A payroll calendar keeps a business and its employees on track with common dates associated with payroll, like pay dates, pay period start and end dates, and time card deadlines. Basically, it’s your payroll schedule mapped conveniently to a calendar.

Large businesses typically have complicated payroll calendars because they might use different pay periods for different types of employees. However, for most employers, it’s just a few pay dates organized on a calendar.

The Three Most Common Payroll Calendar Types

Payroll calendars run alongside a company’s chosen pay period. The most common pay periods are biweekly, semimonthly, and monthly, making them the three most common payroll calendar types.

Biweekly is by far the most common pay period used. Biweekly pay periods last for two weeks, and employees get paid on a set day following the end of each pay period. For example, a pay period ending on Wednesday might pay employees on Friday.

Biweekly pay works best for companies with hourly employees. Hourly wage lines up with a typical workweek, making it easy to account for regular wages and overtime on a biweekly pay schedule.

Employees usually prefer biweekly pay because it provides a regular pay schedule every other week. However, some months have an extra pay period due to how biweekly pay periods fall, which can complicate payroll runs for those months.

Semimonthly pay is also relatively common, giving companies two pay periods each month and employees two set pay dates, like the 1st and 15th.

Semimonthly pay is often used for salaried employees who don’t earn overtime. Their pay is more predictable, therefore fitting into the strict schedule of semimonthly pay. Companies also have two pay periods per month, every month, without variation, making payroll processing slightly less complicated than biweekly pay.

Monthly pay periods last one full month and pay employees on the same date each month. Companies usually only use monthly pay for high earners or if they want to align employee pay and commissions with a monthly business model, like companies with most revenue generated from monthly subscriptions.

In most cases, monthly pay isn’t a good idea. It creates less payroll processing work for employers, but most employees don’t want to wait a full month for their paychecks.

How to Create Your Payroll Calendar

1. Decide on Your Full-Time Pay Frequency

Most companies stick to a biweekly pay frequency because that’s what they know and what’s most common, but it’s not the be-all and end-all solution for every company, just like semimonthly and monthly pay won’t work for all.

Here’s what to consider when deciding on the pay frequency that fits your company’s needs:

- State laws regarding pay frequency: Some states don’t allow certain employees to get paid monthly. Utah, for example, only allows employers to pay their employees monthly if the employee has an annual salary. Check your state’s pay frequency regulations on the U.S. Department of Labor website to remain compliant.

- Business cash flow: Does your business generate steady income throughout the month, or does it have more of a monthly cash flow? Your payroll should align well with the company’s cash flow cycle to avoid budgeting problems.

- Types of employees: Do you have more hourly or salaried employees? While biweekly fits hourly employees best, semimonthly can be a better option for salaried employees. You can also use different pay frequencies for different types of employees, but this can also complicate payroll a bit.

- Employer preference: Consider what you, as an employer, feel is the best pay frequency for your company, payroll budget, and employees.

- Employee preference: Balance your preference with the overall opinion of your employees. How often do they prefer to get paid? Can their preferred pay frequency fit into the company’s needs?

As mentioned, some employees may require a different pay frequency than your company’s number-one choice.

For example, if you chose biweekly because you have mostly hourly employees but also have a few salaried employees, you might put your salaried employees on a semimonthly schedule.

Or, you might choose to pay part-time workers biweekly while all full-time workers get paid semimonthly. Weekly pay can even work for part-time workers, especially if you only have a few of them.

If your company uses contractors, how will you pay them? Usually, contractors get paid once or twice per month. Their pay dates and relevant payroll processing dates need to also be included on your payroll calendar.

2. Check Your Payroll Software

If you need help keeping track of important payroll dates and payroll processes in general, payroll software is the way to go. It pretty much automates the process, from calculating tax withholdings to sending payments to your employees.

To work properly, your payroll software needs to know what pay frequency you use. You’ll need to make sure your software can work with your pay periods. Most top options have support for common pay frequencies, like biweekly and semimonthly.

Set up your software to run along your pay schedule. Then, double-check payroll dates provided by the system, such as pay dates and payroll tax due dates. If everything is correct, your payroll software can take it from there.

3. Map Payment Dates to the Calendar

For this step, you’ll need a calendar template. You can print one to write on as your initial template to make sure you include all dates before digitizing your calendar. This can also help you see whether any holidays might get in the way of typical payroll dates, allowing you to adjust as necessary.

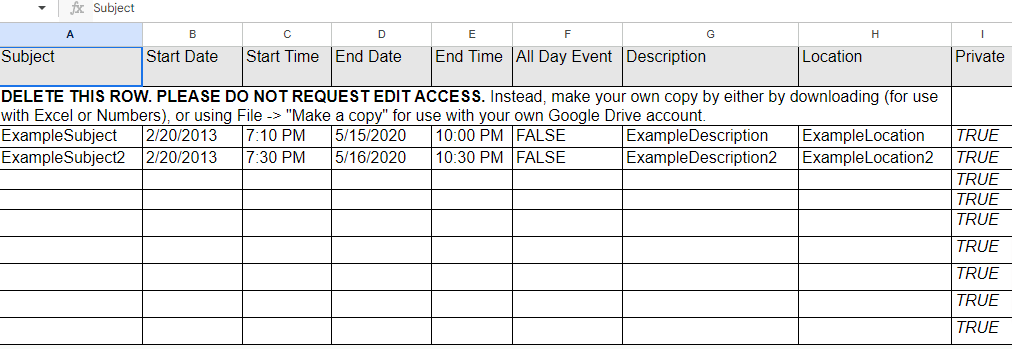

When you’re ready to create your digital version, it’s easiest to create a .CSV file with all relevant payroll dates with spreadsheet software like Google Sheets.

I like this one, which is pretty easy to modify. Make your own copy in your Google Drive before trying to edit it.

Under each header, type your information. For example, under ‘Subject,’ give a brief description of that date, like ‘Payday 1’. Then, fill in the date and time information. You’ll likely mark ‘True’ in the ‘All Day Event’ column to indicate that there’s no set start and end time for each payroll date.

In the description, be sure to differentiate between different types of payments, if necessary, like paychecks vs. freelancer invoices. Or, mark it in the subject area with a name like ‘Freelancer Invoice June Pay.’

When you’ve finished editing the spreadsheet with all your payroll dates, you can upload your .CSV file to Google Calendar or your preferred calendar software.

To begin your import, open Google Calendar from your computer or mobile device. Then, click Settings, followed by Import & Export. Choose your .CSV file and click Import.

4. Share Your Calendar With the Company

Keep everyone at your company aligned when it comes to payroll by sharing your finalized calendar. Once you have it in Google Calendar or another calendar software, this step is easy.

Since Google Calendar and Outlook are top choices for payroll calendars, I’ll explain how to share your calendar in each program.

Google Calendar:

- Find the My Calendars section in the Google Calendar desktop version.

- Hover over the calendar name you want to share, and click the three dots, followed by Settings and sharing.

- Under Share with specific people or groups, click Add people or groups. If you have a work group already created, you can share the calendar with the entire group. Otherwise, enter the email addresses for everyone at your company.

- Click Send to send an email to each person with a link to access the calendar.

Microsoft Outlook:

- From Outlook, click on Calendar, followed by Share Calendar.

- Select the payroll calendar.

- Choose Add and add the people or group you want to share the calendar with.

- Select OK and change permission levels if needed. Company employees will receive an email letting them know the calendar has been shared with them.

Creating your very first payroll calendar is the most time-consuming part of the process. Once it’s set, it should only take you a few minutes to review and update the calendar each year with any new or modified dates.