Employers need to report all wages earned by their employees to the IRS, even if they have just one employee. But did you know that if you hire someone as a household worker and pay them as little as $2,700, you also need to report that income?

It’s true, and having a payroll service or software on your side can make things so much easier. Yes, even for just one employee. I’ll detail why in this guide, plus give you the best payroll service options for one employee.

Why Get Payroll Service for One Employee?

Payroll gets complicated as soon as you have just one full-time employee. Even with one employee, you still need to calculate wages and allowances, withhold the right amount of taxes, and manage deductions.

I recommend outsourcing payroll as soon as possible, even if you have one employee and don’t plan to add more in the near future. The last thing you want to worry about is calculating the wrong amount of pay and potentially sending in the incorrect amount of taxes, which can result in major financial issues and possible penalties down the road.

These problems can even arise if you only have one part-time employee, pay one contractor, or have one nanny or household employee. Yes, you could even make mistakes paying yourself out of your single-member LLC. Miscalculations happen, and when they do, they can be costly.

Payroll services can curb those miscalculation issues. This is one of those times when you should put your trust in computers more than yourself.

Plus, some of the best payroll services have experts on board who can answer your questions or even take over specific tasks so you’re not managing payroll blindly.

Sure, you could probably do payroll on your own, especially if you only have one employee to pay. But why would you?

Most payroll services are highly affordable for a single employee, and their costs are certainly better than the risk you’re putting your business in by not handling or calculating payroll correctly.

The 6 Best Payroll Services for One Employee

1. Gusto – Best Overall

Gusto is a payroll and HR service designed for small to medium-sized businesses. Gusto offers full-service automated payroll, time tracking, employee onboarding, talent management, and more.

- Straightforward guided setup

- Super affordable for one employee

- No free trial or demo

Gusto has tons of services for businesses. But because I’m focusing solely on payroll services in this guide, I’m only going to speak on its payroll service, which is, by and large, the most straightforward and simplest I’ve ever used.

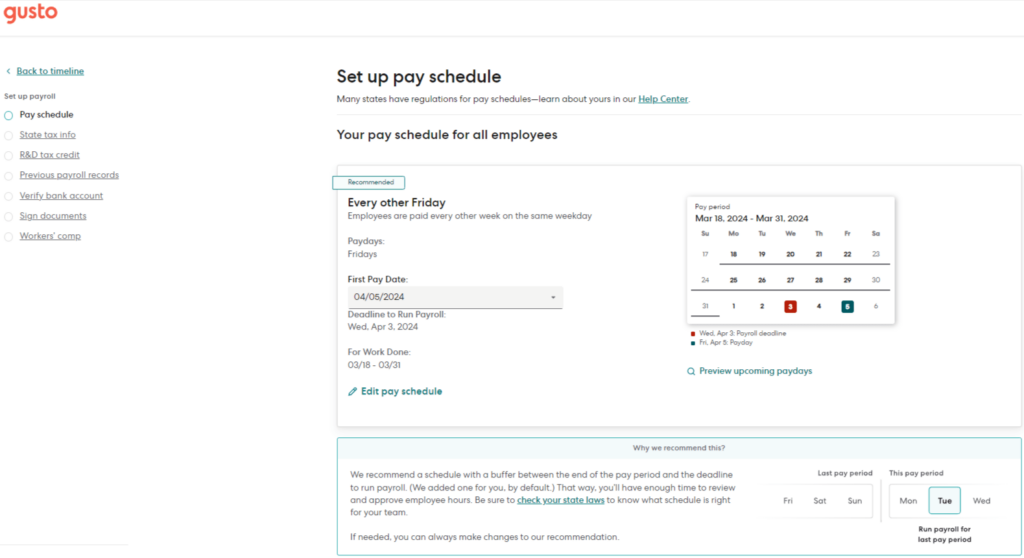

As soon as you set up your Gusto account, its onboarding process guides you through setting up your employee, followed by your payroll. The process takes about 30-60 minutes, depending on how much information you need to add about your employee. But after that, it’s smooth sailing as Gusto takes over tracking your employee’s hours and calculating their pay.

In fact, its easy-to-use interface is a top feature that draws over 300,000 businesses to Gusto. Business owners with zero payroll experience can use it from the jump without needing to brush up on payroll and tax laws or feel like they need an HR degree to get started.

Gusto also manages your employee’s local, state, and federal taxes. The software withholds the right amounts and sends them on their way to the right taxing agencies by their due dates while still sending you reminders and confirmations to keep you updated. It even updates itself on changing tax laws and new tax rates, so you don’t have to.

