A redundancy payment is a lump sum given to an employee after a company makes their position redundant (the role gets eliminated).

The US doesn’t have any labor laws that require redundancy pay, but the UK does.

Some of these terms do get used differently on each side of the pond, so be careful:

- Redundancy means the employee loses their job. This is used in the UK, it isn’t used in the US.

- Redundancy pay is the extra pay you get in the UK to hold you over until you can find a new job. In the US, this is called severance pay. Or just “severance.”

- Lay-off means temporarily not working in the UK. You still have a job, you’re just not working for a period. In the US, this is called a furlough. A lay-off in the US means the employee loses their job. Most often, it’s an event where a group of roles are all eliminated at once.

How Redundancy Pay Works in the UK

The Parliament of the United Kingdom established the Redundancy Payments Act in 1965. It’s one of the three foundational principles of UK labor law.

The other two are the Contracts of Employment Act 1963, which requires employers to give a statutory minimum notice before making someone redundant, and the Industrial Relations Act 1971, which gives employees the right to a fair dismissal.

Together, the UK’s foundational labor laws give employees the right to:

- Be dismissed for fair reasons only, such as economic redundancy, poor conduct, or unmet qualifications

- Receive notice of termination one week to 12 weeks before the effective termination date, depending on seniority

- Take home statutory redundancy pay if you’ve worked for the employer for two or more years

Statutory redundancy pay is based on three things: an employee’s wages, age, and the time they spent at the company.

All calculations are based on the average an employee earned per week over the 12 weeks before the day the employer gave the redundancy notice.

This is capped at a specific amount based on the UK’s average weekly wage, which changes from year to year. In 2024, the cap is £700 per week.

Here’s what employees must receive from their redundancy pay:

- Half a week’s pay for each full year they were under 22 years old

- One week’s pay for each full year they were 22-40 years old

- One and a half week’s pay for each full year they were 41+ years old

Only 20 years of service can be counted. This protects employers from having to pay an astronomical redundancy sum to someone with 30 or 40 years of employment at the company. The weekly pay cap helps with this too.

Calculating Redundancy Pay in the UK

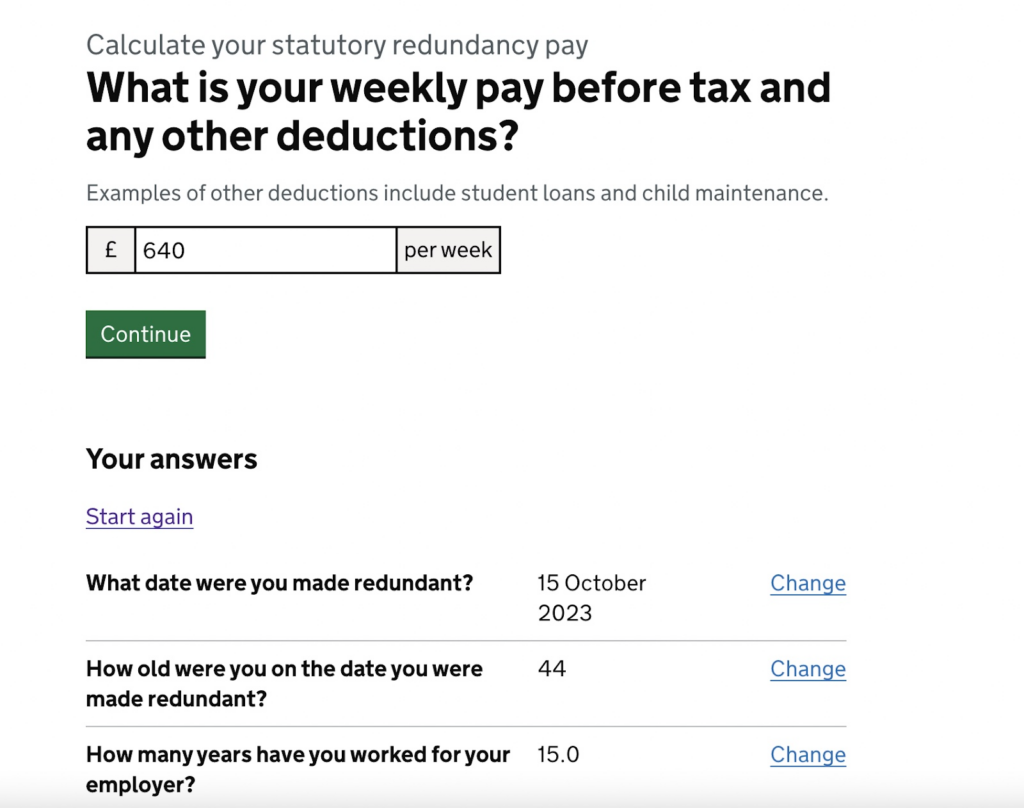

You can head to the UK government’s statutory redundancy calculator to get a clear picture of an employee’s potential redundancy pay.

