Yes, free payroll software exists. Businesses use it every year. But we don’t recommend using free payroll software if you can avoid it.

Free payroll software usually offers only the most basic functionalities. This might be fine if you have one employee, but there’s always a risk you’ll outgrow those basic features. In that case, you’d need to upgrade to a paid version of the free software. Or switch payroll software services altogether.

And there’s more. Free payroll software is less likely to get updated frequently, offer customer support, or keep data locked down tight. This could lead to issues with compliance—and put sensitive data at risk.

In some cases, though, you’ve got to use something. Just make sure you choose a reputable option.

When is Free Payroll Software Good Enough?

Even though it’s not ideal, free payroll software is a lot better than an Excel spreadsheet. It’s important to know when you should use it—and when you should really just spring for a paid program. These two lists can help.

Free Payroll Software Can Work When:

- You have 5-10 employees.

- You rarely hire and have low turnover.

- You are familiar with federal tax laws, the Fair Labor Standards Act (FLSA), and any state labor laws that affect payroll.

- You don’t mind doing some of your payroll manually, like paying and filing taxes.

- You don’t expect to grow in the next several years.

- You don’t have the budget to fully outsource your payroll.

Free Payroll Software is a Bad Idea When:

- You have more than 5-10 employees.

- You pay employees in multiple states.

- You work with international employees or contractors.

- You need payroll software that integrates seamlessly with your HR software suite.

- You don’t know a lot about federal and local tax laws.

- You hate manually filing and paying taxes every month or quarter.

- You expect to grow in the next several years.

With any free payroll service, it’s crucial to triple-check your compliance. You must make sure you’re following all the relevant state, federal, and local laws. If you think you’ve got the chops to do that, here’s a list of our three favorite payroll software services for you to pick from.

The 3 Best Free Payroll Software Services

1. Payroll4Free

Payroll4Free’s mission is pretty straightforward: to offer online payroll services to small businesses—for free. The company started with two Ohio clients in 2012 but now serves clients throughout the U.S.

So how does the company offer free payroll services? And why?

Because the people behind it care about small businesses and understand the financial toll that running a business can take. The Payroll4Free team genuinely loves payroll processing and works round the clock sometimes just to help its clients.

Payroll4Free generates revenue in two ways:

- Running advertisements that appear throughout the payroll processing software. Larger B2B companies pay for ad space because the small businesses that use Payroll4Free are part of their target market.

- Charging a small fee for some of its two add-on services—a Payroll Tax Service and a Direct Deposit Service. Even if a small business chose both, they’d only pay $40 a month for the add-ons.