If you want to add benefits for your employee—or yourself, if you’re using Gusto to pay yourself out of your LLC or S Corp—you can do so through your dashboard. Gusto handles everything from retirement accounts to health plans, ensuring that deductions are included in paychecks.

How Much Does Gusto Cost for One Employee

Gusto pricing starts at $40 per month plus $6 per employee per month, making it $46 per month for one employee. This includes full-service payroll for a single state, employee benefits management, and integrations with common accounting and time-tracking tools.

If you need to add employees down the line from different states, you’ll need to upgrade to the next pricing tier, which is $80 per month plus $12 per employee per month.

Bonus: Gusto is also all-inclusive. You won’t pay extra for direct deposit, filing W-2s, or running extra payrolls for your employee. Once you sign up for your plan, you’ll have all that included without the extra fees that some payroll services charge.

Why We Recommend Gusto for One Employee

Gusto has everything you need for one employee’s payroll, from managing their benefits to withholding and paying their payroll taxes.

Still, if you need to grow beyond one employee, simply add them to your payroll and let Gusto handle the rest. It’s also easy to switch plans if needed if you scale enough to need PTO management, performance reviews, and other features.

If you’re just starting your LLC or S Corp and need the most affordable solution, Gusto might not be the best choice to start with. Instead, consider a free service—I list one below—and upgrade to Gusto or another paid, full-featured service as soon as you can.

Learn more about Gusto with our in-depth Gusto review. Or, try Gusto for yourself.

2. SurePayroll – Best for One Household Employee

SurePayroll is an affordable option for managing payroll for a household employee, like a scheduled landscaper or a nanny. The service takes care of all federal and state tax withholdings and payments for your household employee, plus local taxes if you opt into a full-service plan.

- Automated wage and tax calculations and reporting

- Satisfaction guarantee offers protection from tax mistakes

- Local tax filing is an additional $9.99 per month

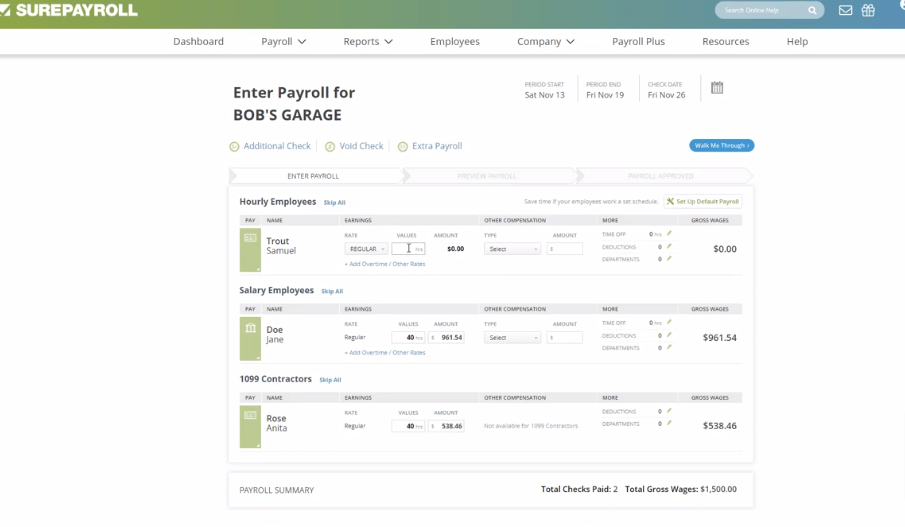

If you simply want to pay a household employee but aren’t technically a business owner, you may not have experience running and overseeing payroll. SurePayroll handles all of that for you through its automated tasks, so you don’t need to worry about lacking payroll knowledge.

Still, although SurePayroll can automate everything like calculating wages, withholding taxes, and paying your employee, you can be involved at each step. SurePayroll gives you the chance to review everything, like your employee’s deductions, before they’re finalized.

You’ll also get to tap into payroll records to view or keep for your records or send to your employee. SurePayroll offers detailed reports on your employee’s taxes, earned wages to date, and more.

You can even do so from your mobile device using the SurePayroll app. Once your employee is set up in the system, they can get their own login credentials to view their earnings and reports whenever they want to.

Perhaps the best perk is SurePayroll’s satisfaction guarantee, which ensures that your employee’s tax payments and filings are correct, or SurePayroll will help you fix any mistakes and pay associated penalties at no extra cost to you.

