The days of the boss handing out checks for employees on Friday afternoon are fading away, replaced by the convenience of direct deposit.

Direct deposit saves the HR department a lot of time while delivering reliable payments. Simply put, when employees receive their wages on time, they’re happier.

To show you how to set up direct deposit, we’ll walk through the entire process using Intuit QuickBooks. The fundamental steps are going to be more or less the same, regardless of what software you use.

Bear in mind that QuickBooks is definitely not one of our favorite payroll software and services. Great accounting software, for sure, but there are much better options out there for paying employees.

Step-By-Step Guide to Setting Up Direct Deposit for Employees

Step 1: Set Up Direct Deposit

For starters, set up the payroll bank account to make use of direct deposit. The account has to be able to make use of ACH transactions. (Most accounts can handle ACH, which is short for automated clearinghouse and is an electronic network that handles bank-to-bank payments.)

Contact the bank and make sure the payroll account is eligible to use ACH and direct deposit. If the bank must add this capability to the payroll bank account, it can take as long as a few business days, depending on the bank involved, so prepare accordingly.

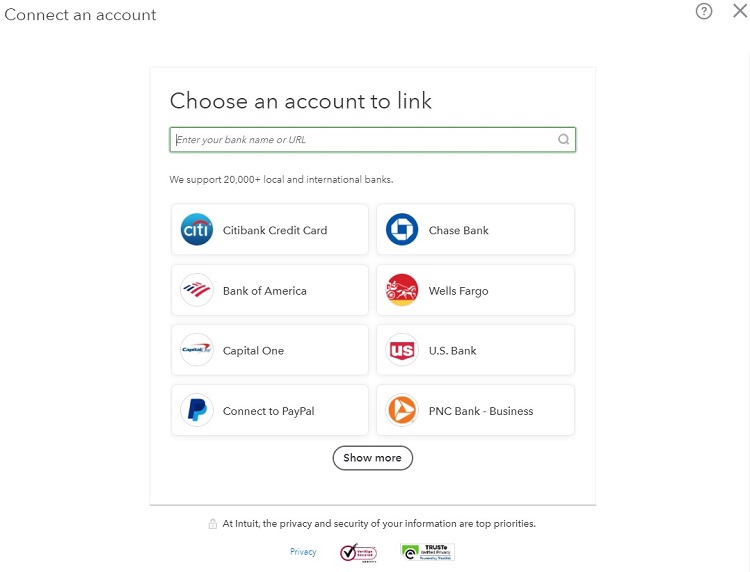

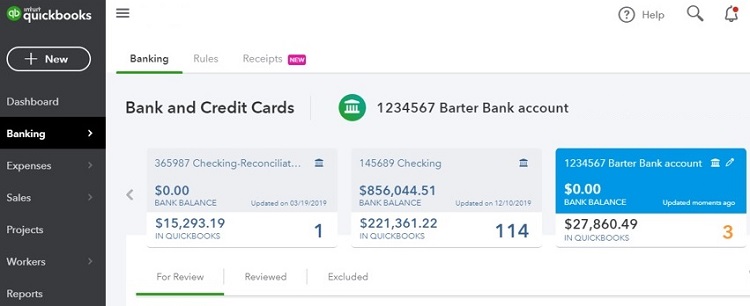

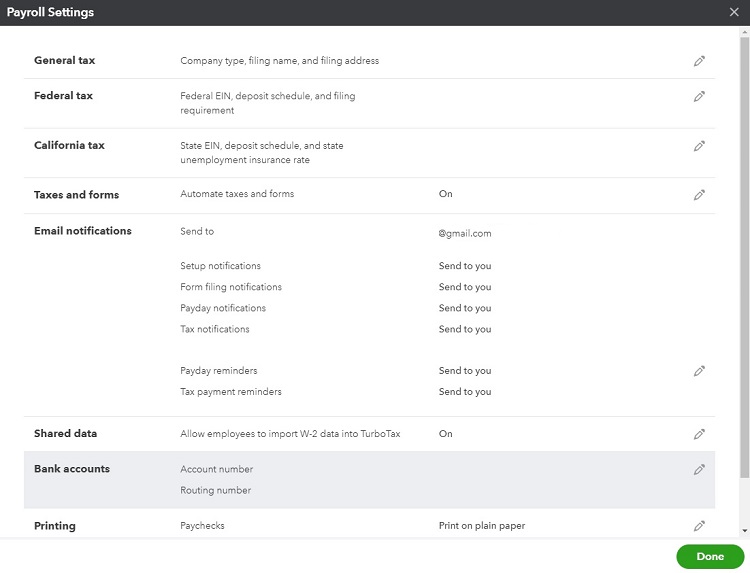

Once the account is ready to go for direct deposit, enter the payroll bank account information into QuickBooks. Click Payroll on the left side, followed by Overview to set up the bank information. Scroll down to Connect Your Bank and click Start. Follow the instructions to find the bank information.

