Some payroll software can do a lot—including your business tax filing—without costing a ton of money. We’ve lined up six cheap payroll software options for people who want to stretch every dollar, as well as economic options for growing businesses that want a viable, no-frills solution.

The following payroll software made our top list of the cheapest solutions offering full tax services.

- Gusto – Overall Best Cheap Payroll Software

- Roll by ADP – Best for Solopreneurs

- Patriot Software – Best for Small Businesses with 5 or Fewer Employees

- SurePayroll – Best for Paying a Household Employee

- Square Payroll – Cheapest for Paying Contractors

- Payroll4Free – Best with a Free Option

Overview of Cheap Payroll Software Options

Most payroll software costs around $40 to $100 per month, plus an additional cost of around $4 to $10 per employee or contractor on payroll. Software on the higher end of the price range is usually reserved for options that handle HR and workforce management tasks.

Our list includes cheaper options—as in those that offer payroll only for a more affordable solution. Many of them have available HR services if you want them, but you don’t have to pay for them if you don’t need it.

However, because payroll tax calculation and filing is a crucial part of any business, we only included options with tax services. Payroll software with full tax services tracks and updates federal and state tax changes, keeping you in the loop without needing to study all facets of tax law. Those on our list don’t cost more than $40 per month for the service, although they have varying costs for each employee.

Alternatively, you could make a one-time purchase for downloadable payroll software rather than pay monthly, but downloadable versions don’t typically offer regular tax updates as online payroll software does.

Our number one cheap payroll software pick is Gusto, which supports payroll for employees and contractors. At $40 per month plus $6 per person per month, Gusto has the highest price tag on this list, but its range of features, like full-service taxes, basic onboarding, and employee profiles, offer tons of value.

Roll by ADP is another solid choice, especially for solopreneurs. You don’t need any experience to use it, and you can run payroll using your mobile device in just a few taps. Starting at $39 per month plus $5 per person per month, it’s an affordable option for a one-person business or small team.

Patriot Software is an affordable pick for small businesses with five or fewer employees. It starts at $17 per month plus $4 per month per person, but tax features bump it up to $37 per month. That price also includes helpful features for growing businesses, like workers’ comp integration, HR tools, and PTO tracking.

The Best 6 Cheap Payroll Software

1. Gusto – Overall Best Cheap Payroll Software

- Easy-to-use interface makes setup a breeze

- Includes basic onboarding and hiring tools

- Costs can become pricey for large companies

Gusto is our overall top pick for cheap payroll software. Gusto supports full-service payroll for employees and contractors, including health insurance administration, employee self-service, federal and state taxes, and time off reports.

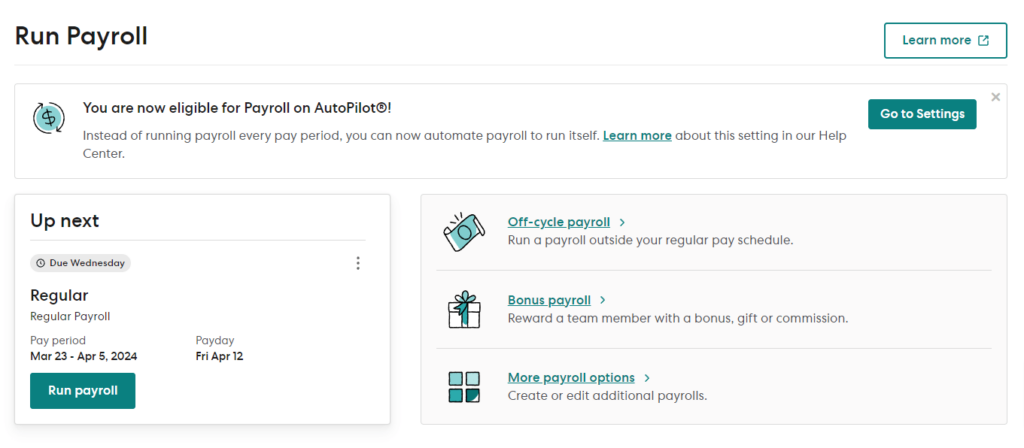

Gusto can be set up and customized within minutes, with its easy-to-use interface guiding you through each step, from onboarding each employee to adding your employees’ benefits. You’ll get access to all tools on your dashboard, like time-tracking reports and tax documents. There’s even hiring and onboarding tools, like offer letter templates and e-signatures, to organize the hiring process.