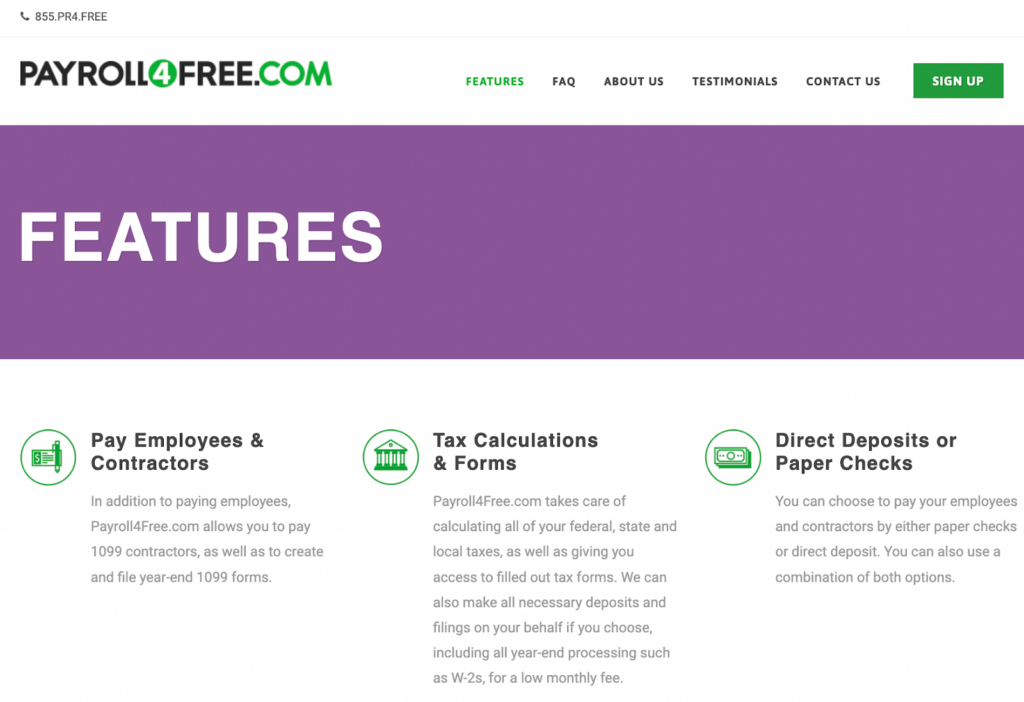

Payroll4Free designed its own, proprietary payroll software that offers this bundle of services:

- Payroll for employees and contractors: Prepare paychecks and pay employees and contractors alike with Payroll4Free’s proprietary software.

- Tax calculations and forms: Payroll4Free calculates all your state, local, and federal taxes and provides pre-filled-out tax forms for easy submission. If you want Payroll4Free to pay and file the taxes for you, pay a small monthly fee for the Payroll Tax Service.

- Direct deposits or paper checks: Prepare and send paper checks or set up direct deposit for secure, online payments. If you want to use Payroll4Free’s bank and have them handle your direct deposits, you can pay for the Direct Deposit Service.

- Vacation time tracking: Payroll4Free calculates and tracks your employees’ PTO for you.

- Employee portal: Employees can view their pay stubs, accrued PTO, W-2s, and more through the employee self-service portal.

- Reporting: Payroll4Free can prepare detailed reports on everything from earnings to accrued vacation time.

- Customer service: The Payroll4Free team includes tax and payroll professionals to help answer your questions.

Here’s one caveat: Payroll4Free is only free if you pay 10 or fewer employees or contractors.

If you have more than 10 employees, we recommend paying for a top-notch payroll software service. These services are more than worth the price and will save your team a ton of time in the long run.

Now let’s talk about the limitations. The two additional paid services are an obvious one. For just over $40 a month, you could pay for a more robust payroll software for a handful of employees. OnPay, for instance, has a base price of $40 a month plus $6 per employee.

Another downside? Payroll4Free software can only be run on a PC. If you have a Mac, you’re out of luck—unless you have a Windows operating system on your device.

2. HR.my

HR.my is a cloud-based employee management software for SMBs. The reason it’s free? Crowdsourcing, ads, and the founder’s pure passion for creating software that everyone can enjoy.

Basically, the mysterious founder and developer built HR.my, and since it was bare-bones at the beginning, they offered it for free. They wanted to share the project with the world. People started to use it and ask for additional features, so the founder built them. Eventually, users suggested crowdfunding as a way to help support the developer’s work.

But you don’t have to contribute anything to the crowdfund if you don’t want to, which is why we’re including HR.my on this list.