How Much Does SurePayroll Cost for One Employee

SurePayroll pricing starts at $49.99 per month for one employee. If you add other employees in the future, you’ll pay an additional $9.99 per month for each one. You’ll also need to add $9.99 per month if you need SurePayroll to manage local taxes for your employee in addition to the included federal and state taxes.

Integrations are additional costs, too, like $4.99 extra per month to integrate your accounting software or another $9.99 per month for timeclock software integration.

Why We Recommend SurePayroll for One Household Employee

SurePayroll is pretty affordable for just one employee, and its satisfaction guarantee offers a blanket of protection against potentially costly miscalculations.

However, if you do have some payroll experience and your employee’s payroll is uncomplicated, you could save some money by using a free payroll service like Payroll4Free.

I recommend SurePayroll if you need to pay just one household employee, don’t plan on adding more, have minimal payroll experience, and don’t need accounting and time clock integrations.

3. Paychex Flex – Best for Scalability

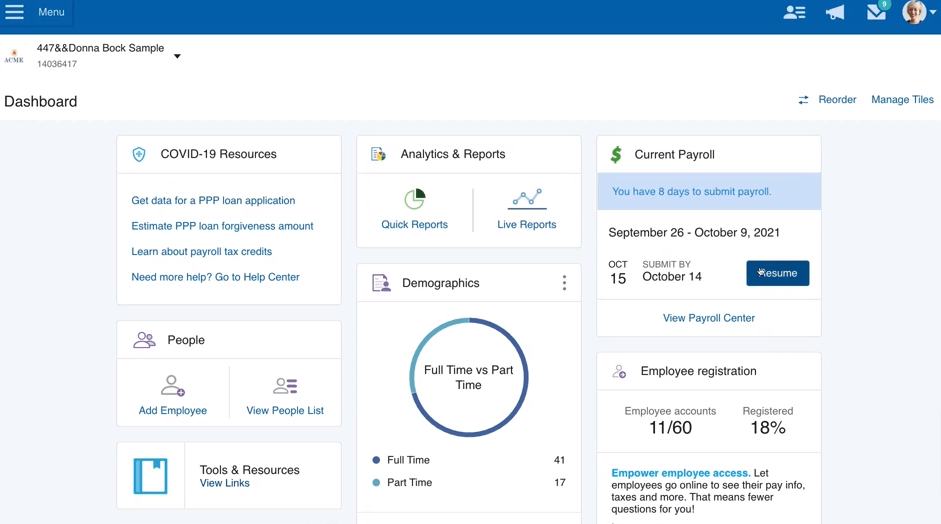

Paychex Flex is a small business payroll service with three plan tiers, allowing you to grow from one employee to multiple, if that’s the goal for your business. Each tier seamlessly adds on to the previous, giving you all the essentials to start with while allowing you to scale when you’re ready with online onboarding, HR tools, and more.

- Scalable to account for future business growth

- 24/7 online and phone support for all plans

- Non-transparent pricing for Select and Pro tiers

As its name suggests, Paychex Flex is designed to grow with you, from its Essentials plan for 1-19 employees to its Select and Pro tiers for small to medium-sized businesses. Starting with Essentials gives you everything you need for one employee, like running payroll with a few clicks of your mouse and viewing and downloading payroll reports.

Paychex Flex gives you access to a mobile app for yourself and your employee. The app features a time-tracking tool, access to W-2 forms, and detailed reports, and you can use it to run payroll without needing to be at your computer.

The service also supports multiple types of payments, including payroll cards, direct deposit, and paper checks, allowing you to pay yourself or your solo employee in whatever way you choose.

When you’re ready to expand with more employees, Select adds an HR library and learning management system, while Pro tacks on state unemployment insurance and workers’ comp services, pre-employment screenings, and more. You can also add à la carte services to the Essentials plan, like a garnishment payment service, to customize your account to your employee’s needs.

All plans feature 24/7 online and phone support, so you can always get the help you need at any point in the payroll process. You can even submit your payroll to a Paychex Flex specialist over the phone rather than have the system automate the process for you.

How Much Does Paychex Flex Cost for One Employee

Paychex Flex Essentials pricing is $39 per month plus $5 per employee, so $44 per month if you’re paying just one employee. This includes paper checks, direct deposit, and payroll cards, plus payroll taxes, employee self-service with the mobile app, new hire reporting, and employee onboarding.

