When you run payroll for your employees, you—or your payroll software—record all the information you need to hang onto, like how much you withheld in taxes and how much you paid each employee for that pay period.

It’s all important information because you may need to refer to it if there’s ever a discrepancy with your taxes or the amount you owe an employee.

A pay stub does the same thing for your employees. It provides them with a record of how much they were paid, how many hours and days they worked, and how much they had withheld in payroll taxes.

Although, once upon a time, all pay stubs were printed on paper, many are now provided digitally so that employees can log into a portal and view all their pay stubs whenever they’d like.

Federal law doesn’t require employers to give pay stubs, but most states do. However, independent contractors receiving 1099s don’t fall under the same rules; these laws generally only apply to W-2 employees. Some states also don’t allow electronic pay stubs unless employees also have access to printed ones.

This guide covers everything you need to know about pay stubs and how to create your own.

What Information Is On A Pay Stub?

Although pay stubs can look vastly different between companies and the software used to generate them, they generally include the same information. Here’s what you’ll find:

- Employee and Employer Information: A pay stub should include the employer and employee’s names and addresses, which helps ensure that it’s going to the right person.

- Hours Worked: Pay stubs show the dates of the current pay period and the hours worked during those dates. For more specificity, the hours should be broken down by regular hours, overtime hours, and shift differential hours, if applicable.

- Employee Pay Rate: This is the rate of pay an employee earns, such as $25 per hour for hourly workers or $300 per day for salaried, exempt workers.

- Employee Gross Pay: Gross pay is the total amount an employee earns before any taxes or deductions come out of their paycheck.

- Paid Time Off: Paid time off for vacation, sick time, family leave, etc. should be included in a PTO section listing the amount of PTO used during that pay period along with the employee’s remaining PTO.

- Taxes and Other Deductions and Garnishments Withheld: Pay stubs often list various taxes, deductions, and garnishments as separate line items for employees to see where their money goes. For example, FICA taxes will be separate from state and federal taxes. Deductions for retirement contributions, health insurance, and child support or tax garnishments will also be included.

- Employee Net Pay: Net pay is the amount left over after all withholdings and deductions are removed from gross pay. Net pay is usually the amount given to the employee.

Do Employers Have to Provide a Pay Stub?

The Fair Labor Standards Act (FLSA) governs how employers pay employees across the United States. This law doesn’t require employers to give their employees pay stubs.

However, states can make their own laws regarding employee pay, and most states have laws requiring employers to furnish a pay stub for employees. As of 2024, only nine states don’t require any form of pay stubs, while 10 make employers provide written pay stubs, even if they have access to electronic versions.

This is true even if you pay your employees with direct deposit in certain states. Maine and California are examples of states requiring printed pay stubs.

Three states—Delaware, Minnesota, and Oregon—also allow employees to opt out of receiving their pay stubs electronically. In this case, employers have to provide paper stubs.

While the FLSA makes employers retain payroll records for at least three years, states make this requirement anywhere from three to seven years, so employees and tax departments can continue to access this information as necessary.

Although an employer doesn’t necessarily need to retain actual pay stubs for this length of time, they do need to hang onto all the information contained on a pay stub. So, really, it’s a good move to at least keep digital records of your pay stubs for the same length of time your state wants you to retain payroll records.

Employees can also ask for pay stubs from employers, so having them handy can make it a quick process to print off the ones they need.

Payroll software makes it easy to generate and view pay stubs whenever you need to or when an employee requests one. These tools do all the calculations for you and cut checks to your employees, too.

Most employers choose to use payroll software to streamline all the pay stub stuff, but when you’re just starting out, it may not fit in your budget yet, so you’ll need to DIY this task.

How To Create Your Own Pay Stub

Payroll software can be pricey for businesses just starting out or micro businesses that only have a couple of employees. For these employers, investing in payroll software right now may be financially challenging.

Still, creating pay stubs for employees is important. The good news is that there are several pay stub generator tools that are free or inexpensive, making them a good option to use before you’re ready to make the leap into full-fledged payroll software.

Here are a few I’ve tested out that are easy to use to create pay stubs in minutes.

Stub Creator

Stub Creator gives you your first pay stub completely free, so it’s a good option to use if you want to test out a generator tool to see if it’s something you want to stick with. Stub Creator works for employees and contractors; simply click the contractor box if you want to switch to contractor mode.

After filling in your employee’s pay information, you can preview the form instantly. There’s also a place to add the number of pay stubs you need for this employee, which pulls up a handy table for you to change pay periods and amounts quickly. After previewing, you can download your stubs immediately and opt to have copies sent to your email.

After the first free stub, each pay stub costs $4.99.

