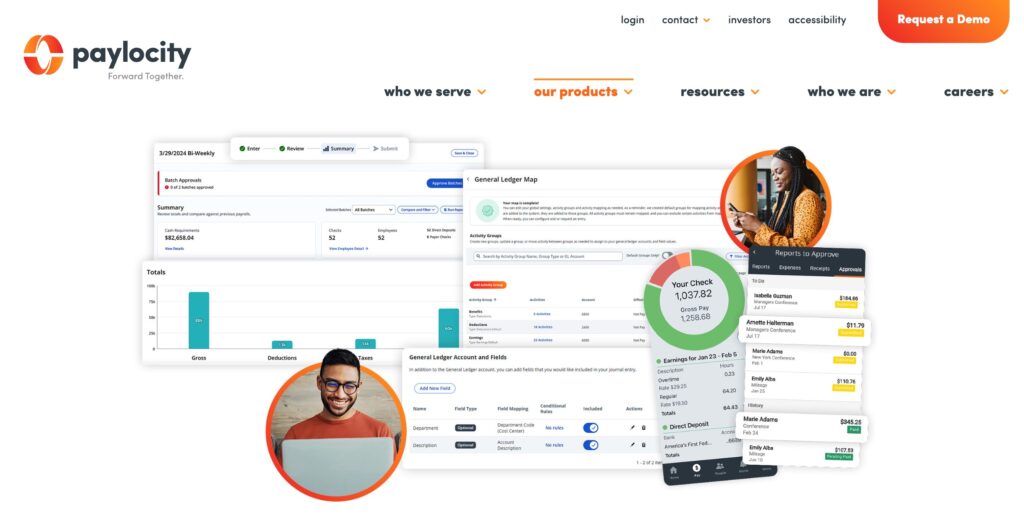

Paylocity Review – Best for Advanced Payroll Teams

In most software categories, there’s the Ferrari option. It’s a pain to control, difficult to learn, maintenance is a huge hassle. But if you know what you’re doing, you can do whatever you want. Paylocity is the Ferrari of payroll tools. On the good AND bad side.

First, Paylocity is extremely complex. Yes, you can set things up however you like. You will have a disgusting amount of control. But that also means a crazy steep learning curve, a horrendous implementation period, and a support team that’s usually out of their depth. If none of this scares you, it could be a great fit.

And once it’s working, Paylocity will run really smoothly. You just need to know how to handle it.

What I Really Like

- Paylocity really is for advanced payroll users. If that’s you, having the complexity you need to do things your way can be a dream. That said, this much complexity usually ends up being a massive problem for most people.

- Stability once you’re up and running. If you make it through the implementation period, don’t need much support, and take control yourself, you will have stable payroll system you can rely on.

What I Don’t Like

- Gear up for a brutal implementation period. Also do not depend on Paylocity to hold your hand. Be proactive, verify EVERYTHING, and take control. If you do, it’ll get done right. If not, you’ll be looking at new providers in a year.

- There’s tons of complaints out there about the support team. Sounds like their account managers have terrible turnover. Expect long hold times, lots of beginner support folks, and having to fix most things yourself.

- For anyone looking for a “hands-off” payroll tool, this aint it.

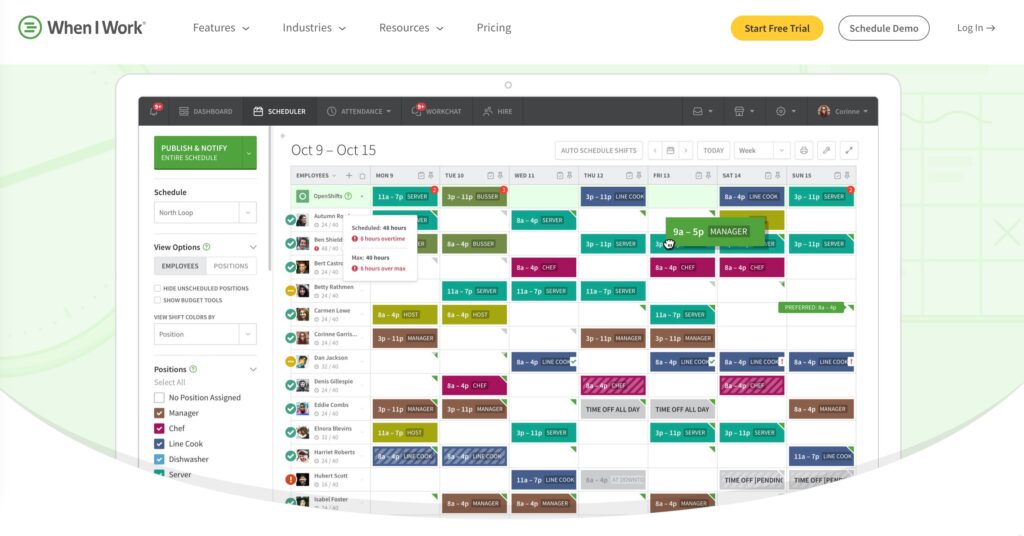

When I Work Review – Best Scheduling with Payroll Tool

When I Work is your best option if you heavily rely on employee shifts to run your business.