If you’re just looking for basic payroll features, like automatic tax payments and paying employees, Gusto includes these features in its lowest-priced plan. Still, there’s plenty of room to scale with Gusto, whether you eventually need to add on multi-state payroll, next-day deposits, performance reviews, etc., all of which are available in other tiers that are easy to switch to down the road.

The downside is that Gusto’s pricing can become costly when you have many employees to include, especially if you move up to a higher tier. However, small businesses with 10 or fewer employees should find it reasonably priced for the large number of payroll processing features it offers.

Gusto Pricing

Simple is Gusto’s basic and most affordable plan, costing $40 per month plus $6 per person per month. So, if you’re paying just one employee, you’ll pay $46 per month or $100 per month for ten employees.

Alternatively, businesses only using contractors can pay for a contractor-only plan for $35 per month plus $6 per month per contractor.

Features that are necessary for some businesses, like multi-state payroll and PTO management, require the Plus plan, which costs $80 per month plus $12 per person per month.

Gusto offers a free demo so you can test out different features before committing. There are also occasional deals for reduced pricing for three or six months on various Gusto plans. Check out Gusto’s current pricing, plans, and offers.

2. Roll by ADP – Best for Solopreneurs

- Automatic payroll compliance alerts

- Clean and user-focused employee self-service profiles

- Only integrates with QuickBooks Online

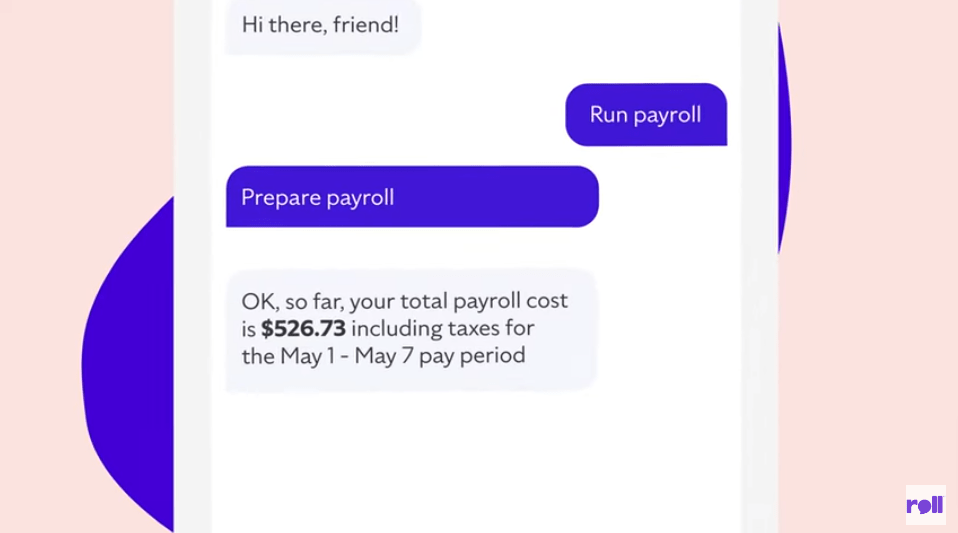

Roll by ADP is the best cheap payroll software for solopreneurs, especially those with no prior payroll experience. Roll by ADP is entirely app-based, so you never have to log on via a computer to manage payroll. And, to run payroll, all you need to do is chat with the app.

Roll by ADP uses AI to understand what you want it to do and complete those tasks through its smart chat system. For example, you can ask the app to provide help with calculating overtime pay for another employee or get suggestions for interview questions to ask a potential employee.

And if you have no experience running payroll, Roll by ADP is there to help. The app can send you payroll compliance alerts to let you know when laws change or tax rules update, for example, to keep you in the loop. It also calculates and pays your federal, state, and local taxes for you.

Because it’s designed for solopreneurs and small business owners, Roll by ADP connects with QuickBooks Online, another service that’s best for smaller businesses. Unfortunately, that’s the only accounting software it currently integrates with, which can be a drawback if you use something else.

Roll by ADP Pricing

Roll by ADP has just one subscription plan, which costs $39 per month plus $5 per employee per month. If you’re paying only yourself out of your company, you’ll pay just $44 per month, contract-free. That gives you access to payroll for all states, unlimited payroll runs, direct deposit, W-2 and 1099 payments, QuickBooks Online integration, and more.

Start a free 3-month trial of Roll by ADP to test it for yourself.