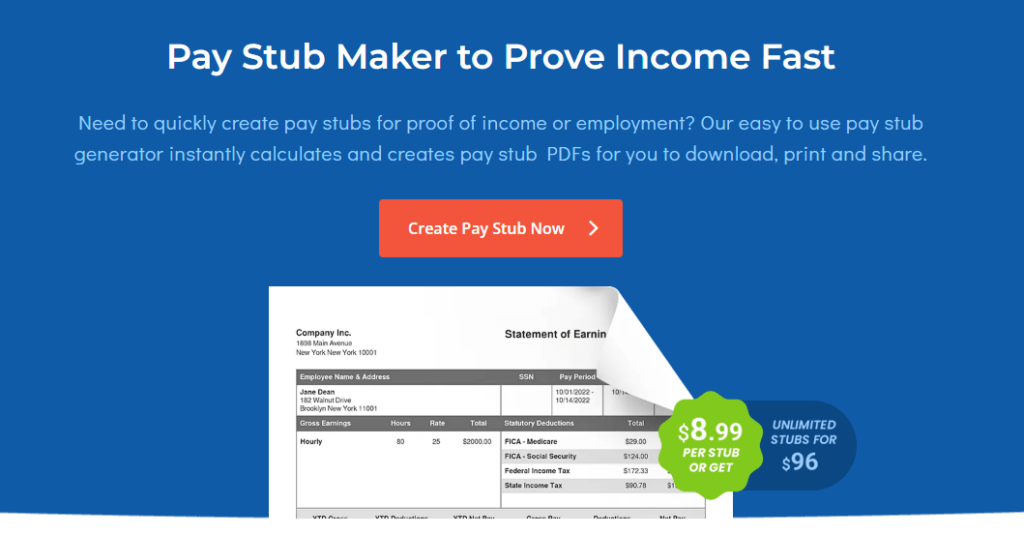

Form Pros

Form Pros offers auto-calculated pay stubs based on the rate and hour information you enter about an employee. There are also spots to add custom deductions, like retirement contributions or wage garnishments, for no extra cost.

You can also complete multiple pay stubs for the same employee at one time and customize the template format and colors to match your branding.

As soon as you’re done entering information, you can download your pay stubs to print or email.

Form Pros charges $8.99 per pay stub, so if you have even one employee, you’re better off opting for an annual subscription for $96, which gives you unlimited pay stubs.

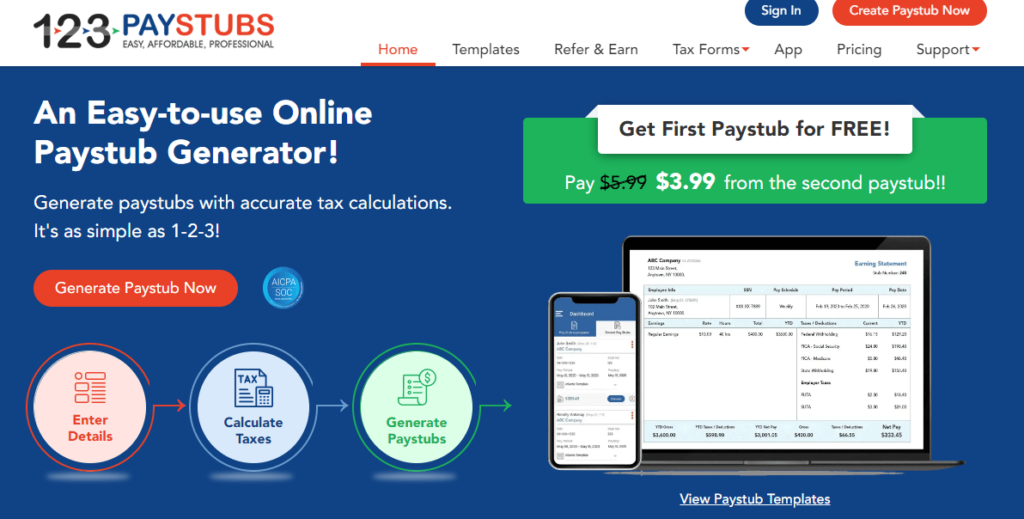

123PayStubs

Like Stub Creator, 123PayStubs gifts you a free pay stub to make sure its service is right for you before paying for it. After that, each pay stub is $3.99. The company also offers a few optional add-ons, like a deposit slip for $1 per pay stub, and additional earnings, like tips and commissions, added to a pay stub for $2.

You can enter taxes on each pay stub manually—a good option if you already have everything calculated or have some atypical tax situations on your payroll—or have 123PayStubs calculate them for you by checking a box.

123PayStubs has numerous templates to start from, all of which keep everything tidy and organized for your employees. Download each pay stub immediately after generating it to print or send your employee electronically.

Pay Stub Best Practices

Whether you need to pay yourself out of your LLC or generate multiple pay stubs for your team, creating pay stubs is always a good move. They help both you and your employees keep track of earnings, which is helpful when referring back to documents for taxes or income verification.

I absolutely suggest getting payroll software as soon as you can, which usually generate pay stubs as one of their many features.

Until then, use a pay stub generator to do it. It’ll cost a few dollars per pay stub for decent ones, but it’s way easier than typing and formatting them yourself.