Regardless of which tool you use, definitely find a tool that puts shift scheduling front and center, with a deep payroll integration. The last thing you want is to duct tape payroll, PTO tracking, and shift scheduling together. You’ll spend all your time managing spreadsheets instead of running your business.

Look for features like:

- Leave management

- Drag-and-drop schedule building

- Scheduling rules and automations

- Support for multiple locations and job sites

- Shift templates

- Overtime and PTO tracking

- Help with labor laws, PTO laws, and compliance

- Deeply integrated payroll.

When I Work has all of this. And it starts at just $1.50 per employee per month. That’s so low, especially these days as hourly wages rise and squeeze business profits. This lowest plan of theirs includes quite a lot, like multiple locations, shift swapping, auto achedling, and unlimited users. While it has payroll integrations, it doesn’t include full-service payroll.

To agave When I Work run payroll for you, you’ll have to spend another $39 + $6/user per month. This is right in line with the rest of the industry, on the low end actually.

If I was signing up for When I Work, I wouldn’t try to run payroll elsewhere at all. I’d get the full-service payroll right from day one.

What I Really Like

- A fully built out tool for businesses that rely on shift scheduling. Please tell me if it’s missing something because I’m having trouble finding any gaps.

- Really solid UI that’s easy to use. It’ll click really fast for your managers.

- Pricing. Plans are as reasonable as it gets in payroll.

What I Don’t Like

- Depending on how good your POS system is, you might be able to skip this entirely. That’s not a product category I’m super familiar with so I can’t speak to it.

- Some employees report issues with the UI for certain edge-cases, like getting locked out of profiles during inactive periods for seasonal jobs.

SurePayroll Review – Best for Household Payroll

SurePayroll is hands down the best option for paying household employees, like nannies, housekeepers, personal chefs, or babysitters. It has a custom plan just for households. You’ll get everything you need and nothing you don’t.

You might think you can get away with not using a payroll tool for a household employee but the IRS has strong opinions on how to handle taxes for household employees. I would never mess around with this. Get a payroll system for your household. Not only will you avoid tons of headaches, you’ll save a TON of time.

I don’t have personal experience with SurePayroll, but someone close to me does and they have nothing but great things to say about it. They’ve also tried other providers, all of which have been acquired by SurePayroll.

So, even if you try to go with something else, you’ll likely end up with it eventually.

What I Really Like

- The pricing can’t be beat for what you get. The Household Plan includes one employee for only $39/month. That includes unlimited payroll and all your tax filings.

- A dedicated Household payroll plan. It shows that the team is prioritizing Household customers and their unique needs. This is going to be way better than a generic payroll provider that’s trying to serve all types of small businesses.

What I Don’t Like

- SurePayroll is owned by Paychex, one of the dominant payroll providers. They’re huge. While I haven’t used Paychex I have heard some VERY mixed feedback. While I’ve only heard good things about SurePayroll, I do wonder how long that can last.

- I also worry how they keep gobbling up all their competitors. I understand it’s good business for them, but it reduces competition. That could encourage them to rest on their laurels and stop investing in their product.

What about PEO Solutions? Most People Don’t Need Them

I don’t recommend PEOs for most businesses. They’re not bad by any means, but most regular, normal companies don’t need it.

These types of agreements are structured on co-employment models—the provider shares responsibility, liability, and risks with you. In exchange, they force you to adopt their policies to protect themselves.

Most PEOs offer the same services. It’s really more about choosing a company you align and work well with. Check out my full post on the best PEO services if you want to learn more about my top recommendations.

If you don’t want to enter into a full PEO agreement, you can also consider outsourcing payroll instead.

What Matters Most When Choosing a Payroll Provider

There’s a lot of noise around payroll.

It’s deep integration into HR software makes it convoluted and extremely confusing to make sense of.

My advice is to go through the following list, mark down the things you have to have, what you’d like to have, and what you can ignore.