The software will need to verify the bank account information provided by making a small deposit into the account. Once this deposit shows up successfully, everything is ready to set up direct deposit through QuickBooks.

Step 2: Receive Your Employees’ Banking Information

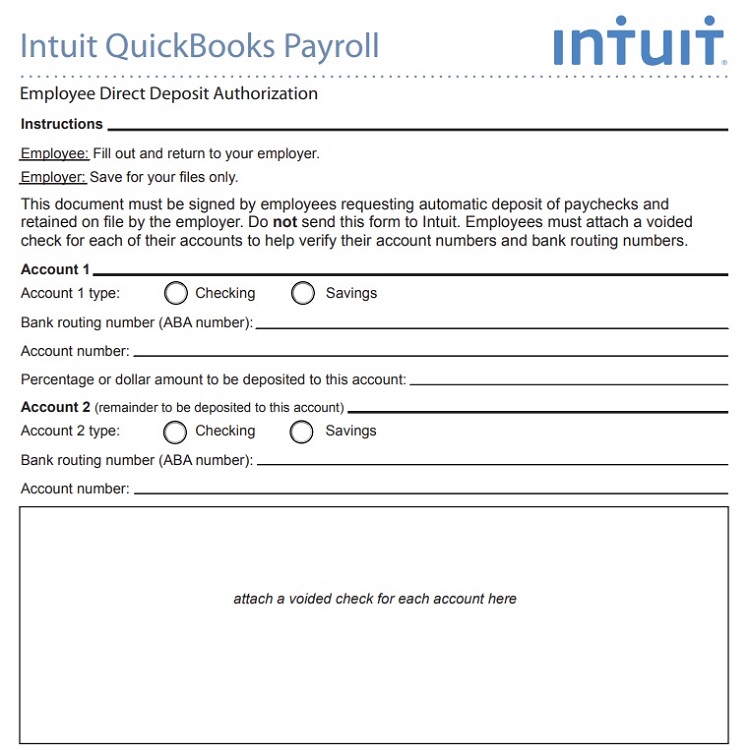

To make use of direct deposit, employees must provide the company with information about their bank accounts. QuickBooks provides a printable form for the employees to submit this information, simplifying the process.

Employees must provide signed and dated forms as authorization to send payments to their accounts. Along with the form, the employee must provide a voided check for the account.

To access the form, click on Payroll on the right-hand side of the QuickBooks window. Click Employees at the top of the window. Then either click on the name of the employee who will start using direct deposit or click the Add An Employee button to add the employee’s information, along with the direct deposit information.

After entering the information for an employee, moving down the window, the last section will ask how the company wants to pay the employee. Select Direct Deposit from the drop-down menu. Then click on the Direct Deposit Authorization Form link.

The form will open in a new window as a PDF file. Save it and print it as a PDF to give to the employee. The company can use the same form for each employee, as the blank PDF form doesn’t contain any personal information.

Step 3: Enter the Employees’ Bank Account Information

With the signed form in hand, it’s time to begin entering the data for the employees into QuickBooks. (Understand that the employees might not return these forms very quickly, so it may take a few days before the information is available for entry.)

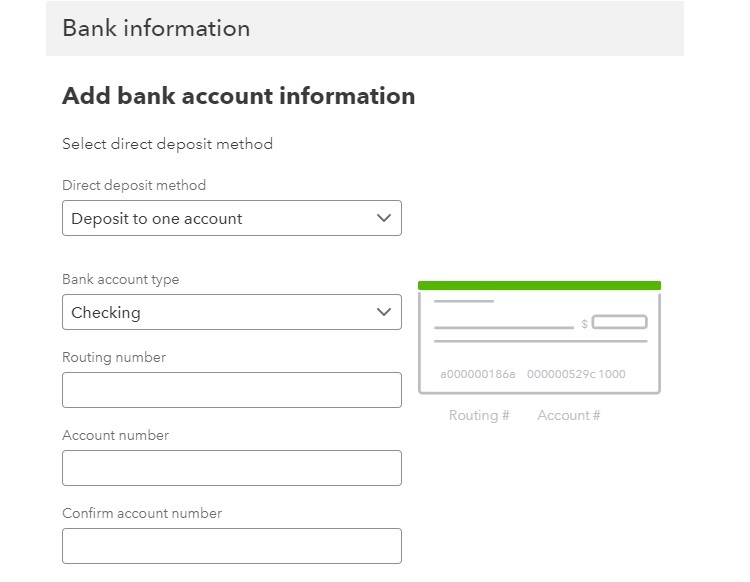

Click on Enter Bank Info, which is in the same section of the employee information window that provided the link to print the direct deposit authorization form.