Several other services are optional add-ons, like time and attendance tracking, integrations, and benefits management. Unfortunately, the Select and Pro tiers don’t have published pricing, as Paychex Flex customizes each plan to your needs. You’ll need to contact the company for a quote personalized to your business if you choose one of these plans.

Why We Recommend Paychex Flex If You Plan to Scale

Paychex Flex starts with all the necessities for a one-employee business with its Essentials plan. Its affordable price still includes a lot of features, especially the ability to hand off your payroll to a specialist or get help running payroll with a quick phone call.

If you’re a one-person business that’s looking to scale in the future, Paychex Flex should definitely be on your radar.

4. Roll by ADP – Best for Self-Employed Business Owners

Self-employed business owners who are just paying themselves don’t typically need the bells and whistles that other payroll services provide. That’s where Roll by ADP comes into play. Roll by ADP is a chat-based mobile app that lets you run payroll with a quick text through your phone.

- 24/7 AI-driven and live agent support

- Simplified payroll through a text-based mobile app

- Offers benefits deductions but not management

Roll by ADP lets you set up your payroll in a matter of minutes via its easy-to-use mobile app. It works just like a texting app, asking you the questions it needs to know and waiting for your text responses. Once you’re set up, Roll by ADP manages your wages and taxes and keeps you updated along the way.

For example, when the service is about to pay and file your taxes, it’ll send you a text via the app to let you know the due date is coming and when to expect the tax money to be withdrawn from your account. You can also get alerts when it’s time to run payroll or when a paycheck is coming your way.

Roll by ADP also features 24/7 support through the app. Ask a question and get an immediate response powered by generative AI. And if you need help that AI can’t give you, a support agent can offer you more personalized help without needing to hire a payroll specialist.

You can also use the Roll by ADP app to pay contractors or add others to your team if you begin to scale. With a quick text, you can start their setup process, run payroll on demand, and even get guided help with giving an employee a raise or bonus.

This service connects with QuickBooks Online for no extra cost, so you can keep your financials all in one place. It also supports payroll in all 50 states, same-day and next-day direct deposit, and deductions for garnishments or benefits, although it doesn’t offer management for those benefit programs.

How Much Does Roll by ADP Cost for One Employee

Roll by ADP has just one pricing plan for $39 plus $5 per employee per month, making it right around the same cost as other services on this list. Where it differs is that what you see is what you get. There are no features you’ll need to add on for an extra cost in this all-inclusive package.

It also comes with a free trial for three months to make sure you get what you need out of it before you start paying.

Why We Recommend Roll by ADP for Self-Employed Business Owners

Roll by ADP is the simplest payroll service you can use, making it an excellent option for self-employed business owners. There’s literally no learning curve. If you know how to text using your mobile device, you can start using the app just as easily.

Considering that Roll by ADP also includes all its features in one plan with no hidden fees or extras, it also makes it easy to budget for.

Its one downside, perhaps, is that Roll by ADP only offers benefits deductions rather than management, so you might need to look elsewhere if you need help maintaining your retirement plan.

Consider Roll by ADP if you’re looking for a straightforward, hassle-free way to run payroll from your mobile device.

5. QuickBooks Payroll – Best for a Single-Member LLC with Benefits

QuickBooks Payroll is a full-featured, automated payroll service that can work for one employee as well as it can for multiple employees. If you own a single-member LLC and give yourself benefits out of that LLC, you can use QuickBooks Payroll to manage them.

- Offers health insurance and 401(k) plans, even for just one employee

- 24/7 support available via chat

- Pricier than other options

If you already use QuickBooks for your single-member LLC’s accounting, you’ll find that adding QuickBooks Payroll is a natural next step. As you might guess, the two services work together seamlessly to help you manage your finances in one convenient place.

QuickBooks Payroll takes over everything on the payroll end, from calculating your salary per pay period and paying you accordingly to withholding, filing, and paying your payroll taxes. Setting up your payroll in the system is relatively quick and easy, and QuickBooks experts are on hand to help if needed.

You can turn on automatic notifications to stay updated every time QuickBooks Payroll does something on your behalf, such as sending your direct deposit to your bank or preparing to pay your federal and state taxes. This way, you’ll know what’s happening while still being able to take a passive role in your payroll processing.

If you want to give yourself a 401(k) or health insurance benefits sponsored by your LLC, QuickBooks Payroll will not only deduct the costs from your pay automatically but will also manage your plans. You can enroll directly through the system and add more employees to your plans later if you choose to expand.