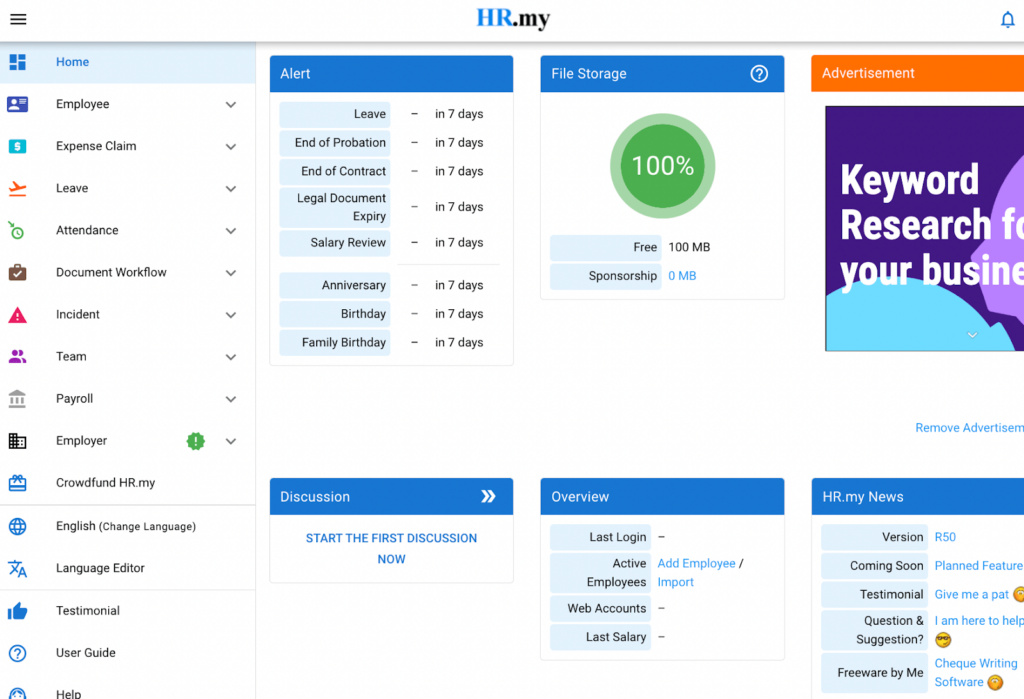

Here’s a snapshot of what you get when you sign up for HR.my:

- Expense claim management: Have employees submit claims through HR.my, where you can review receipts and approve or deny the claims.

- Leave management: Approve leave and PTO requests and view employee leave records.

- Manage attendance: HR.my’s time clock gives you the option of having employees clock in online and provide a selfie to prevent buddy punching.

- Process payroll: Set up payroll with custom salaries and/or hourly wages worked and generate pay stubs for each employee. You can rerun previous payroll processes over and over again if nothing changes—i.e., if you have a team of salaried employees and none of them take unpaid leave. You can process weekly, bi-weekly, monthly, and semi-monthly payroll with HR.my. You have three payment method choices, too: direct deposit, cash, or check.

- Approval workflows: Route leave and claim requests to the right people with HR.my’s customizable approval workflows.

- Employee self-service: HR.my’s employee portal allows your team members to apply for leave, submit expense claims and attach files for your review, check leave balances, and view pay stubs.

- Multilingual capabilities: If you need free payroll software that can run on 66 languages, HR.my’s got you covered. The lion’s share of these languages rely on Google Translate, but Simplified Chinese and English are human-translated.

Remember—all of these services are available on any device via the cloud. You don’t have to download any special software, like you do with Payroll4Free.

Another big perk of HR.my is it offers all of these services to an unlimited number of employees. So even if you have 100 employees, you can use it. But we’d stick to the 5-10 rule if we were you because HR.my has one glaring limitation: it’s missing any semblance of payroll tax withholding, filing, and payment tools.

If you use HR.my, you’ll need to manage your state and federal payroll taxes on your own.