In the next window, enter the employee’s bank account information from the form. QuickBooks allows employees to have the entire paycheck deposited into one account or to split the paycheck for deposit into two different accounts. Enter the employee’s account type, bank routing number, and bank account number before clicking Save.

Step 4: Creating a Payroll Run

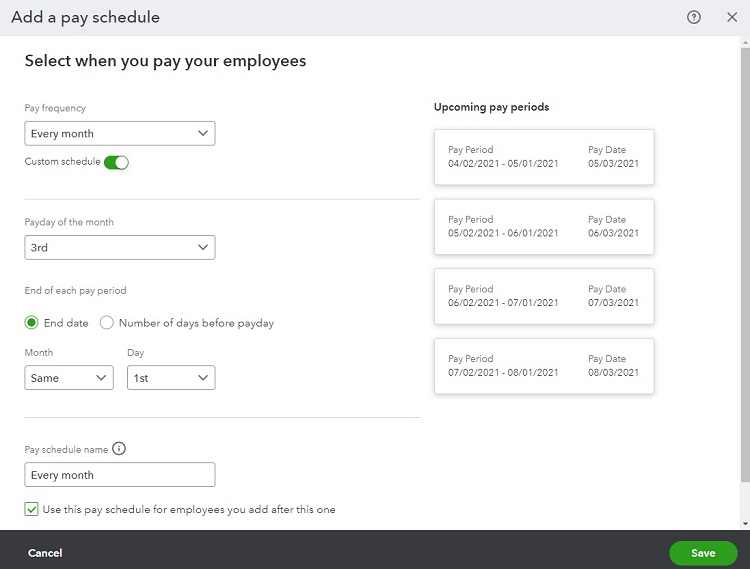

After entering the banking information for each employee, scroll upward to the middle section of the window to the How Often Do You Pay section. This area allows the HR department to set up the frequency of running the payroll and submitting the direct deposit for this employee.

With QuickBooks, different pay schedules for different employees is a possibility, or the company can create one type of pay schedule for everyone in the company. This is a significant advantage of this payroll software, providing plenty of flexibility for how payroll runs for the company and employees.

After setting up a pay schedule for one employee, you can choose to apply that same pay schedule to others, or you can create a new schedule, if desired, through this section of the window.

To set up the pay schedule, select the frequency of payment from the drop-down menu or click the pencil icon (which allows editing of an existing pay schedule). Within the Add a Pay Schedule window, enter the following information.

- Pay Frequency: In the drop-down menu, select the frequency of running the payroll, which can be every week, every other week, twice a month, or once a month. If needing a different type of pay frequency than what’s in the list, click on the Custom Schedule button to pick the desired pay frequency.

- Next Payday: Select the date for running payroll the next time. QuickBooks lists a series of example pay periods and pay dates along the right side of the window to aid in picking the correct date for the next payday.

- End of Next Pay Period: Select the date where the next pay period will end. This date should be before the next payday. For example, if employees receive payment every Friday, the pay period may end on the previous Friday, giving the HR department a week to prepare payroll.

- Pay Schedule Name: To make use of this same pay schedule in the future with other employees, give it a descriptive name in the text box, so it’s easy to find it the next time. QuickBooks will suggest a name for the pay schedule by prefilling the text box. To create a new name, just delete the suggested name and enter a more descriptive name.

To continue using this pay schedule for other employees the company adds to the payroll in the future, leave a checkmark in the box at the bottom left of the window. Then click the Save button.

3 Top Benefits of Setting Up Direct Deposit

With direct deposit, the business will send the employees’ wages directly to their bank accounts. There are a few benefits to this process versus making payroll payments through other methods.

Reduces Chances for Errors

When a business sets up direct deposit for employees, it lessens the chances for errors in payroll to occur, including:

- No misprinted checks that require reprinting

- No lost checks that require replacement

- No need to physically hand out or mail checks

- Correcting payroll errors is easier by making another deposit or reversing a deposit

- Reduces chances of fraud occurring through employees writing their own checks

Payroll Withdrawal Occurs All at Once

When issuing paper checks to employees, some employees may take their time depositing the check. This can cause significant headaches for the accounting department, as it tries to reconcile account balances with any potential outstanding payroll checks.

When account balances do not match, it could be a sign of fraud occurring in the business. This means that employees waiting to cash their paychecks can create unwanted headaches as the HR department tries to track down the source of the unmatched balances.

This can be a significant issue for a business that doesn’t carry an excess balance in the payroll account too.

With direct deposit, all of the payroll leaves the account at the same time. The accounting department will always know the correct balance, never wondering if all of the employees cashed their checks yet.

Saves Time and Money

Versus issuing checks, using direct deposit can save the business a bit of money and time. Printing checks and distributing them represents time that the HR department could be spending on other tasks. Over a year, these processes can represent hundreds of hours.