Because payroll can get tricky at times, even when it’s automated, QuickBooks Payroll makes it easy to contact an expert by phone or chat, with chat support available 24/7 to paid subscribers.

How Much Does QuickBooks Payroll Cost for One Employee

QuickBooks Payroll offers three plans, with its most basic, Payroll Core, starting at $45 plus $6 per employee per month, totaling $51 monthly. Fortunately, this tier will suit most single-member LLC owners, as it includes full-service payroll, next-day direct deposit, and benefits management.

Higher tiers cost from $80-$125 plus $8-$10 per employee per month and add perks like same-day direct deposit, a mobile app, and an HR support center. These features could come in handy if you need to add employees in the future but probably aren’t necessary when you’re the only employee.

Why We Recommend QuickBooks Payroll for Managing Benefits as a Single-Member LLC

QuickBooks Payroll is an all-in-one solution for someone paying themselves wages and benefits out of their single-member LLC. It’s also especially helpful for those already using QuickBooks to manage their business finances.

That said, it comes at a higher price tag than other services on our list, but only a few dollars more. I recommend QuickBooks Payroll if you don’t mind spending a little more to connect your payroll and accounting software together and have the goal of giving yourself an LLC-sponsored retirement plan or health insurance.

6. Payroll4Free – Best Free Payroll Service for One Employee

Not everyone needs a full-featured, paid payroll service. Payroll4Free has the basics—tax calculations, done-for-you tax forms, and direct deposit—for $0 a month, making it an excellent option for budget-focused business owners.

- Calculates taxes and deductions once you set up rules

- Integrates with QuickBooks

- Paying and filing taxes for you costs extra

Need a no-frills, cost-effective way to manage your one-employee payroll? Payroll4Free is it. Once you give it a few rules for calculating your employees’ wages and taxes, it will automate the process.

And this isn’t one of those “We’re free, but we’re not really free” gimmicks. It’s actually free if you pay 1-10 employees, aside from a couple of upgrades you can opt into. The free software includes wage and tax calculations, pre-filled tax forms for you to submit, vacation time-tracking, W-2 and 1099 payments, direct deposit, and reporting.

Employees can even access a portal to view their W-2, timesheet, earned wages, deductions, and more right through the Payroll4Free website.

Despite being a free service, Payroll4Free has support professionals on call for help, so you won’t feel left hung out to dry if you run into a payroll snag or technical issue.

I want to be clear that there are some downsides to using a free service like Payroll4Free. For starters, there’s no mobile app to help you manage payroll on the go. Also, because it relies on ads to keep the service free, the software feels somewhat outdated, clunky, and messy.

How Much Does Payroll4Free Cost for One Employee

Payroll4Free is 100% free for its basic services when you pay 10 or fewer people. For about $40 per month, you can use Payroll4Free’s bank to transfer direct deposits to your employee and have the service pay and file your taxes for you.

Why We Recommend Payroll4Free If Pricing Is Your Priority

Payroll4Free certainly doesn’t have the bells and whistles that paid payroll services do, like filing and paying your taxes for you and managing benefits. But not everyone needs all that, especially when paying just one employee.

If you want a full-service platform, Payroll4Free won’t be for you. But if you want something simple to help you calculate payroll and don’t mind seeing some ads while you use the service, you can try Payroll4Free, at least for a month or two, to see if it suits your needs until you feel like you need something more.

Methodology + Why You Can Trust HRAdvice

At this point, I’ve spent years hiring employees and contractors and networking with others who’ve hired employees and contractors. I’ve also been a part of small and large companies and have seen the differences in what they need when it comes to managing payroll.

I’m a longtime user of Gusto myself, originally using it to pay US-based contractors. It had what I needed for an affordable price while allowing me to scale, if necessary, still at an affordable price.

But I know that one solution doesn’t work for all, so I’ve also spoken with other small business owners and solo entrepreneurs to learn what works for them. Each of these people needed something just a little different and have found quality solutions in the options they picked.

After researching their top picks myself, I chose the six payroll services on this list. These are the options I’d want to have at my disposal if I ever needed a payroll solution for one employee.

To be clear, partnerships and affiliate payouts don’t drive my choices behind any of these guides that I write, and the same is true for this one. I thoroughly enjoy helping other business owners, and that’s why I take my time to research and weed out unworthy options before writing and publishing.

Hopefully, in doing so, this guide points you toward your go-to, one-employee payroll service.