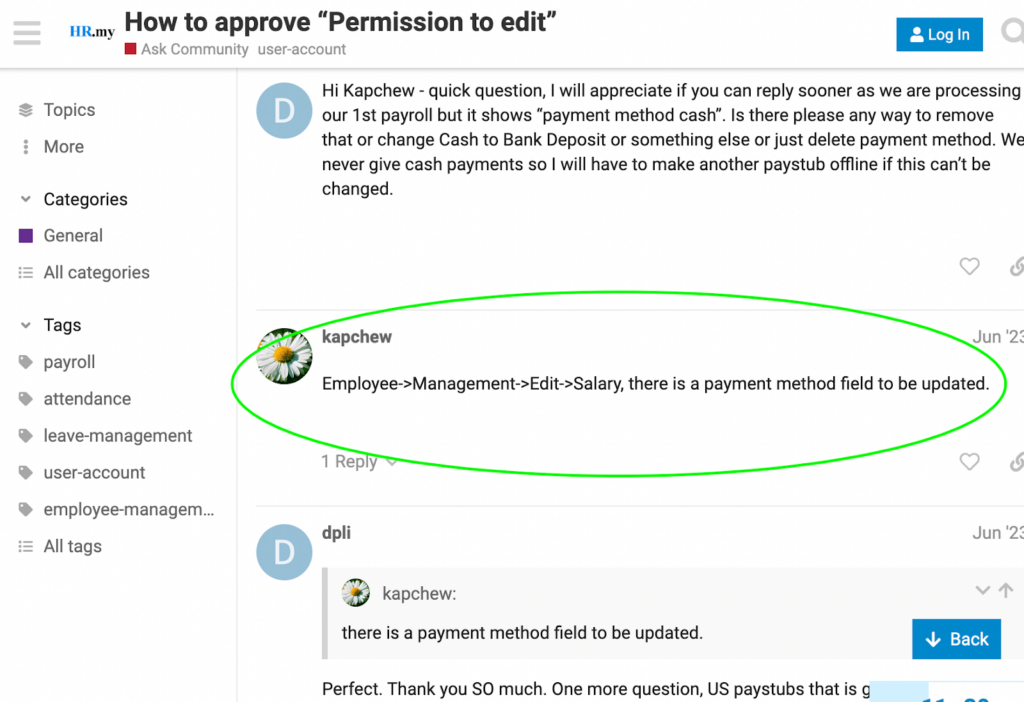

Another downside? There’s no customer support, and the get-started guides are limited. There is, however, an active HR.my forum on the site that you can go to for crowdsourced answers to all sorts of HR.my-specific questions.

I tested it out when I was trying to nail down an answer for a question I had while researching this software. I wanted hard, cold proof that HR.my actually allows employers to pay employees directly from the site.

So I searched “deposit” on the forum and found exact directions for how to change the employee payment method.

Then I tested it out on the HR.my dashboard—and, indeed, you can pay employees from the HR.my interface via direct deposit, cash, or check.

It appears that the HR.my developer may be one of the top responders on the forums, which is pretty genius if you think about it. The developer might not have time or money to provide typical customer support services. But with a forum, they can reply when they do have time—and the entire HR.my community can see the exchange.

3. TimeTrex Community Edition

TimeTrex Community Edition is an open-source HR and payroll software for SMBs. Employers can access it both via the cloud or as a download. An important clarification: TimeTrex Community Edition is the bare-bones version of TimeTrex Workforce Management. If you try looking for a free version of TimeTrex on the TimeTrex Workforce Management pricing page, you won’t find it.

You have to specifically search for TimeTrex Community Edition to find the free stuff.

Here’s what’s included in the open-source, free version of TimeTrex:

- Employee scheduling: Create and reuse employee schedules to eliminate the time you spend building them manually.

- Time and attendance: Track and monitor everything from daily attendance and overtime to missed punches and PTO.

- Payroll: Calculate tax deductions, create tax reports, print checks, and run direct deposits to process payroll.

- Human resources management: Track each employee’s skills, qualifications, licenses, languages, and education. Create KPIs and document performance and wage reviews.

- Reports: Slice and dice employee, payroll, or tax data any way you want it with TimeTrex Reports.

- Tax Wizard: Use TimeTrex’s Tax Wizard to keep track of different tax due dates, like W2 filings and quarterly Form 941 payments. You can generate tax forms for each employee, too. You’ll have to navigate to the relevant state or federal portal to actually pay and file the taxes, though.

- Policy management: Document all your company policies and assign pay formulas and pay codes to specific situations. For instance, you can give sick pay its own pay code and pay formula for easy calculation when it’s time to process payroll.

All told, TimeTrex Community Edition is a sturdy little tool with surprisingly robust capabilities. It’s got more going for it, tax-wise, than HR.my.

But as you’d expect for completely free payroll software, you have to do some of the work manually. Like filing and paying taxes. TimeTrex Community Edition helps you do the legwork to get there, though. If you don’t mind keeping track of login credentials for various state and federal tax portals, you could probably handle up to 10 employees with TimeTrex.

If you want free payroll software that files taxes on your behalf, Payroll4Free’s low-cost filing service is the closest you’ll get.

TimeTrex Community Edition also lacks customer support. As with HR.my, you have to rely on the TimeTrex community forum and a few get-started guides.