3. Patriot Software – Best for Small Businesses with 5 or Fewer Employees

- Up to five pay rates per employee

- Free, done-for-you payroll setup

- Time attendance and HR software are extra costs

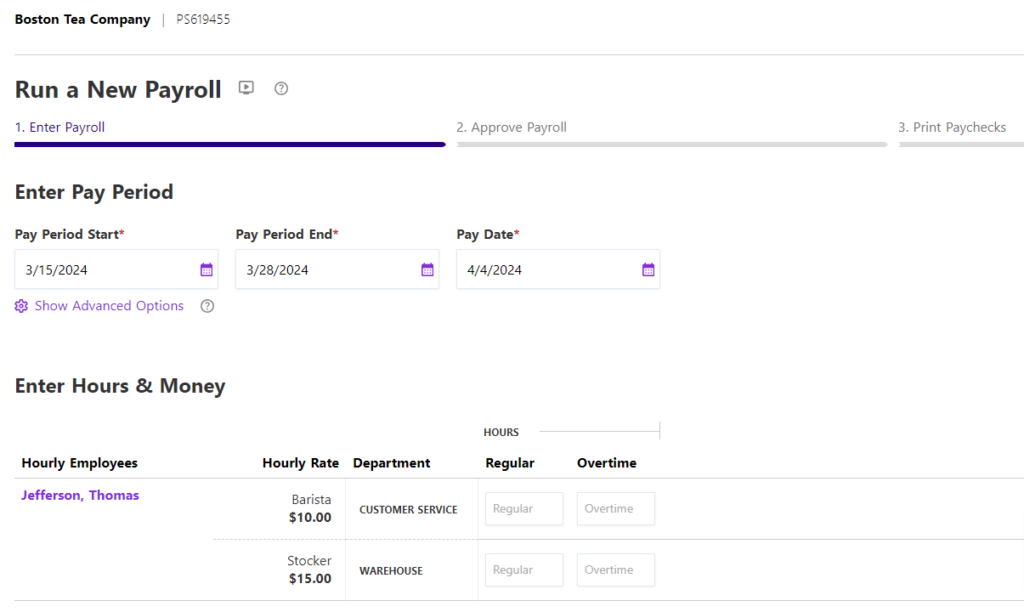

We chose Patriot Software as our top cheap payroll software pick for small businesses with five or fewer employees. Patriot Software’s primary offering is its payroll software, which has just about everything most small businesses need without overpaying for things they may never use.

For example, the full-service payroll plan lets you run unlimited payrolls without any extra charges. So, if you need to run an additional payroll to account for an error made during a previous run, you can do so without penalties.

The software also supports paper checks and direct deposits, plus multiple pay rates for the same employee. Therefore, an employee eligible for overtime pay and a shift differential can have all their different pay rates tracked and calculated appropriately.

First time setting up payroll? Patriot Software can guide you through it for free. You have the choice of using the simplified setup wizard if you’d rather figure it out on your own. If not, the Patriot team can jump in to do it for you, including setting up each employee and configuring the software to your needs.

For convenience, you can run Patriot Software from your mobile device using the app. Each employee or contractor also gets a free profile allowing them to self-manage their pay and tax information.

Patriot Software Pricing

Patriot Software has a low-priced plan for $17 per month plus $4 per employee per month. However, it doesn’t include federal tax filing, which is a prime reason most business owners choose payroll software. For that, you’ll pay $37 per month plus $4 per employee. For five or fewer employees, you won’t pay more than $57 per month—an affordable price for unlimited payrolls, accounting software integrations, employee portals, and more.

Optionally, you can add on time and attendance software or HR software, each costing $6 per month plus $2 per employee per month.

Sign up for a free 30-day trial of Patriot Software or get a free demo to try out its features.

4. SurePayroll – Best for Paying a Household Employee

- SurePayroll sends reminders to review payroll and taxes before they’re finalized

- Sick and PTO time tracking for household employees

- No guaranteed free trial

SurePayroll is the best cheap payroll software for paying a household employee, like a nanny or landscaper. At under $50 per month, it’s on the upper end of the affordable range, but it has absolutely everything necessary to make sure your household employee gets paid properly and that you file the right amount of taxes on their behalf. It also has a cheaper small business plan that could suit your needs.

SurePayroll automatically calculates employee pay based on their pay rate and deducts and files their taxes for you, so you never have to do any of that yourself. It can also report your new hire’s information to the appropriate federal and state agencies, track sick time and PTO, and give employees access to their pay stubs and tax documents.