- Benefits administration — This covers all aspects of offering and managing employee benefits, like health insurance, retirement plans, and other perks

- Employee self-service portal — Employees can onboard themselves, set up their own account, access pay stubs, see their tax forms, request time off, etc. Lifetime access is a solid bonus

- Self-service onboarding — This goes beyond a simple form to fill out. It includes quick, compliant, and hassle-free integration of new hires into the payroll system

- Document vault with e-signing — You can sign and securely store documents without leaving the platform

- PTO management — Comprehensive, flexible, and user-friendly tools to manage all components of employee paid time off, from accrual calculations to time off requests

- Time-tracking — A built-in system for tracking time to clients, projects, or tasks for hourly employees. If it’s not built in, it should integrate directly with your time tracker

- Support for the states you work in — The ability to meet compliance requirements, calculate taxes, file tax forms, and process payments in all the states you work in. Many providers charge extra fees for certain things if you work across multiple states

- Contractor payments — You can onboard and pay contractors just as easily as you would an employee

- International operations — Compliance, onboarding, and localized support for employees or contractors outside the United States

- Automated tax filing and payments — All providers help calculate taxes, but some of the barebones providers don’t pay and file them for you. Furthermore, some can only do so in certain states

- Accounting software integrations — The ability to connect and sync your payroll with accounting. These integrations come in all shapes and sizes

- Household employees — Handle payments to household employees, which typically require specialized taxes and compliance rules

- Complex scheduling — You get what you need to build and manage detailed employee schedules. This is particularly useful for shift work and large teams of hourly employees

There are also a few other things to keep in mind, including the user experience, customer service, availability and cost of consultations, the overall price (including processing fees, set up fees, and other hidden costs), and the company’s future outlook.

I’ve listed these separately because they’re really personal preferences more than anything else. If you’re stuck between two or three options, use these to narrow it down to your favorite.

Methodology + Why You Can Trust HR Advice

I started with Gusto to run payroll because I was only paying US-based employees and contractors. When I needed recruiting features, I added Workable. Most recently, I invested in Deel to pay international freelancers.

I didn’t know that I’d need all those things when I chose Gusto. But I was happy with it and didn’t want to switch to something else, so I added new tools to get the job done.

Eventually I’ll upgrade to something more all-inclusive to consolidate down to one platform.

We have one person taking care of all things HR for the company, but a full team depending on us to take care of them.

I understand the weight of making the right choice.

The advice here comes from my experience choosing and implementing various payroll solutions over the last five years.

I didn’t dive this deep just because I wanted to. Nothing I read online was really helping me when I needed it–I had to get lost in the weeds to make sure I made the best decision for my team.

For me, the hardest part was making sense of an industry that’s intentionally vague and confusing. Everyone says something different and there are so many options, it really was incredibly overwhelming.

So, I put together this guide–the exact thing I wish I had at the beginning.

You Can’t Run Payroll Without Onboarding, Leave Management, Benefits, and Time Tracking Data

So, I only recommend payroll software that (at least) covers all of these functions.

Time tracking is optional–I don’t have hourly employees so I don’t need it. But if you use it, it’s best if it’s deeply integrated with payroll.

While it may seem too early to think about these things, you’ll be really glad you have them. Even with one missing piece, you could be stuck adding manual adjustments and deductions, importing timesheets, and emailing tax forms back and forth every time you run payroll or hire someone new.

At that point, you might as well use a spreadsheet. While there’s nothing wrong with doing it that way, you’re here because you want a better way to run payroll.

Don’t Use Payroll Software that Makes You Pay and File Taxes Yourself

This is a key component of any payroll solution worth your time and money. Straight up, you shouldn’t use a provider that doesn’t handle payroll taxes for you.

Full-service providers may cost a bit more, but staying on top of local, state, and federal tax requirements–even in one state–is next to impossible. Not to mention doing it for multiple states AND all the payroll forms you have to submit when you hire someone.

Doing it all yourself will cost you in other ways–mainly time and headache.

Solutions like Payroll4Free may sound great with their non-existent or incredibly low price tags. But they leave you with an even more expensive burden.

Even if you’re in a full-service state, there are cheaper and more comprehensive options out there.

Whether you’re paying one person or more than one hundred, centralizing payroll-adjacent functions and automated taxes will make the difference between seamless payroll processing and a never-ending nightmare.

It’s even more critical if you don’t have an HR department, let alone a dedicated HR person.

The smaller you are, the more important it is.

Focus On What You Know You Need

It’s important to think ahead to an extent, but don’t get caught up in what you might need someday.