I went ahead and did it for fun.

My hypothetical employee was 44 years old at the time of redundancy. They earned a weekly salary of £640 per week before taxes and had worked for the employer for 15 years.

With these calculations, my mock employee would take home £10,560 in redundancy pay. This is equivalent to about $12,845.

If they were 30 years old and had five years of experience working for an average of £450 per week before taxes, they’d get just £2,250 (about $2,735).

Of course, employers can pay more than the statutory minimum if they want. Many do this when they want people to make themselves redundant voluntarily.

And in the UK, up to £30,000 of redundancy pay is tax-free for the employee.

Severance Pay vs. Redundancy Pay

There’s no redundancy payment law for US businesses to follow. And in the US, no one calls it “redundancy pay.” There’s no such thing.

Instead, US businesses use something called severance pay. It’s basically the exact same thing as redundancy pay: employees get an extra bonus on their final paycheck in order to help with their transition into a different job.

But there’s one major difference with severance pay. It’s not required. Businesses don’t have to offer any severance under any condition unless they want to.

Many US businesses don’t offer any severance pay at all. And most folks count themselves lucky if they even get two weeks worth of severance. If you’re super lucky, you might get 4-8 weeks.

Think of it this way: redundancy pay is a type of severance pay. And in the UK, redundancy pay is the term that carries legal weight and applies only when an employee is made redundant.

In the US, on the other hand, severance pay is the more common term. It’s optional but not required when employees are laid off or made redundant.

Without Redundancy Pay, Severance is a Good Idea

I strongly endorse offering some type of severance, even if the company isn’t required to do so. And I think the UK regulation that forces redundancy pay is an excellent rule.

Employees shouldn’t have to live in fear that their paycheck can disappear without notice. Switching jobs is never easy, it can easily take several months of effort. Folks should be able to pay their bills and feed their families during those periods.

Severance pay can also:

- Help protect companies against costly lawsuits. While the US gives employers free rein to fire their employees at-will in many situations, there are important exceptions. Severance agreements usually include clauses that the separation is amicable, reducing the likelihood of lawsuits in the future.

- Preserve a company’s reputation. Angry employees who are legally fired at-will tend to spread the news about how poorly their former employer treated them. This can result in bad press for a company. Severance helps end everything on a positive note.

- Protect company secrets and other proprietary information. Companies can offer a severance package in exchange for a non-disclosure agreement (NDA). This is very standard in the US.

To create your own severance package, I recommend picking a standard amount for every role, like 4 weeks of pay. Complicated formulas based on tenure are usually more trouble than they’re worth. I’ve done 8 weeks severance at my company.

In the United States, you should also check healthcare and dental/vision. Most folks expect these to last until the end of the month. But that’s up to the specific details of your policy. I’ve gotten burned here myself. We set up our dental/vision policy, were never given the option to select when it ends, then we all discovered that it ended on the last day of employment during a round of layoffs (redundancies). That was… not fun.

So double check your benefits policies and make sure they end when you think they do. I make this a standard step before doing a layoff (redundancy) round.

A few other thoughts on doing severance right:

- If cash is super tight, still try to do at least 2 weeks severance if you can.

- 4-8 weeks severance is ideal, that’s well ahead of the curve but also reasonable in my book.

- When budgeting, remember the payouts for unused PTO which are legally required in an increasing number of states

The Best Resources for Redundancy Pay

If you’re in the UK, make sure you’re doing everything by the book. Don’t trust some random person on the internet like myself. These resources will get you sorted:

- Redundancy: Your Rights: good overview of the rights that you have as an employee during redundancy in the UK.

- Dismissing Staff: a quick overview of what’s involved for dismissals in the UK.

- Dismissal Procedures: more details on everything that’s required during dismissals in the UK.

- Redundancy Pay Calculator: use this calculator to figure out what you’re owed, or what you need to pay as an employer.