Run payroll as much as you’d like using SurePayroll with no additional fees. Although SurePayroll automates the process, you can always elect to view your payroll and taxes before they’re finalized just to double-check their accuracy.

Once you have your employee and payroll process set up, you can use SurePayroll via the website or log onto the mobile app to view documents, receive and review notifications, and run payroll.

SurePayroll Pricing

SurePayroll’s payroll and tax plan for businesses costs $29.99 per month plus $5 per employee. Or, if you’re paying a household employee, you can swap to its household employee plan for $49.99 per month with one employee included.

The household employee plan allows you to easily pause your plan on the months you’re not paying a household employee, giving you pay-as-you-go flexibility.

Some eligible businesses can get up to six months of SurePayroll service free. Fill out the form to see if you’re eligible for the promotion.

5. Square Payroll – Cheapest for Paying Contractors

- Contractor-only plan available

- Live support from payroll specialists

- One plan tier for employees

We chose Square Payroll as the most affordable payroll service for contractors. Contractors are responsible for their own taxes, so you won’t get all the automated tax features you’d find in an employee-focused plan because you don’t need them. However, Square Payroll automatically generates your contractors’ 1099s and provides them with an employee dashboard to check up on their pay and download their pay and tax documents.

If you ever switch from paying just contractors to adding employees to your company, you can move up to Square Payroll’s employee plan seamlessly while still keeping your ability to pay contractors. This plan adds tax calculations and filings, benefits deductions, new hire reporting, and other features pertinent to employees.

For companies already using Square payment services, adding on Square Payroll is a no-brainer. It fully integrates with Square to keep your payroll, appointments, invoicing, time-tracking, and onboarding in one place.

If you get stuck at any point, Square’s payroll specialists have convenient weekly hours for live support. The caveat: There’s no dedicated payroll help available on weekends, although you can still contact customer support if you experience technical issues or have general questions.

Square Payroll Pricing

Square Payroll’s contractor-only plan costs just $6 per month per contractor, including full-service payroll features plus automatic generation of year-end 1099 forms.

If you also pay employees, you’ll pay $35 per month plus $6 per month per employee. You can also add contractors to this plan, each for $6 per month. This includes multistate payroll, automatic tax deductions, multiple pay rates, direct deposit, labor-cost reporting, and more.

Get a 30-day free trial of Square Payroll or check out its full demo to get a feel for it before signing up.

6. Payroll4Free – Best with a Free Option

- Completely free for 10 or fewer employees

- Simple, web-based interface

- No tax filings on the 100% free plan

Payroll4Free is the best free payroll service. And, yes, it really is free for basic payroll services, which include payroll processing, unlimited customer service, and tax calculations. Even if you want to add automated tax filing, you’ll never pay more than $40 per month for its extra services.

Payroll4Free stays free by placing ads into its software. These ads don’t interfere with your payroll processing experience but help the service stay free.

The web-based software can import your employees’ time-tracking information from popular software for accurate payroll reporting. You can also set up common deductions for benefits and contributions and integrate the software with your accounting service.

Although Payroll4Free won’t file taxes on your behalf without signing up for its tax add-on, it still calculates your taxes for you, giving you all the information you need for filing. It even takes it a step further to create your tax forms, so you only need to file the pre-filled forms.

Payroll4Free Pricing

Payroll4Free really is free—if you have 10 or fewer employees, that is. The free version calculates pay for contractors and employees, tracks vacation time, gives you the option of paper checks or direct deposit, and calculates all taxes for you.

If you ever decide that you want your payroll software to file taxes for you, Payroll4Free will do it for $35 per month or $350 per year, which includes tax filing services for up to 10 employees. Payroll4Free also offers a lifetime service fee of $1,750 for tax filing.

Learn more about Payroll4Free’s optional fees, or sign up for a free Payroll4Free plan to get started.

Which Cheap Payroll Software Is Right For Me?

It’s tough to find a payroll service for under $40, as most services charge a monthly fee per employee on top of their monthly base fee. Even if you have just a few employees, you’ll typically pay upwards of $60 per month unless you can get by with a free service like Payroll4Free.

However, payroll service is invaluable, even to micro-businesses and solopreneurs. The right software keeps track of your employees, payments, hours, and tax calculations, reducing the risk of error if you were to do payroll manually. Plus, it can save you several hours each week.

Payroll software should be considered an investment in your business rather than another unwanted monthly cost. The cheap payroll software options on this list are highly affordable, especially considering the potential value they can bring to your business.