Your needs will inevitably change in ways you can’t predict. If you try to think too far ahead, you’ll end up paying a lot of money for a bunch of features you never use.

Instead, handle those situations as they come. You can always switch to something more powerful and consolidate everything when you’re ready.

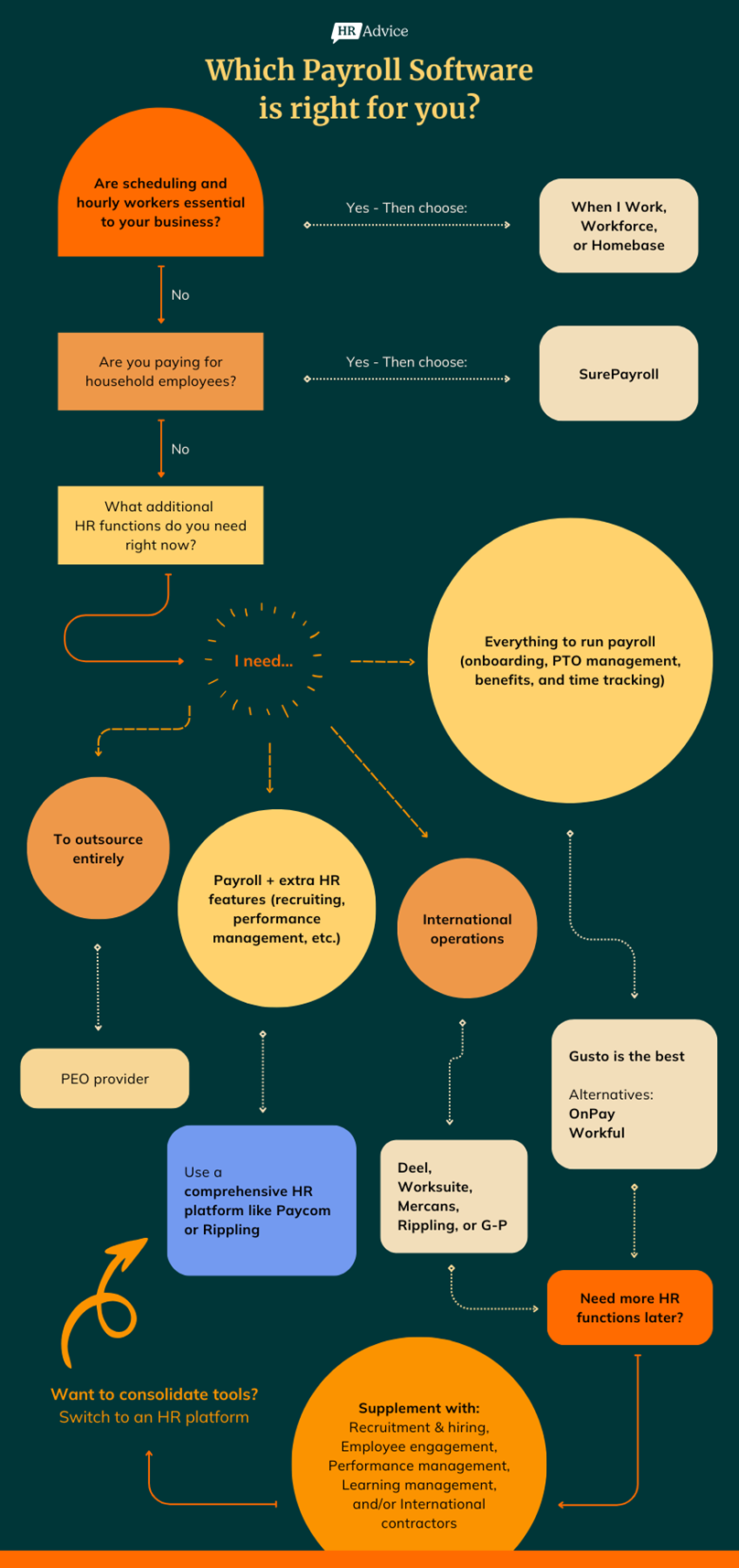

Every payroll provider falls into one of the following buckets:

- Payroll for new or small businesses

- Comprehensive HR platforms

- International payroll software

- Dynamic scheduling solutions

- Household payroll tools

- PEOs that do it all for you

I recommend most people start with something in the first bucket. Most people can also avoid the last one. Outsourcing to a PEO sounds good on paper, but it’s extremely limiting in practice–I won’t go into a ton of detail here, just know that standard, normal businesses don’t need it.