Purchasing envelopes, blank checks, ink, a compatible printer, and check printing software all create ongoing costs. Setting up direct deposit eliminates this.

If the payroll software subscription the company is using contains direct deposit capabilities as part of the monthly price, there’s no additional cost for the required software either. However, some payroll software packages, including QuickBooks, will charge extra for using direct deposit.

3 Biggest Challenges With Setting Up Direct Deposit & How to Troubleshoot Them

Although using direct deposit is highly convenient for businesses, there are a few challenges and downsides associated with the setup process.

Potential Bank Fees

One would think that the company’s bank and the employees’ banks would appreciate having the company use direct deposit for payroll. It eliminates the use of paychecks and reduces the chances of errors that the bank may have to handle.

However, even with the advantages it provides, some banks still choose to charge fees related to using direct deposit. It’s possible that either or both the originating bank and the bank accepting the deposit will charge fees of $1 or $2 per transaction. These fees can add up quickly when paying hundreds of employees every other week.

There are a few ways to avoid this issue. One is to negotiate with the bank to either reduce or eliminate any fees that it charges for the direct deposit withdrawals. Or you could select a bank that doesn’t charge these fees.

Additionally, some payroll and direct deposit software packages, through their relationships with banks, can help their clients reduce or eliminate these fees.

Difficulty in Tracking Employees’ Time

After setting up direct deposit, payroll will run at a certain day and time. This gives the HR department a deadline for compiling all of the information needed to run payroll, such as employee time cards.

If an employee fails to turn in a time card or if the card has some sort of error, the HR department must track down the correct information. This isn’t always an easy process, especially if the supervisor must become involved.

If it takes too long to find the right information, the HR department could miss the window to run payroll to meet the deadline for using direct deposit. The HR department could choose to run payroll anyway and skip the payment for the employee whose time card is in question. However, this can cause unhappiness among the employee and a huge hassle for the HR department to fix things after the fact.

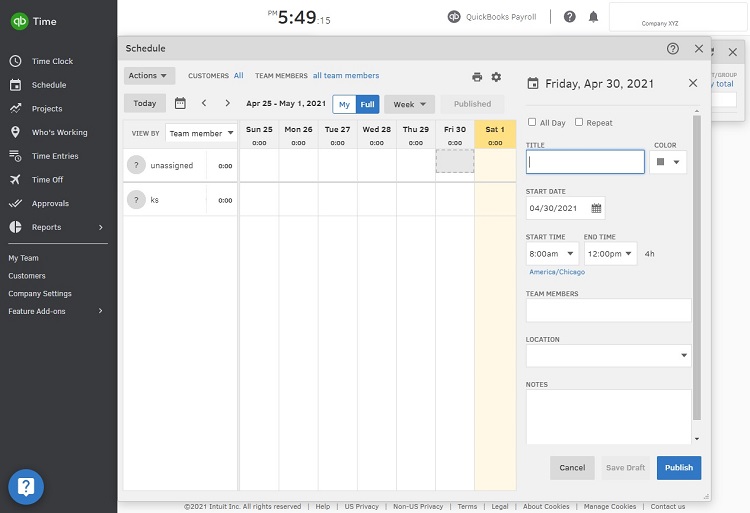

The best way to avoid this problem is to use payroll software that also provides the option of tracking employee time digitally. With automatic tracking of employee time through the software, the chances of missing or mistaken information go down significantly. The software can alert the HR department to problems with employee time tracking ahead of time too, providing more time to find any required information.

Overpayment Errors

Even though using direct deposit for the company’s employees reduces the chances for payroll errors by a significant margin, it’s still possible that errors could occur. Perhaps one of the employees could alter the information in the direct deposit software to receive a large, unauthorized payment, resulting in unnoticed fraud.

If the error is large enough, it could drain the business’ bank account, placing the company in jeopardy of not meeting its obligations to vendors.

QuickBooks allows the company to set up a limit for payroll using direct deposit. Should an error occur that would push the total payroll payment over the limit, QuickBooks provides a notification. This catches the error before it causes damage to the account balance.

Other Options for Setting Up Direct Deposit for Your Employees

We used Intuit QuickBooks as an example because it’s one of the more popular options out there. The thing is, QuickBooks is well-known for their accounting software.

As a payroll software, however, we recommend avoiding QuickBooks. If you use QuickBooks for accounting already, fine, but there are a lot of better options built specifically to pay employees.

Tools like Gusto and OnPay allow employees to onboard themselves. Setting up direct deposit is just one of a few easy steps employees complete by themselves online. HR oversees everything and answers questions, but they don’t have to hassle people or track paper documents.

For small business payroll, those tools are great. Of course if you are trying to set up direct deposit for an international employee, you’re going to want something like Deel or Rippling.

We have blogged extensively about the best payroll software and services. We have strong opinions about what works for paying personal chefs, thousands of employees around the globe, and everything in between.